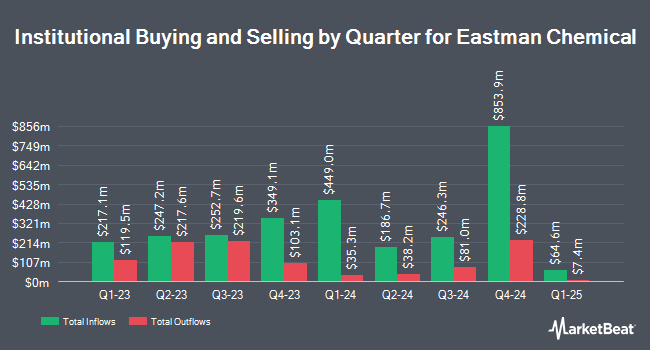

Universal Beteiligungs und Servicegesellschaft mbH raised its holdings in Eastman Chemical Company (NYSE:EMN - Free Report) by 4.6% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 137,407 shares of the basic materials company's stock after buying an additional 6,050 shares during the period. Universal Beteiligungs und Servicegesellschaft mbH owned about 0.12% of Eastman Chemical worth $12,107,000 as of its most recent filing with the Securities and Exchange Commission.

Other large investors have also recently made changes to their positions in the company. Principal Financial Group Inc. lifted its position in shares of Eastman Chemical by 5.9% during the first quarter. Principal Financial Group Inc. now owns 155,509 shares of the basic materials company's stock valued at $13,702,000 after purchasing an additional 8,708 shares in the last quarter. OneDigital Investment Advisors LLC increased its holdings in Eastman Chemical by 36.9% during the first quarter. OneDigital Investment Advisors LLC now owns 3,029 shares of the basic materials company's stock worth $267,000 after buying an additional 816 shares during the last quarter. Teacher Retirement System of Texas purchased a new stake in Eastman Chemical during the first quarter worth about $1,494,000. Farther Finance Advisors LLC increased its holdings in Eastman Chemical by 12.8% during the first quarter. Farther Finance Advisors LLC now owns 1,890 shares of the basic materials company's stock worth $167,000 after buying an additional 214 shares during the last quarter. Finally, Golden State Wealth Management LLC increased its holdings in Eastman Chemical by 882.3% during the first quarter. Golden State Wealth Management LLC now owns 943 shares of the basic materials company's stock worth $83,000 after buying an additional 847 shares during the last quarter. 83.65% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of analysts recently issued reports on EMN shares. KeyCorp decreased their price objective on shares of Eastman Chemical from $106.00 to $93.00 and set an "overweight" rating for the company in a report on Monday, July 14th. Wells Fargo & Company decreased their price objective on shares of Eastman Chemical from $125.00 to $90.00 and set an "overweight" rating for the company in a report on Wednesday, April 9th. Royal Bank Of Canada upgraded shares of Eastman Chemical from a "sector perform" rating to an "outperform" rating and set a $91.00 price objective for the company in a report on Wednesday, April 9th. Barclays decreased their price objective on shares of Eastman Chemical from $108.00 to $85.00 and set an "equal weight" rating for the company in a report on Tuesday, April 29th. Finally, UBS Group reduced their target price on shares of Eastman Chemical from $107.00 to $101.00 and set a "buy" rating for the company in a research note on Wednesday, July 9th. Six analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average price target of $97.08.

Check Out Our Latest Stock Analysis on Eastman Chemical

Eastman Chemical Price Performance

NYSE:EMN traded down $1.02 during mid-day trading on Tuesday, hitting $75.70. 165,116 shares of the stock traded hands, compared to its average volume of 1,477,747. The business's 50-day moving average price is $78.61 and its 200 day moving average price is $85.07. The company has a market cap of $8.74 billion, a PE ratio of 9.64, a price-to-earnings-growth ratio of 2.25 and a beta of 1.22. Eastman Chemical Company has a 12-month low of $70.90 and a 12-month high of $114.50. The company has a quick ratio of 0.79, a current ratio of 1.72 and a debt-to-equity ratio of 0.80.

Eastman Chemical Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, July 8th. Investors of record on Friday, June 13th were paid a dividend of $0.83 per share. The ex-dividend date of this dividend was Friday, June 13th. This represents a $3.32 annualized dividend and a yield of 4.39%. Eastman Chemical's dividend payout ratio is currently 42.24%.

About Eastman Chemical

(

Free Report)

Eastman Chemical Company operates as a specialty materials company in the United States, China, and internationally. The company's Additives & Functional Products segment offers amine derivative-based building blocks, intermediates for surfactants, metam-based soil fumigants, and organic acid-based solutions; specialty coalescent and solvents, paint additives, and specialty polymers; and heat transfer and aviation fluids.

Read More

Before you consider Eastman Chemical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eastman Chemical wasn't on the list.

While Eastman Chemical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.