Valeo Financial Advisors LLC boosted its holdings in shares of argenex SE (NASDAQ:ARGX - Free Report) by 203.7% during the 2nd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 1,303 shares of the company's stock after acquiring an additional 874 shares during the period. Valeo Financial Advisors LLC's holdings in argenex were worth $718,000 as of its most recent filing with the Securities and Exchange Commission.

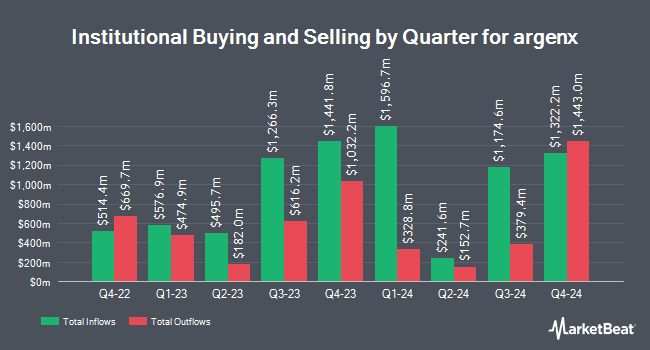

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in ARGX. Millennium Management LLC lifted its holdings in argenex by 316.9% during the first quarter. Millennium Management LLC now owns 268,604 shares of the company's stock worth $158,977,000 after acquiring an additional 204,180 shares in the last quarter. BNP Paribas Financial Markets lifted its holdings in argenex by 1,203.4% during the first quarter. BNP Paribas Financial Markets now owns 133,359 shares of the company's stock worth $78,931,000 after acquiring an additional 123,127 shares in the last quarter. Braidwell LP lifted its holdings in shares of argenex by 99.2% in the first quarter. Braidwell LP now owns 160,849 shares of the company's stock valued at $95,201,000 after purchasing an additional 80,083 shares in the last quarter. Assenagon Asset Management S.A. lifted its holdings in shares of argenex by 215.8% in the first quarter. Assenagon Asset Management S.A. now owns 110,390 shares of the company's stock valued at $65,336,000 after purchasing an additional 75,435 shares in the last quarter. Finally, Lord Abbett & CO. LLC lifted its holdings in shares of argenex by 33.2% in the first quarter. Lord Abbett & CO. LLC now owns 274,700 shares of the company's stock valued at $162,585,000 after purchasing an additional 68,498 shares in the last quarter. 60.32% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

ARGX has been the topic of a number of research reports. JPMorgan Chase & Co. boosted their price target on argenex from $775.00 to $830.00 and gave the company an "overweight" rating in a report on Monday, August 4th. Stifel Nicolaus set a $882.00 price target on argenex in a report on Thursday, September 18th. Weiss Ratings restated a "hold (c)" rating on shares of argenex in a report on Wednesday. Zacks Research upgraded argenex from a "hold" rating to a "strong-buy" rating in a report on Monday, September 22nd. Finally, HC Wainwright boosted their price target on argenex from $720.00 to $774.00 and gave the company a "buy" rating in a report on Friday, August 1st. Three analysts have rated the stock with a Strong Buy rating, twenty have assigned a Buy rating and two have given a Hold rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Buy" and an average price target of $802.90.

Read Our Latest Research Report on ARGX

argenex Stock Performance

NASDAQ:ARGX opened at $798.94 on Thursday. The stock's 50-day simple moving average is $714.80 and its 200 day simple moving average is $624.77. The company has a market cap of $48.90 billion, a P/E ratio of 40.97, a P/E/G ratio of 0.87 and a beta of 0.46. argenex SE has a 52-week low of $510.05 and a 52-week high of $807.91.

argenex (NASDAQ:ARGX - Get Free Report) last announced its quarterly earnings results on Thursday, July 31st. The company reported $3.74 earnings per share for the quarter, topping analysts' consensus estimates of $2.84 by $0.90. The firm had revenue of $866.79 million for the quarter, compared to the consensus estimate of $776.82 million. argenex had a return on equity of 21.06% and a net margin of 40.98%. As a group, equities analysts predict that argenex SE will post 3.13 earnings per share for the current fiscal year.

argenex Company Profile

(

Free Report)

argenx SE, a biotechnology company, engages in the developing of various therapies for the treatment of autoimmune diseases in the United States, Japan, Europe, Middle East, Africa, and China. Its lead product candidate is efgartigimod for the treatment of patients with myasthenia gravis, immune thrombocytopenia, pemphigus vulgaris, generalized myasthenia gravis, chronic inflammatory demyelinating polyneuropathy, thyroid eye disease, bullous pemphigoid, myositis, primary sjögren's syndrome, post-covid postural orthostatic tachycardia syndrome, membranous nephropathy, lupus nephropathy, anca-associated vasculitis, and antibody mediated rejection; ENHANZE SC; Empasiprubart for multifocal motor neuropath, delayed graft function, and dermatomyositis; and ARGX-119 for congenital myasthenic syndrome and amyotrophic lateral sclerosis.

Recommended Stories

Want to see what other hedge funds are holding ARGX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for argenex SE (NASDAQ:ARGX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider argenex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and argenex wasn't on the list.

While argenex currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.