Truvestments Capital LLC acquired a new stake in American Superconductor Corporation (NASDAQ:AMSC - Free Report) in the first quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 11,176 shares of the technology company's stock, valued at approximately $203,000.

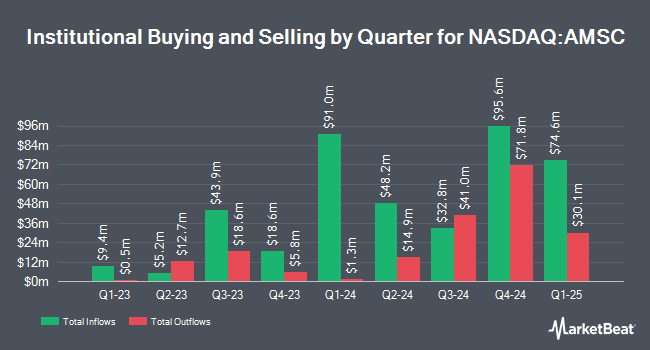

Other hedge funds also recently made changes to their positions in the company. Gen Wealth Partners Inc acquired a new position in shares of American Superconductor in the 4th quarter valued at $58,000. CWM LLC raised its stake in shares of American Superconductor by 49.5% in the 1st quarter. CWM LLC now owns 7,915 shares of the technology company's stock valued at $144,000 after buying an additional 2,622 shares in the last quarter. GAMMA Investing LLC raised its stake in shares of American Superconductor by 3,089.8% in the 1st quarter. GAMMA Investing LLC now owns 8,453 shares of the technology company's stock valued at $153,000 after buying an additional 8,188 shares in the last quarter. National Bank of Canada FI increased its position in shares of American Superconductor by 27.9% during the 1st quarter. National Bank of Canada FI now owns 9,506 shares of the technology company's stock worth $172,000 after purchasing an additional 2,072 shares in the last quarter. Finally, Acas LLC bought a new stake in American Superconductor during the first quarter worth about $184,000. Institutional investors and hedge funds own 52.28% of the company's stock.

American Superconductor Stock Performance

AMSC traded up $0.74 during midday trading on Wednesday, hitting $49.50. The company had a trading volume of 159,424 shares, compared to its average volume of 1,032,372. The company has a market capitalization of $2.24 billion, a PE ratio of 126.84 and a beta of 2.88. American Superconductor Corporation has a twelve month low of $13.98 and a twelve month high of $58.42. The firm's 50-day simple moving average is $46.04 and its 200-day simple moving average is $31.02.

Analysts Set New Price Targets

Several analysts have weighed in on the stock. Wall Street Zen raised shares of American Superconductor from a "hold" rating to a "buy" rating in a research note on Tuesday, July 15th. Oppenheimer reaffirmed an "outperform" rating on shares of American Superconductor in a research note on Thursday, July 31st. Three research analysts have rated the stock with a Buy rating, According to data from MarketBeat, the company currently has an average rating of "Buy" and an average price target of $33.67.

View Our Latest Research Report on American Superconductor

Insider Buying and Selling at American Superconductor

In other American Superconductor news, CEO Daniel P. Mcgahn sold 100,848 shares of the firm's stock in a transaction dated Monday, August 4th. The shares were sold at an average price of $54.49, for a total value of $5,495,207.52. Following the completion of the sale, the chief executive officer owned 1,183,134 shares in the company, valued at approximately $64,468,971.66. This trade represents a 7.85% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Arthur H. House sold 9,703 shares of the firm's stock in a transaction dated Friday, August 8th. The shares were sold at an average price of $50.92, for a total transaction of $494,076.76. Following the completion of the sale, the director owned 48,663 shares of the company's stock, valued at $2,477,919.96. The trade was a 16.62% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 122,984 shares of company stock worth $6,384,950. 4.80% of the stock is currently owned by corporate insiders.

About American Superconductor

(

Free Report)

American Superconductor Corporation, together with its subsidiaries, provides megawatt-scale power resiliency solutions worldwide. The company operates through Grid and Wind segments. The Grid segment offers products and services that enable electric utilities, industrial facilities, and renewable energy project developers to connect, transmit, and distribute power under the Gridtec Solutions brand.

Featured Articles

Before you consider American Superconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Superconductor wasn't on the list.

While American Superconductor currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.