Universal Beteiligungs und Servicegesellschaft mbH bought a new stake in Macerich Company (The) (NYSE:MAC - Free Report) in the 1st quarter, according to its most recent disclosure with the SEC. The fund bought 162,002 shares of the real estate investment trust's stock, valued at approximately $2,782,000. Universal Beteiligungs und Servicegesellschaft mbH owned approximately 0.06% of Macerich at the end of the most recent reporting period.

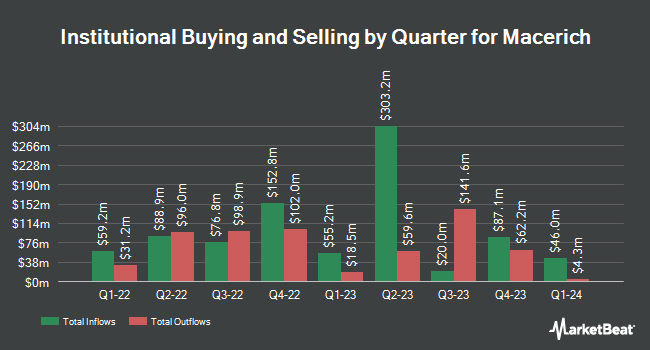

Several other institutional investors and hedge funds have also recently bought and sold shares of MAC. CIBC Private Wealth Group LLC increased its position in Macerich by 9.7% during the 4th quarter. CIBC Private Wealth Group LLC now owns 5,787 shares of the real estate investment trust's stock worth $118,000 after purchasing an additional 512 shares during the period. Signaturefd LLC lifted its position in shares of Macerich by 34.9% in the first quarter. Signaturefd LLC now owns 3,329 shares of the real estate investment trust's stock valued at $57,000 after acquiring an additional 862 shares in the last quarter. Townsquare Capital LLC raised its position in shares of Macerich by 7.0% in the fourth quarter. Townsquare Capital LLC now owns 14,395 shares of the real estate investment trust's stock valued at $287,000 after buying an additional 947 shares during the last quarter. Gotham Asset Management LLC boosted its holdings in shares of Macerich by 8.4% during the fourth quarter. Gotham Asset Management LLC now owns 12,830 shares of the real estate investment trust's stock worth $256,000 after purchasing an additional 997 shares during the last quarter. Finally, Quantbot Technologies LP acquired a new position in shares of Macerich during the 4th quarter valued at about $30,000. 87.38% of the stock is owned by institutional investors and hedge funds.

Macerich Stock Performance

Shares of MAC traded down $0.65 during mid-day trading on Wednesday, hitting $16.55. The company's stock had a trading volume of 2,239,654 shares, compared to its average volume of 1,377,631. The stock's 50-day moving average is $16.28 and its two-hundred day moving average is $16.99. The firm has a market capitalization of $4.18 billion, a PE ratio of -38.49, a price-to-earnings-growth ratio of 3.32 and a beta of 2.13. The company has a debt-to-equity ratio of 1.91, a quick ratio of 1.09 and a current ratio of 1.09. Macerich Company has a one year low of $12.48 and a one year high of $22.27.

Macerich (NYSE:MAC - Get Free Report) last announced its quarterly earnings data on Monday, May 12th. The real estate investment trust reported $0.33 EPS for the quarter, topping analysts' consensus estimates of $0.31 by $0.02. The company had revenue of $249.22 million during the quarter, compared to the consensus estimate of $221.61 million. Macerich had a negative return on equity of 4.37% and a negative net margin of 12.26%. The company's quarterly revenue was up 19.3% on a year-over-year basis. During the same quarter last year, the company earned $0.33 EPS. As a group, sell-side analysts anticipate that Macerich Company will post 1.55 EPS for the current year.

Analysts Set New Price Targets

A number of analysts recently issued reports on the stock. Mizuho raised shares of Macerich from a "neutral" rating to an "outperform" rating and dropped their target price for the stock from $22.00 to $18.00 in a research report on Tuesday, June 10th. LADENBURG THALM/SH SH began coverage on Macerich in a research report on Friday, July 18th. They set a "buy" rating and a $25.00 price target on the stock. Truist Financial upped their price target on shares of Macerich from $19.00 to $21.00 and gave the stock a "buy" rating in a research report on Monday, June 9th. Scotiabank reduced their price objective on shares of Macerich from $21.00 to $16.00 and set a "sector perform" rating for the company in a report on Wednesday, April 23rd. Finally, Morgan Stanley cut their target price on shares of Macerich from $20.00 to $19.00 and set an "equal weight" rating for the company in a research note on Tuesday, April 1st. Three investment analysts have rated the stock with a sell rating, six have assigned a hold rating and five have given a buy rating to the stock. According to MarketBeat.com, Macerich currently has an average rating of "Hold" and an average target price of $19.26.

View Our Latest Stock Analysis on MAC

About Macerich

(

Free Report)

Macerich is a fully integrated, self-managed and self-administered real estate investment trust (REIT). As a leading owner, operator and developer of high-quality retail real estate in densely populated and attractive U.S. markets, Macerich's portfolio is concentrated in California, the Pacific Northwest, Phoenix/Scottsdale, and the Metro New York to Washington, DC corridor.

See Also

Before you consider Macerich, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Macerich wasn't on the list.

While Macerich currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.