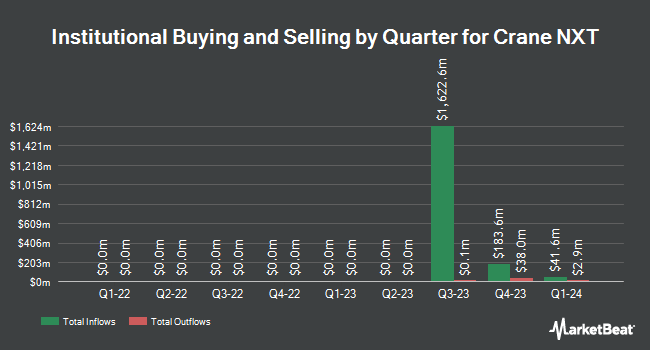

Universal Beteiligungs und Servicegesellschaft mbH purchased a new stake in shares of Crane NXT, Co. (NYSE:CXT - Free Report) in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund purchased 65,249 shares of the company's stock, valued at approximately $3,354,000. Universal Beteiligungs und Servicegesellschaft mbH owned 0.11% of Crane NXT as of its most recent SEC filing.

A number of other large investors have also made changes to their positions in the company. Financial Harvest LLC bought a new stake in shares of Crane NXT during the 1st quarter valued at about $139,000. Victory Capital Management Inc. grew its stake in shares of Crane NXT by 13.4% during the 1st quarter. Victory Capital Management Inc. now owns 1,367,931 shares of the company's stock valued at $70,312,000 after purchasing an additional 161,417 shares during the period. MQS Management LLC bought a new stake in shares of Crane NXT during the 1st quarter valued at about $378,000. Isthmus Partners LLC bought a new stake in shares of Crane NXT during the 1st quarter valued at about $1,480,000. Finally, Linden Thomas Advisory Services LLC grew its stake in shares of Crane NXT by 7.7% during the 1st quarter. Linden Thomas Advisory Services LLC now owns 22,218 shares of the company's stock valued at $1,142,000 after purchasing an additional 1,595 shares during the period. 77.49% of the stock is currently owned by institutional investors.

Crane NXT Stock Performance

Shares of CXT stock traded down $2.10 during trading hours on Friday, reaching $57.24. 108,521 shares of the company traded hands, compared to its average volume of 421,070. Crane NXT, Co. has a 12-month low of $41.54 and a 12-month high of $67.00. The company has a debt-to-equity ratio of 0.49, a current ratio of 1.20 and a quick ratio of 0.92. The company has a market cap of $3.28 billion, a P/E ratio of 19.67 and a beta of 1.29. The firm has a 50-day moving average price of $55.96 and a 200 day moving average price of $54.80.

Crane NXT (NYSE:CXT - Get Free Report) last posted its quarterly earnings data on Wednesday, May 7th. The company reported $0.54 earnings per share for the quarter, beating analysts' consensus estimates of $0.51 by $0.03. Crane NXT had a return on equity of 21.58% and a net margin of 11.17%. The firm had revenue of $330.30 million for the quarter, compared to analysts' expectations of $318.46 million. During the same period in the previous year, the firm earned $0.85 EPS. The business's quarterly revenue was up 5.3% on a year-over-year basis. As a group, sell-side analysts predict that Crane NXT, Co. will post 4.16 earnings per share for the current fiscal year.

Crane NXT Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, June 11th. Investors of record on Friday, May 30th were issued a $0.17 dividend. The ex-dividend date of this dividend was Friday, May 30th. This represents a $0.68 dividend on an annualized basis and a yield of 1.2%. Crane NXT's payout ratio is currently 23.37%.

Analyst Upgrades and Downgrades

A number of equities research analysts have issued reports on the company. DA Davidson cut their price target on Crane NXT from $100.00 to $85.00 and set a "buy" rating for the company in a research note on Friday, May 9th. UBS Group cut their price target on Crane NXT from $62.00 to $60.00 and set a "neutral" rating for the company in a research note on Tuesday, May 13th. Three investment analysts have rated the stock with a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, Crane NXT has an average rating of "Moderate Buy" and a consensus price target of $73.75.

Get Our Latest Analysis on CXT

About Crane NXT

(

Free Report)

Crane NXT, Co operates as an industrial technology company that provides technology solutions to secure, detect, and authenticate customers' important assets. The company operates through Crane Payment Innovations and Crane Currency segments. The Crane Payment Innovations segment offers electronic equipment and associated software, as well as advanced automation solutions, processing systems, field service solutions, remote diagnostics, and productivity software solutions.

See Also

Before you consider Crane NXT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crane NXT wasn't on the list.

While Crane NXT currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.