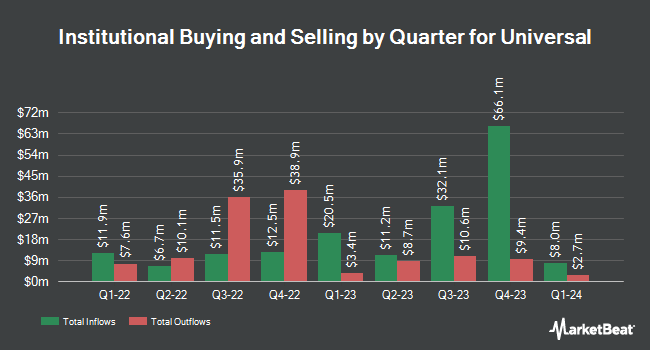

Deutsche Bank AG increased its stake in shares of Universal Co. (NYSE:UVV - Free Report) by 47.4% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 21,580 shares of the company's stock after purchasing an additional 6,936 shares during the period. Deutsche Bank AG owned 0.09% of Universal worth $1,183,000 as of its most recent SEC filing.

Several other institutional investors have also recently modified their holdings of UVV. Barclays PLC grew its stake in shares of Universal by 341.2% during the 3rd quarter. Barclays PLC now owns 40,565 shares of the company's stock valued at $2,155,000 after buying an additional 31,370 shares during the period. Nisa Investment Advisors LLC raised its stake in Universal by 14.8% during the fourth quarter. Nisa Investment Advisors LLC now owns 20,553 shares of the company's stock worth $1,127,000 after acquiring an additional 2,648 shares during the period. SG Americas Securities LLC raised its stake in Universal by 6.5% during the fourth quarter. SG Americas Securities LLC now owns 9,166 shares of the company's stock worth $503,000 after acquiring an additional 556 shares during the period. Exchange Traded Concepts LLC raised its stake in Universal by 2.6% during the fourth quarter. Exchange Traded Concepts LLC now owns 14,322 shares of the company's stock worth $785,000 after acquiring an additional 360 shares during the period. Finally, Blue Trust Inc. raised its stake in Universal by 30.4% during the fourth quarter. Blue Trust Inc. now owns 3,303 shares of the company's stock worth $175,000 after acquiring an additional 770 shares during the period. 81.00% of the stock is currently owned by institutional investors and hedge funds.

Universal Stock Performance

UVV traded down $0.45 on Wednesday, hitting $59.33. 199,727 shares of the company's stock were exchanged, compared to its average volume of 157,475. The firm has a market cap of $1.47 billion, a PE ratio of 12.21 and a beta of 0.71. Universal Co. has a twelve month low of $45.19 and a twelve month high of $62.00. The stock has a fifty day moving average of $55.69 and a two-hundred day moving average of $54.62. The company has a current ratio of 2.60, a quick ratio of 0.96 and a debt-to-equity ratio of 0.43.

Universal (NYSE:UVV - Get Free Report) last posted its quarterly earnings data on Monday, April 21st. The company reported $2.37 earnings per share (EPS) for the quarter. Universal had a net margin of 4.31% and a return on equity of 8.92%. The business had revenue of $937.19 million during the quarter.

Universal Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, August 4th. Shareholders of record on Monday, July 14th will be given a $0.82 dividend. This is an increase from Universal's previous quarterly dividend of $0.81. The ex-dividend date of this dividend is Monday, July 14th. This represents a $3.28 dividend on an annualized basis and a yield of 5.53%. Universal's dividend payout ratio is presently 65.34%.

Universal Company Profile

(

Free Report)

Universal Corporation processes and supplies leaf tobacco and plant-based ingredients worldwide. The company operates through two segments, Tobacco Operations; and Ingredients Operations. It is involved in the procuring, financing, processing, packing, storing, and shipping leaf tobacco for sale to manufacturers of consumer tobacco products.

Read More

Before you consider Universal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal wasn't on the list.

While Universal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.