Citizens Financial Group Inc. RI trimmed its holdings in Union Pacific Corporation (NYSE:UNP - Free Report) by 3.8% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 33,427 shares of the railroad operator's stock after selling 1,318 shares during the quarter. Citizens Financial Group Inc. RI's holdings in Union Pacific were worth $7,897,000 as of its most recent filing with the Securities and Exchange Commission.

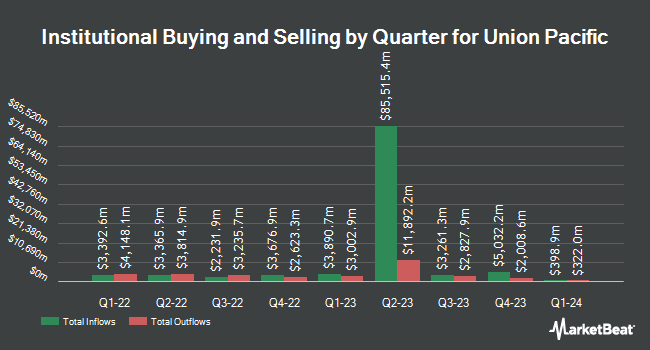

A number of other institutional investors and hedge funds also recently bought and sold shares of UNP. Capital Research Global Investors boosted its holdings in shares of Union Pacific by 14.3% in the fourth quarter. Capital Research Global Investors now owns 10,395,364 shares of the railroad operator's stock worth $2,370,559,000 after buying an additional 1,298,178 shares during the period. Northern Trust Corp lifted its position in shares of Union Pacific by 15.2% in the 4th quarter. Northern Trust Corp now owns 6,962,650 shares of the railroad operator's stock valued at $1,587,763,000 after acquiring an additional 920,414 shares in the last quarter. Price T Rowe Associates Inc. MD boosted its stake in Union Pacific by 1.6% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 6,594,882 shares of the railroad operator's stock worth $1,503,899,000 after purchasing an additional 105,111 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its position in Union Pacific by 35.2% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 4,968,658 shares of the railroad operator's stock worth $1,133,053,000 after purchasing an additional 1,294,643 shares in the last quarter. Finally, Nuveen Asset Management LLC raised its stake in Union Pacific by 2.1% during the 4th quarter. Nuveen Asset Management LLC now owns 4,372,636 shares of the railroad operator's stock valued at $997,136,000 after purchasing an additional 89,199 shares during the period. 80.38% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Several analysts have recently commented on UNP shares. BMO Capital Markets raised their target price on Union Pacific from $270.00 to $277.00 and gave the stock an "outperform" rating in a research report on Friday, July 25th. Argus upgraded Union Pacific to a "strong-buy" rating in a research report on Friday, May 16th. Baird R W upgraded Union Pacific to a "hold" rating in a report on Tuesday, July 1st. Wells Fargo & Company increased their price target on shares of Union Pacific from $250.00 to $260.00 and gave the stock an "overweight" rating in a research report on Friday, July 25th. Finally, Evercore ISI dropped their price objective on shares of Union Pacific from $244.00 to $238.00 and set an "in-line" rating on the stock in a research note on Friday, July 25th. One equities research analyst has rated the stock with a sell rating, eleven have issued a hold rating, fourteen have given a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $258.21.

View Our Latest Report on Union Pacific

Union Pacific Stock Performance

UNP traded down $0.39 on Friday, hitting $222.27. The company had a trading volume of 2,345,506 shares, compared to its average volume of 5,336,163. The stock has a market cap of $131.82 billion, a price-to-earnings ratio of 19.31, a price-to-earnings-growth ratio of 2.17 and a beta of 1.05. The company has a debt-to-equity ratio of 1.86, a current ratio of 0.65 and a quick ratio of 0.53. The company's fifty day moving average price is $227.09 and its 200 day moving average price is $230.48. Union Pacific Corporation has a 1-year low of $204.66 and a 1-year high of $258.07.

Union Pacific (NYSE:UNP - Get Free Report) last issued its quarterly earnings data on Thursday, July 24th. The railroad operator reported $3.03 earnings per share for the quarter, topping analysts' consensus estimates of $2.84 by $0.19. The business had revenue of $6.15 billion during the quarter, compared to analysts' expectations of $6.09 billion. Union Pacific had a net margin of 28.43% and a return on equity of 41.73%. Union Pacific's revenue for the quarter was up 2.4% on a year-over-year basis. During the same period in the previous year, the company earned $2.74 earnings per share. Equities analysts predict that Union Pacific Corporation will post 11.99 earnings per share for the current fiscal year.

Union Pacific Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Friday, August 29th will be given a $1.38 dividend. This is an increase from Union Pacific's previous quarterly dividend of $1.34. This represents a $5.52 annualized dividend and a dividend yield of 2.5%. The ex-dividend date of this dividend is Friday, August 29th. Union Pacific's dividend payout ratio (DPR) is 46.57%.

About Union Pacific

(

Free Report)

Union Pacific Corporation, through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States. The company offers transportation services for grain and grain products, fertilizers, food and refrigerated products, and coal and renewables to grain processors, animal feeders, ethanol producers, renewable biofuel producers, and other agricultural users; and construction products, industrial chemicals, plastics, forest products, specialized products, metals and ores, petroleum, liquid petroleum gases, soda ash, and sand, as well as finished automobiles, automotive parts, and merchandise in intermodal containers.

See Also

Before you consider Union Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Union Pacific wasn't on the list.

While Union Pacific currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report