Meeder Advisory Services Inc. raised its holdings in shares of Uber Technologies, Inc. (NYSE:UBER - Free Report) by 12.8% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 41,652 shares of the ride-sharing company's stock after buying an additional 4,728 shares during the period. Meeder Advisory Services Inc.'s holdings in Uber Technologies were worth $3,035,000 at the end of the most recent quarter.

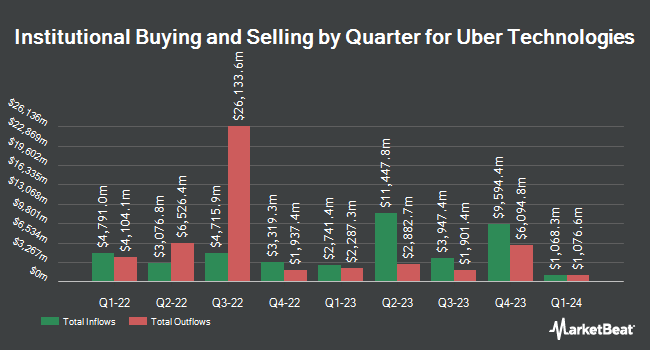

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Transce3nd LLC purchased a new position in Uber Technologies during the fourth quarter valued at $27,000. Fourth Dimension Wealth LLC bought a new stake in shares of Uber Technologies in the 4th quarter worth about $27,000. Kozak & Associates Inc. lifted its holdings in shares of Uber Technologies by 155.9% in the 1st quarter. Kozak & Associates Inc. now owns 366 shares of the ride-sharing company's stock worth $27,000 after acquiring an additional 223 shares during the last quarter. Noble Wealth Management PBC purchased a new position in Uber Technologies in the 1st quarter worth about $27,000. Finally, GPS Wealth Strategies Group LLC increased its stake in Uber Technologies by 305.1% in the 1st quarter. GPS Wealth Strategies Group LLC now owns 397 shares of the ride-sharing company's stock worth $29,000 after buying an additional 299 shares during the period. 80.24% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Several research firms have recently commented on UBER. Roth Capital boosted their price target on shares of Uber Technologies from $93.00 to $110.00 and gave the company a "buy" rating in a report on Monday, July 14th. Piper Sandler lifted their target price on shares of Uber Technologies from $95.00 to $103.00 and gave the stock an "overweight" rating in a research note on Thursday, July 24th. Tigress Financial set a $110.00 target price on shares of Uber Technologies and gave the stock a "buy" rating in a research note on Friday, May 23rd. UBS Group lifted their price objective on shares of Uber Technologies from $107.00 to $115.00 and gave the company a "buy" rating in a research note on Tuesday. Finally, Loop Capital restated a "buy" rating and set a $105.00 price objective (up from $89.00) on shares of Uber Technologies in a research note on Wednesday, May 21st. Ten analysts have rated the stock with a hold rating and twenty-nine have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $100.71.

Check Out Our Latest Stock Report on UBER

Uber Technologies Stock Performance

Shares of Uber Technologies stock traded down $3.41 during trading on Tuesday, reaching $87.19. The company's stock had a trading volume of 24,941,633 shares, compared to its average volume of 15,250,838. The company has a 50-day moving average price of $89.25 and a two-hundred day moving average price of $79.89. The firm has a market cap of $182.33 billion, a PE ratio of 15.27, a P/E/G ratio of 1.04 and a beta of 1.40. Uber Technologies, Inc. has a fifty-two week low of $54.84 and a fifty-two week high of $97.71. The company has a current ratio of 1.02, a quick ratio of 1.02 and a debt-to-equity ratio of 0.37.

Uber Technologies (NYSE:UBER - Get Free Report) last announced its earnings results on Wednesday, May 7th. The ride-sharing company reported $0.83 EPS for the quarter, beating analysts' consensus estimates of $0.50 by $0.33. Uber Technologies had a net margin of 27.07% and a return on equity of 66.46%. The business had revenue of $11.53 billion for the quarter, compared to analysts' expectations of $11.61 billion. During the same period in the previous year, the company posted ($0.32) EPS. The company's quarterly revenue was up 13.8% on a year-over-year basis. On average, analysts forecast that Uber Technologies, Inc. will post 2.54 EPS for the current year.

Insiders Place Their Bets

In related news, CFO Prashanth Mahendra-Rajah sold 2,750 shares of Uber Technologies stock in a transaction on Monday, July 7th. The shares were sold at an average price of $95.00, for a total value of $261,250.00. Following the transaction, the chief financial officer directly owned 21,975 shares in the company, valued at $2,087,625. This trade represents a 11.12% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, insider Jill Hazelbaker sold 34,884 shares of Uber Technologies stock in a transaction on Monday, May 12th. The stock was sold at an average price of $86.03, for a total value of $3,001,070.52. Following the transaction, the insider directly owned 102,135 shares of the company's stock, valued at $8,786,674.05. This trade represents a 25.46% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 40,384 shares of company stock worth $3,496,071. 3.70% of the stock is currently owned by insiders.

About Uber Technologies

(

Free Report)

Uber Technologies, Inc develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia excluding China and Southeast Asia. It operates through three segments: Mobility, Delivery, and Freight. The Mobility segment connects consumers with a range of transportation modalities, such as ridesharing, carsharing, micromobility, rentals, public transit, taxis, and other modalities; and offers riders in a variety of vehicle types, as well as financial partnerships products and advertising services.

Further Reading

Before you consider Uber Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Uber Technologies wasn't on the list.

While Uber Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.