Universal Beteiligungs und Servicegesellschaft mbH increased its stake in Carpenter Technology Corporation (NYSE:CRS - Free Report) by 22.7% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 61,886 shares of the basic materials company's stock after purchasing an additional 11,457 shares during the period. Universal Beteiligungs und Servicegesellschaft mbH owned approximately 0.12% of Carpenter Technology worth $11,213,000 as of its most recent filing with the Securities and Exchange Commission.

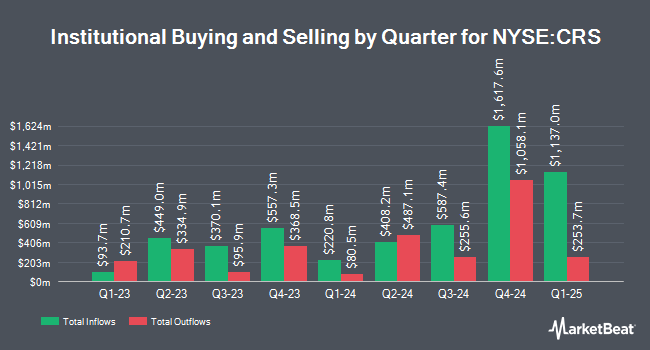

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the stock. Bessemer Group Inc. lifted its position in Carpenter Technology by 50.3% during the 1st quarter. Bessemer Group Inc. now owns 230 shares of the basic materials company's stock worth $42,000 after buying an additional 77 shares in the last quarter. Ameriflex Group Inc. bought a new stake in Carpenter Technology during the 4th quarter worth about $44,000. CIBC Private Wealth Group LLC lifted its position in Carpenter Technology by 109.5% during the 4th quarter. CIBC Private Wealth Group LLC now owns 243 shares of the basic materials company's stock worth $45,000 after buying an additional 127 shares in the last quarter. Versant Capital Management Inc lifted its position in Carpenter Technology by 27.3% during the 1st quarter. Versant Capital Management Inc now owns 359 shares of the basic materials company's stock worth $65,000 after buying an additional 77 shares in the last quarter. Finally, UMB Bank n.a. lifted its position in Carpenter Technology by 54.9% during the 1st quarter. UMB Bank n.a. now owns 471 shares of the basic materials company's stock worth $85,000 after buying an additional 167 shares in the last quarter. 92.03% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

CRS has been the topic of several analyst reports. JPMorgan Chase & Co. boosted their price target on shares of Carpenter Technology from $245.00 to $305.00 and gave the stock an "overweight" rating in a research report on Tuesday, June 17th. Benchmark upped their target price on shares of Carpenter Technology from $250.00 to $300.00 and gave the company a "buy" rating in a report on Monday, June 9th. Northcoast Research raised shares of Carpenter Technology from a "sell" rating to a "neutral" rating in a report on Wednesday, April 9th. Finally, Cowen reaffirmed a "buy" rating on shares of Carpenter Technology in a report on Thursday, June 12th. One investment analyst has rated the stock with a hold rating and four have issued a buy rating to the company. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and an average target price of $278.33.

View Our Latest Report on CRS

Carpenter Technology Stock Performance

Shares of CRS stock traded down $1.46 on Tuesday, reaching $274.85. The stock had a trading volume of 97,398 shares, compared to its average volume of 902,086. The company has a quick ratio of 1.89, a current ratio of 3.75 and a debt-to-equity ratio of 0.39. The firm's 50-day moving average is $259.95 and its two-hundred day moving average is $216.23. The firm has a market capitalization of $13.68 billion, a price-to-earnings ratio of 38.95, a P/E/G ratio of 0.91 and a beta of 1.39. Carpenter Technology Corporation has a 12 month low of $119.69 and a 12 month high of $290.84.

Carpenter Technology declared that its board has authorized a stock buyback plan on Thursday, April 24th that authorizes the company to repurchase $400.00 million in outstanding shares. This repurchase authorization authorizes the basic materials company to repurchase up to 4% of its shares through open market purchases. Shares repurchase plans are generally an indication that the company's leadership believes its shares are undervalued.

Insider Activity

In other Carpenter Technology news, Director Anastasios John Hart sold 1,000 shares of the stock in a transaction dated Thursday, June 12th. The shares were sold at an average price of $243.72, for a total value of $243,720.00. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Insiders own 2.90% of the company's stock.

Carpenter Technology Company Profile

(

Free Report)

Carpenter Technology Corporation engages in the manufacture, fabrication, and distribution of specialty metals in the United States, Europe, the Asia Pacific, Mexico, Canada, and internationally. It operates in two segments, Specialty Alloys Operations and Performance Engineered Products. The company offers specialty alloys, including titanium alloys, powder metals, stainless steels, alloy steels, and tool steels, as well as additives, and metal powders and parts.

Featured Stories

Before you consider Carpenter Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carpenter Technology wasn't on the list.

While Carpenter Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.