Truffle Hound Capital LLC lifted its stake in shares of Douglas Elliman Inc. (NYSE:DOUG - Free Report) by 15.0% during the first quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 2,300,000 shares of the company's stock after purchasing an additional 300,000 shares during the quarter. Douglas Elliman accounts for about 1.4% of Truffle Hound Capital LLC's holdings, making the stock its 20th largest position. Truffle Hound Capital LLC owned about 2.59% of Douglas Elliman worth $3,956,000 as of its most recent filing with the SEC.

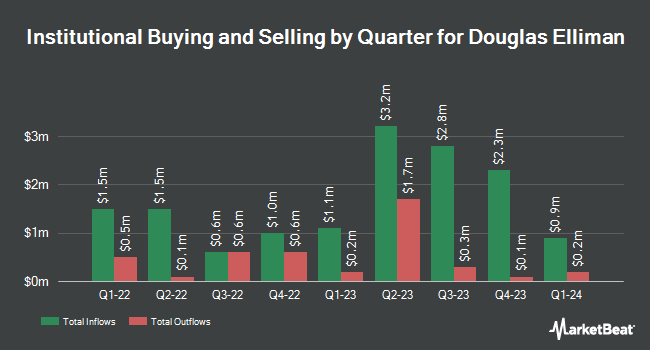

A number of other hedge funds and other institutional investors also recently made changes to their positions in the stock. Cubist Systematic Strategies LLC increased its position in shares of Douglas Elliman by 218.1% during the 4th quarter. Cubist Systematic Strategies LLC now owns 243,678 shares of the company's stock valued at $407,000 after purchasing an additional 167,070 shares during the last quarter. Bank of America Corp DE increased its position in shares of Douglas Elliman by 1,112.0% during the 4th quarter. Bank of America Corp DE now owns 151,291 shares of the company's stock valued at $253,000 after purchasing an additional 138,808 shares during the last quarter. Squarepoint Ops LLC increased its position in shares of Douglas Elliman by 220.7% during the 4th quarter. Squarepoint Ops LLC now owns 229,192 shares of the company's stock valued at $383,000 after purchasing an additional 157,718 shares during the last quarter. Two Sigma Investments LP increased its position in shares of Douglas Elliman by 213.8% during the 4th quarter. Two Sigma Investments LP now owns 262,023 shares of the company's stock valued at $438,000 after purchasing an additional 178,519 shares during the last quarter. Finally, OMERS ADMINISTRATION Corp bought a new position in shares of Douglas Elliman during the 4th quarter valued at about $274,000. 59.56% of the stock is currently owned by institutional investors.

Insider Activity at Douglas Elliman

In other news, Director Patrick J. Bartels, Jr. acquired 58,104 shares of the business's stock in a transaction that occurred on Monday, May 12th. The stock was bought at an average price of $1.92 per share, with a total value of $111,559.68. Following the completion of the acquisition, the director directly owned 193,975 shares of the company's stock, valued at approximately $372,432. The trade was a 42.76% increase in their position. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 6.79% of the company's stock.

Douglas Elliman Stock Up 1.1%

Shares of NYSE:DOUG traded up $0.03 during trading on Wednesday, hitting $2.31. The stock had a trading volume of 554,731 shares, compared to its average volume of 782,027. Douglas Elliman Inc. has a 12 month low of $1.35 and a 12 month high of $3.20. The company has a market capitalization of $204.55 million, a PE ratio of -3.11 and a beta of 1.78. The firm's fifty day moving average is $2.59 and its 200 day moving average is $2.11. The company has a quick ratio of 3.78, a current ratio of 3.78 and a debt-to-equity ratio of 0.20.

Douglas Elliman (NYSE:DOUG - Get Free Report) last announced its quarterly earnings data on Thursday, July 31st. The company reported ($0.06) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.03 by ($0.09). The company had revenue of $271.37 million for the quarter, compared to analysts' expectations of $333.91 million. Douglas Elliman had a negative net margin of 5.98% and a negative return on equity of 6.81%.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen cut Douglas Elliman from a "hold" rating to a "sell" rating in a report on Saturday.

Get Our Latest Stock Report on DOUG

Douglas Elliman Profile

(

Free Report)

Douglas Elliman Inc owns Douglas Elliman Realty, LLC, operating as a residential brokerage company in the United States with operations in New York, Florida, California, Texas, Colorado, Nevada, Massachusetts, Connecticut, Maryland, Virginia and Washington, DC In addition, Douglas Elliman sources, uses and invests in early-stage, disruptive property technology (“PropTech”) solutions and companies and provides other real estate services, including development marketing, property management and settlement and escrow services in select markets.

Featured Stories

Before you consider Douglas Elliman, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Douglas Elliman wasn't on the list.

While Douglas Elliman currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.