Universal Beteiligungs und Servicegesellschaft mbH acquired a new stake in Pilgrim's Pride Corporation (NASDAQ:PPC - Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund acquired 17,190 shares of the company's stock, valued at approximately $937,000.

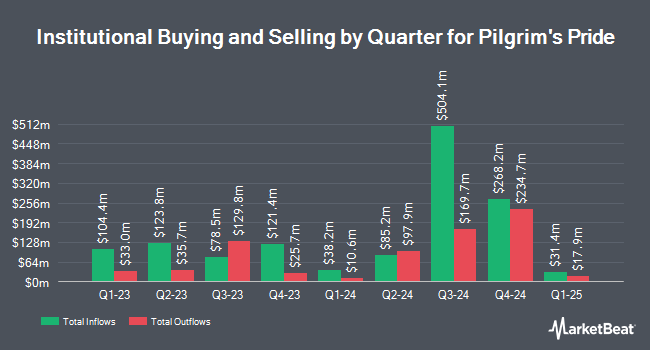

A number of other hedge funds and other institutional investors have also made changes to their positions in the business. Vanguard Group Inc. grew its position in shares of Pilgrim's Pride by 0.7% in the fourth quarter. Vanguard Group Inc. now owns 5,113,888 shares of the company's stock valued at $232,119,000 after purchasing an additional 33,965 shares during the period. AQR Capital Management LLC grew its position in shares of Pilgrim's Pride by 44.1% in the fourth quarter. AQR Capital Management LLC now owns 1,883,708 shares of the company's stock valued at $85,502,000 after purchasing an additional 576,438 shares during the period. Jacobs Levy Equity Management Inc. grew its position in shares of Pilgrim's Pride by 26.8% in the fourth quarter. Jacobs Levy Equity Management Inc. now owns 1,845,480 shares of the company's stock valued at $83,766,000 after purchasing an additional 389,967 shares during the period. Invesco Ltd. grew its position in shares of Pilgrim's Pride by 11.9% in the fourth quarter. Invesco Ltd. now owns 1,125,329 shares of the company's stock valued at $51,079,000 after purchasing an additional 119,555 shares during the period. Finally, Geode Capital Management LLC grew its position in shares of Pilgrim's Pride by 1.8% in the fourth quarter. Geode Capital Management LLC now owns 897,805 shares of the company's stock valued at $40,761,000 after purchasing an additional 15,905 shares during the period. Hedge funds and other institutional investors own 16.64% of the company's stock.

Analyst Upgrades and Downgrades

A number of brokerages recently weighed in on PPC. The Goldman Sachs Group began coverage on Pilgrim's Pride in a report on Monday, June 23rd. They issued a "neutral" rating and a $50.00 target price on the stock. Wall Street Zen cut Pilgrim's Pride from a "strong-buy" rating to a "buy" rating in a report on Friday, July 18th. Six research analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to MarketBeat.com, Pilgrim's Pride presently has a consensus rating of "Hold" and a consensus price target of $48.67.

Get Our Latest Stock Report on PPC

Pilgrim's Pride Stock Up 0.6%

Shares of NASDAQ:PPC traded up $0.29 during trading on Wednesday, hitting $49.25. The company's stock had a trading volume of 384,754 shares, compared to its average volume of 1,310,930. The company has a debt-to-equity ratio of 0.83, a quick ratio of 0.88 and a current ratio of 1.63. Pilgrim's Pride Corporation has a fifty-two week low of $40.09 and a fifty-two week high of $57.16. The stock's 50-day moving average price is $46.41 and its two-hundred day moving average price is $49.23. The company has a market capitalization of $11.70 billion, a PE ratio of 9.50 and a beta of 0.50.

Pilgrim's Pride (NASDAQ:PPC - Get Free Report) last released its quarterly earnings results on Wednesday, July 30th. The company reported $1.70 EPS for the quarter, topping the consensus estimate of $1.54 by $0.16. Pilgrim's Pride had a return on equity of 37.15% and a net margin of 6.81%. The business had revenue of $4.76 billion for the quarter, compared to analysts' expectations of $4.62 billion. During the same quarter in the previous year, the firm posted $1.67 earnings per share. The company's revenue was up 4.3% compared to the same quarter last year. As a group, sell-side analysts expect that Pilgrim's Pride Corporation will post 5.13 EPS for the current year.

Pilgrim's Pride Company Profile

(

Free Report)

Pilgrim's Pride Corp. engages in the production, processing, marketing, and distribution of fresh, frozen and value-added chicken and pork products to retailers, distributors, and foodservice operators. It operates through the following segments: U.S., U.K. and Europe, and Mexico. The company was founded by Lonnie A.

Further Reading

Before you consider Pilgrim's Pride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pilgrim's Pride wasn't on the list.

While Pilgrim's Pride currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.