Voya Investment Management LLC cut its stake in UiPath, Inc. (NYSE:PATH - Free Report) by 74.4% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 200,802 shares of the company's stock after selling 582,309 shares during the quarter. Voya Investment Management LLC's holdings in UiPath were worth $2,068,000 at the end of the most recent quarter.

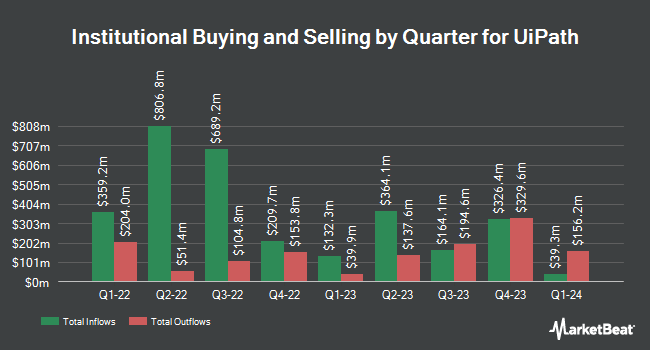

Other hedge funds have also bought and sold shares of the company. Vanguard Group Inc. increased its position in shares of UiPath by 3.0% in the first quarter. Vanguard Group Inc. now owns 48,061,096 shares of the company's stock worth $495,029,000 after acquiring an additional 1,396,972 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in shares of UiPath by 10.9% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 6,132,003 shares of the company's stock valued at $63,164,000 after acquiring an additional 602,866 shares during the period. Federated Hermes Inc. increased its stake in UiPath by 479.3% during the 1st quarter. Federated Hermes Inc. now owns 5,720,096 shares of the company's stock worth $58,917,000 after purchasing an additional 4,732,712 shares in the last quarter. Acadian Asset Management LLC grew its position in shares of UiPath by 222.6% in the 1st quarter. Acadian Asset Management LLC now owns 4,241,047 shares of the company's stock valued at $43,667,000 after acquiring an additional 2,926,263 shares during the period. Finally, Charles Schwab Investment Management Inc. lifted its holdings in UiPath by 6.3% during the 1st quarter. Charles Schwab Investment Management Inc. now owns 2,995,632 shares of the company's stock valued at $30,855,000 after purchasing an additional 177,071 shares during the last quarter. 62.50% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, CEO Daniel Dines sold 122,733 shares of the company's stock in a transaction on Monday, September 22nd. The shares were sold at an average price of $12.20, for a total transaction of $1,497,342.60. Following the completion of the sale, the chief executive officer directly owned 2,209,201 shares of the company's stock, valued at approximately $26,952,252.20. This represents a 5.26% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders have sold 1,199,509 shares of company stock valued at $14,822,395 over the last ninety days. Insiders own 23.19% of the company's stock.

UiPath Price Performance

Shares of NYSE:PATH traded up $1.29 during trading on Monday, reaching $13.16. 28,127,980 shares of the company's stock traded hands, compared to its average volume of 12,326,224. The company has a 50 day moving average of $11.51 and a 200-day moving average of $11.76. The stock has a market capitalization of $6.99 billion, a P/E ratio of 438.50, a price-to-earnings-growth ratio of 4.54 and a beta of 1.02. UiPath, Inc. has a 12 month low of $9.38 and a 12 month high of $15.93.

UiPath (NYSE:PATH - Get Free Report) last issued its quarterly earnings results on Thursday, September 4th. The company reported $0.15 earnings per share for the quarter, topping analysts' consensus estimates of $0.08 by $0.07. UiPath had a net margin of 1.35% and a return on equity of 1.28%. The company had revenue of $361.73 million during the quarter, compared to analyst estimates of $347.36 million. During the same period in the prior year, the business posted $0.04 EPS. The business's revenue for the quarter was up 14.6% compared to the same quarter last year. UiPath has set its FY 2026 guidance at EPS. Q3 2026 guidance at EPS. Equities research analysts predict that UiPath, Inc. will post -0.17 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several analysts have recently weighed in on PATH shares. Zacks Research upgraded UiPath from a "hold" rating to a "strong-buy" rating in a report on Monday, September 8th. Royal Bank Of Canada increased their price target on UiPath from $13.00 to $15.00 and gave the stock a "sector perform" rating in a research note on Friday, May 30th. Scotiabank raised their price target on UiPath from $12.00 to $13.00 and gave the company a "sector perform" rating in a report on Friday, May 30th. Evercore ISI lifted their price target on UiPath from $11.00 to $15.00 and gave the stock an "in-line" rating in a research note on Friday, May 30th. Finally, Wall Street Zen upgraded UiPath from a "buy" rating to a "strong-buy" rating in a research report on Saturday, September 6th. One equities research analyst has rated the stock with a Strong Buy rating, two have assigned a Buy rating, twelve have issued a Hold rating and two have given a Sell rating to the company. Based on data from MarketBeat, UiPath currently has an average rating of "Hold" and a consensus price target of $13.18.

View Our Latest Stock Report on PATH

UiPath Profile

(

Free Report)

UiPath Inc provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally. The company offers a suite of interrelated software to build, manage, run, engage, measure, and govern automation within the organization.

See Also

Before you consider UiPath, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UiPath wasn't on the list.

While UiPath currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report