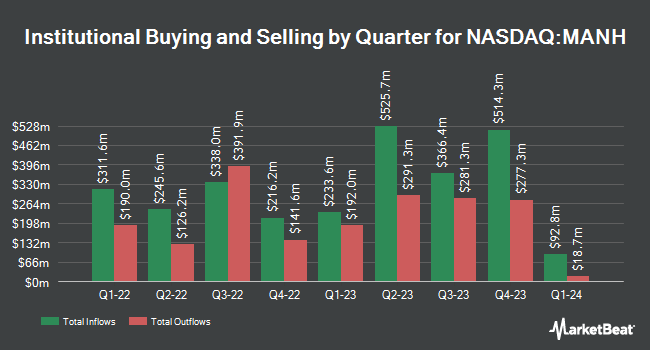

Truist Financial Corp decreased its holdings in Manhattan Associates, Inc. (NASDAQ:MANH - Free Report) by 21.6% during the second quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 21,910 shares of the software maker's stock after selling 6,044 shares during the period. Truist Financial Corp's holdings in Manhattan Associates were worth $4,327,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other hedge funds and other institutional investors have also bought and sold shares of the business. Swedbank AB increased its stake in Manhattan Associates by 50.0% in the second quarter. Swedbank AB now owns 1,199,969 shares of the software maker's stock worth $236,958,000 after purchasing an additional 399,969 shares during the period. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its stake in Manhattan Associates by 101.7% in the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,100,410 shares of the software maker's stock worth $190,415,000 after purchasing an additional 554,840 shares during the period. Northern Trust Corp increased its stake in Manhattan Associates by 6.3% in the first quarter. Northern Trust Corp now owns 809,894 shares of the software maker's stock worth $140,144,000 after purchasing an additional 48,074 shares during the period. AQR Capital Management LLC increased its stake in Manhattan Associates by 103.0% in the first quarter. AQR Capital Management LLC now owns 684,663 shares of the software maker's stock worth $116,872,000 after purchasing an additional 347,358 shares during the period. Finally, Jacobs Levy Equity Management Inc. increased its stake in Manhattan Associates by 1,214.2% in the first quarter. Jacobs Levy Equity Management Inc. now owns 606,038 shares of the software maker's stock worth $104,869,000 after purchasing an additional 559,923 shares during the period. Hedge funds and other institutional investors own 98.45% of the company's stock.

Manhattan Associates Stock Down 0.8%

MANH opened at $198.95 on Wednesday. The firm's 50-day moving average price is $212.95 and its 200-day moving average price is $195.19. The company has a market cap of $12.03 billion, a P/E ratio of 55.57 and a beta of 1.12. Manhattan Associates, Inc. has a 52-week low of $140.81 and a 52-week high of $312.60.

Manhattan Associates (NASDAQ:MANH - Get Free Report) last released its earnings results on Tuesday, July 22nd. The software maker reported $1.31 earnings per share for the quarter, topping the consensus estimate of $1.12 by $0.19. The company had revenue of $272.42 million for the quarter, compared to the consensus estimate of $263.62 million. Manhattan Associates had a net margin of 20.91% and a return on equity of 82.91%. Manhattan Associates's revenue was up 2.7% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $1.18 EPS. Manhattan Associates has set its FY 2025 guidance at 4.760-4.840 EPS. On average, research analysts anticipate that Manhattan Associates, Inc. will post 3.3 EPS for the current fiscal year.

Insider Buying and Selling

In other news, Director Linda T. Hollembaek sold 2,024 shares of the stock in a transaction dated Tuesday, July 29th. The stock was sold at an average price of $221.53, for a total value of $448,376.72. Following the transaction, the director directly owned 11,907 shares of the company's stock, valued at approximately $2,637,757.71. This represents a 14.53% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP James Stewart Gantt sold 2,300 shares of Manhattan Associates stock in a transaction dated Friday, July 25th. The stock was sold at an average price of $220.33, for a total value of $506,759.00. Following the sale, the executive vice president directly owned 48,660 shares of the company's stock, valued at $10,721,257.80. This trade represents a 4.51% decrease in their position. The disclosure for this sale can be found here. Insiders sold 41,666 shares of company stock worth $9,251,781 in the last 90 days. Insiders own 0.72% of the company's stock.

Analyst Upgrades and Downgrades

MANH has been the topic of a number of recent analyst reports. Redburn Atlantic lowered Manhattan Associates from a "buy" rating to a "neutral" rating and reduced their target price for the stock from $270.00 to $200.00 in a research note on Tuesday, June 10th. Loop Capital raised their price target on Manhattan Associates from $170.00 to $200.00 and gave the company a "hold" rating in a research note on Tuesday, July 22nd. DA Davidson upped their price objective on shares of Manhattan Associates from $225.00 to $250.00 and gave the stock a "buy" rating in a research note on Wednesday, July 23rd. Barclays set a $247.00 target price on shares of Manhattan Associates in a research report on Tuesday. Finally, Weiss Ratings restated a "hold (c)" rating on shares of Manhattan Associates in a report on Saturday, September 27th. Six research analysts have rated the stock with a Buy rating, five have assigned a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $222.45.

Check Out Our Latest Stock Analysis on MANH

Manhattan Associates Company Profile

(

Free Report)

Manhattan Associates, Inc develops, sells, deploys, services, and maintains software solutions to manage supply chains, inventory, and omni-channel operations. It offers Warehouse Management Solution for managing goods and information across the distribution centers; Manhattan Active Warehouse Management, a cloud native and version less application for the associate; and Transportation Management Solution for helping shippers navigate their way through the demands and meet customer service expectations at the lowest possible freight costs; Manhattan SCALE, a portfolio of logistics execution solution; and Manhattan Active Omni, which offers order management, store inventory and fulfillment, POS, and customer engagement tools for enterprises and stores.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Manhattan Associates, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manhattan Associates wasn't on the list.

While Manhattan Associates currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report