Universal Beteiligungs und Servicegesellschaft mbH bought a new position in Sterling Infrastructure, Inc. (NASDAQ:STRL - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 41,044 shares of the construction company's stock, valued at approximately $6,914,000. Universal Beteiligungs und Servicegesellschaft mbH owned approximately 0.13% of Sterling Infrastructure as of its most recent SEC filing.

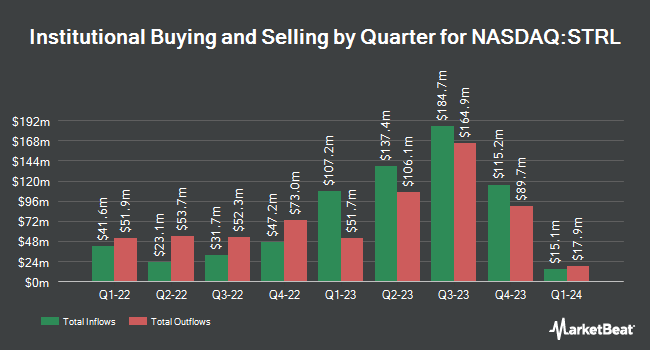

A number of other hedge funds and other institutional investors have also bought and sold shares of STRL. Vanguard Group Inc. raised its position in shares of Sterling Infrastructure by 30.0% during the 4th quarter. Vanguard Group Inc. now owns 2,523,804 shares of the construction company's stock valued at $425,135,000 after buying an additional 581,847 shares in the last quarter. Invesco Ltd. increased its stake in shares of Sterling Infrastructure by 22.5% in the 4th quarter. Invesco Ltd. now owns 757,273 shares of the construction company's stock worth $127,563,000 after acquiring an additional 139,081 shares in the last quarter. Allspring Global Investments Holdings LLC boosted its position in shares of Sterling Infrastructure by 7.9% in the 4th quarter. Allspring Global Investments Holdings LLC now owns 666,909 shares of the construction company's stock worth $111,873,000 after purchasing an additional 49,008 shares in the last quarter. Capital Research Global Investors grew its stake in shares of Sterling Infrastructure by 78.5% in the fourth quarter. Capital Research Global Investors now owns 574,976 shares of the construction company's stock worth $96,855,000 after acquiring an additional 252,934 shares during the last quarter. Finally, GW&K Investment Management LLC raised its holdings in Sterling Infrastructure by 3.4% in the fourth quarter. GW&K Investment Management LLC now owns 363,251 shares of the construction company's stock worth $61,190,000 after buying an additional 12,064 shares during the last quarter. Institutional investors own 80.95% of the company's stock.

Sterling Infrastructure Trading Down 0.2%

Shares of STRL traded down $0.42 during trading hours on Wednesday, reaching $193.81. 237,405 shares of the company traded hands, compared to its average volume of 500,524. The firm has a market cap of $5.89 billion, a price-to-earnings ratio of 32.74, a PEG ratio of 1.28 and a beta of 1.27. The company has a current ratio of 1.29, a quick ratio of 1.29 and a debt-to-equity ratio of 0.41. Sterling Infrastructure, Inc. has a 12-month low of $93.50 and a 12-month high of $206.07. The stock's fifty day moving average price is $157.12 and its 200 day moving average price is $157.01.

Wall Street Analyst Weigh In

Several equities analysts have issued reports on the stock. DA Davidson upgraded shares of Sterling Infrastructure from a "neutral" rating to a "buy" rating and set a $185.00 target price on the stock in a research note on Thursday, February 27th. Wall Street Zen raised shares of Sterling Infrastructure from a "hold" rating to a "buy" rating in a research note on Thursday, May 22nd.

Read Our Latest Analysis on STRL

Sterling Infrastructure Profile

(

Free Report)

Sterling Infrastructure, Inc engages in the provision of e-infrastructure, transportation, and building solutions primarily in the United States. It operates through three segments: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The E-Infrastructure Solutions segment provides site development services for the blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors.

See Also

Before you consider Sterling Infrastructure, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sterling Infrastructure wasn't on the list.

While Sterling Infrastructure currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.