Universal Beteiligungs und Servicegesellschaft mbH grew its position in Carnival Corporation (NYSE:CCL - Free Report) by 17.9% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 532,098 shares of the company's stock after purchasing an additional 80,704 shares during the quarter. Universal Beteiligungs und Servicegesellschaft mbH's holdings in Carnival were worth $10,392,000 as of its most recent SEC filing.

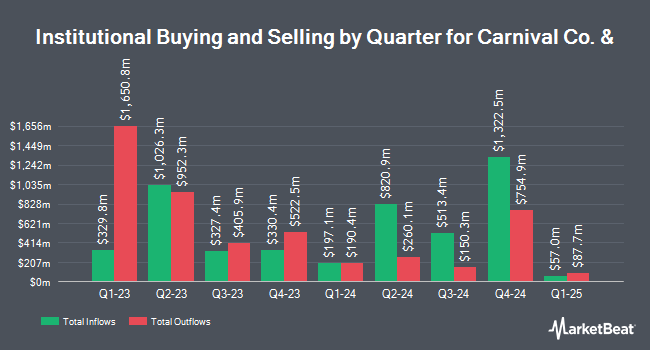

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Y Intercept Hong Kong Ltd grew its position in shares of Carnival by 25.8% in the first quarter. Y Intercept Hong Kong Ltd now owns 18,090 shares of the company's stock valued at $353,000 after purchasing an additional 3,713 shares during the last quarter. Choreo LLC boosted its stake in shares of Carnival by 43.0% in the first quarter. Choreo LLC now owns 24,968 shares of the company's stock valued at $488,000 after buying an additional 7,506 shares during the period. 4WEALTH Advisors Inc. bought a new stake in shares of Carnival in the first quarter valued at approximately $227,000. Teachers Retirement System of The State of Kentucky boosted its stake in shares of Carnival by 7.0% in the first quarter. Teachers Retirement System of The State of Kentucky now owns 80,065 shares of the company's stock valued at $1,564,000 after buying an additional 5,205 shares during the period. Finally, J.W. Cole Advisors Inc. boosted its stake in shares of Carnival by 43.5% in the first quarter. J.W. Cole Advisors Inc. now owns 51,522 shares of the company's stock valued at $1,006,000 after buying an additional 15,617 shares during the period. Institutional investors and hedge funds own 67.19% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities research analysts recently issued reports on the company. Wall Street Zen upgraded Carnival from a "hold" rating to a "buy" rating in a research note on Wednesday, May 14th. Macquarie cut their price target on Carnival from $31.00 to $26.00 and set an "outperform" rating for the company in a research note on Friday, May 9th. Bank of America boosted their price target on Carnival from $31.00 to $38.00 and gave the company a "buy" rating in a research note on Wednesday, July 23rd. Loop Capital reiterated a "hold" rating and issued a $22.00 price target on shares of Carnival in a research note on Monday, June 23rd. Finally, Mizuho boosted their price target on Carnival from $33.00 to $35.00 and gave the company an "outperform" rating in a research note on Wednesday, June 25th. Seven investment analysts have rated the stock with a hold rating and fourteen have given a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $30.71.

Get Our Latest Analysis on CCL

Carnival Price Performance

Shares of CCL traded down $0.37 during trading hours on Tuesday, reaching $29.36. The stock had a trading volume of 10,478,246 shares, compared to its average volume of 24,371,842. Carnival Corporation has a 12 month low of $13.78 and a 12 month high of $31.01. The stock has a market capitalization of $34.27 billion, a PE ratio of 15.87, a PEG ratio of 0.67 and a beta of 2.61. The company has a debt-to-equity ratio of 2.58, a quick ratio of 0.30 and a current ratio of 0.34. The company's 50-day moving average is $26.14 and its two-hundred day moving average is $23.42.

Carnival (NYSE:CCL - Get Free Report) last announced its quarterly earnings results on Tuesday, June 24th. The company reported $0.35 EPS for the quarter, beating analysts' consensus estimates of $0.24 by $0.11. Carnival had a return on equity of 27.88% and a net margin of 9.72%. The company had revenue of $6.33 billion during the quarter, compared to analysts' expectations of $6.20 billion. During the same period in the prior year, the company earned $0.11 EPS. Carnival's revenue was up 9.5% compared to the same quarter last year. Research analysts expect that Carnival Corporation will post 1.77 EPS for the current year.

About Carnival

(

Free Report)

Carnival Corp. engages in the operation of cruise ships. It operates through the following business segments: North America and Australia (NAA) Cruise, Europe and Asia (EA) Cruise Operations, Cruise Support, and Tour and Others. The North America and Australia (NAA) Cruise segment includes the Carnival Cruise Line, Holland America Line, Princess Cruises, and Seabourn.

Featured Stories

Before you consider Carnival, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carnival wasn't on the list.

While Carnival currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.