TD Asset Management Inc boosted its holdings in UBS Group AG (NYSE:UBS - Free Report) by 12.5% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,081,873 shares of the bank's stock after purchasing an additional 120,442 shares during the period. TD Asset Management Inc's holdings in UBS Group were worth $32,864,000 at the end of the most recent reporting period.

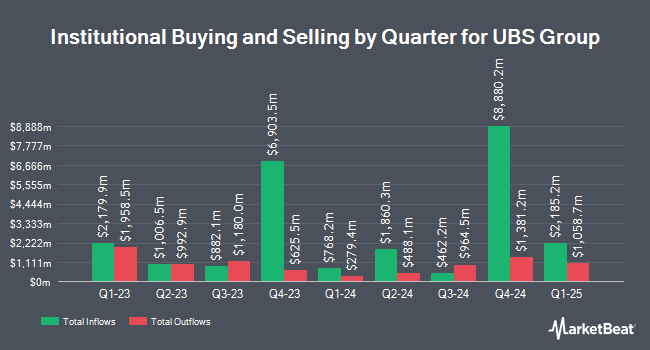

Several other hedge funds have also added to or reduced their stakes in the business. City Holding Co. bought a new position in UBS Group during the 1st quarter valued at approximately $25,000. Grove Bank & Trust purchased a new position in UBS Group during the 1st quarter valued at about $28,000. Headlands Technologies LLC purchased a new position in UBS Group in the fourth quarter worth about $33,000. Berbice Capital Management LLC raised its holdings in UBS Group by 44.4% in the first quarter. Berbice Capital Management LLC now owns 1,300 shares of the bank's stock worth $40,000 after buying an additional 400 shares during the last quarter. Finally, Rakuten Securities Inc. raised its holdings in UBS Group by 45.9% in the first quarter. Rakuten Securities Inc. now owns 1,466 shares of the bank's stock worth $45,000 after buying an additional 461 shares during the last quarter.

UBS Group Trading Down 2.1%

UBS stock traded down $0.77 during trading on Friday, hitting $36.56. The company had a trading volume of 2,596,680 shares, compared to its average volume of 3,216,965. The firm has a market capitalization of $117.24 billion, a P/E ratio of 19.36, a PEG ratio of 0.68 and a beta of 1.15. UBS Group AG has a 52-week low of $25.75 and a 52-week high of $38.42. The company has a 50 day simple moving average of $34.05 and a 200-day simple moving average of $32.71. The company has a quick ratio of 1.04, a current ratio of 1.04 and a debt-to-equity ratio of 3.72.

UBS Group (NYSE:UBS - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The bank reported $0.72 EPS for the quarter, topping the consensus estimate of $0.70 by $0.02. The company had revenue of $11.55 billion for the quarter, compared to the consensus estimate of $9.77 billion. UBS Group had a net margin of 9.21% and a return on equity of 7.23%. During the same quarter last year, the firm posted $0.34 EPS. As a group, research analysts forecast that UBS Group AG will post 1.9 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several research analysts have recently weighed in on the stock. Bank of America raised shares of UBS Group from an "underperform" rating to a "neutral" rating in a report on Tuesday, July 22nd. DZ Bank upgraded shares of UBS Group from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, May 6th. Wall Street Zen upgraded shares of UBS Group from a "sell" rating to a "hold" rating in a research report on Saturday, July 26th. Royal Bank Of Canada reaffirmed an "outperform" rating on shares of UBS Group in a research note on Wednesday, May 21st. Finally, Morgan Stanley downgraded shares of UBS Group from an "equal weight" rating to an "underweight" rating in a research note on Wednesday, June 18th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, UBS Group currently has an average rating of "Moderate Buy".

Get Our Latest Stock Report on UBS Group

About UBS Group

(

Free Report)

UBS Group AG provides financial advice and solutions to private, institutional, and corporate clients worldwide. It operates through five divisions: Global Wealth Management, Personal & Corporate Banking, Asset Management, Investment Bank, and Non-core and Legacy. The company offers investment advice, estate and wealth planning, investing, corporate and banking, and investment management, as well as mortgage, securities-based, and structured lending solutions.

Read More

Before you consider UBS Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UBS Group wasn't on the list.

While UBS Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.