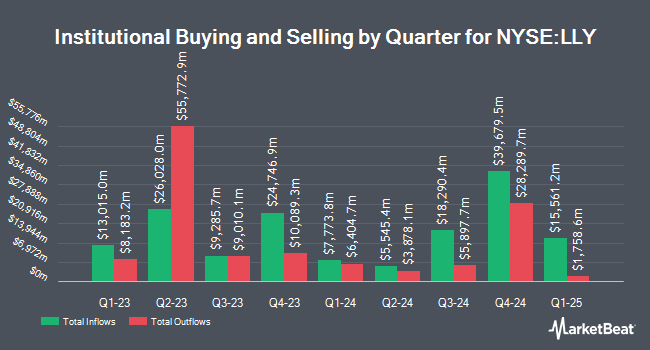

Valmark Advisers Inc. trimmed its stake in Eli Lilly and Company (NYSE:LLY - Free Report) by 5.8% in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 5,424 shares of the company's stock after selling 336 shares during the quarter. Valmark Advisers Inc.'s holdings in Eli Lilly and Company were worth $4,228,000 as of its most recent SEC filing.

Other large investors have also bought and sold shares of the company. Precedent Wealth Partners LLC lifted its stake in shares of Eli Lilly and Company by 15.3% in the second quarter. Precedent Wealth Partners LLC now owns 294 shares of the company's stock valued at $229,000 after buying an additional 39 shares in the last quarter. Capital Advisors Inc. OK lifted its stake in shares of Eli Lilly and Company by 6.8% in the second quarter. Capital Advisors Inc. OK now owns 6,747 shares of the company's stock valued at $5,260,000 after buying an additional 429 shares in the last quarter. Family CFO Inc bought a new position in shares of Eli Lilly and Company in the second quarter valued at $54,000. Duquesne Family Office LLC lifted its stake in shares of Eli Lilly and Company by 52.5% in the first quarter. Duquesne Family Office LLC now owns 94,830 shares of the company's stock valued at $78,321,000 after buying an additional 32,640 shares in the last quarter. Finally, Corient IA LLC bought a new position in shares of Eli Lilly and Company in the first quarter valued at $570,000. 82.53% of the stock is currently owned by institutional investors and hedge funds.

Eli Lilly and Company Stock Performance

Shares of LLY stock opened at $845.55 on Thursday. The firm's 50-day simple moving average is $738.69 and its two-hundred day simple moving average is $766.57. Eli Lilly and Company has a 52 week low of $623.78 and a 52 week high of $937.00. The company has a debt-to-equity ratio of 1.86, a quick ratio of 1.00 and a current ratio of 1.28. The firm has a market cap of $800.28 billion, a price-to-earnings ratio of 55.26, a P/E/G ratio of 1.18 and a beta of 0.47.

Eli Lilly and Company (NYSE:LLY - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The company reported $6.31 earnings per share (EPS) for the quarter, beating the consensus estimate of $5.59 by $0.72. Eli Lilly and Company had a net margin of 25.91% and a return on equity of 92.72%. The company had revenue of $15.56 billion for the quarter, compared to analyst estimates of $14.40 billion. During the same quarter in the previous year, the firm posted $3.92 earnings per share. The company's quarterly revenue was up 37.6% compared to the same quarter last year. Eli Lilly and Company has set its FY 2025 guidance at 21.750-23.000 EPS. As a group, equities analysts forecast that Eli Lilly and Company will post 23.48 earnings per share for the current year.

Insider Buying and Selling

In other news, Director J Erik Fyrwald acquired 1,565 shares of Eli Lilly and Company stock in a transaction that occurred on Tuesday, August 12th. The stock was bought at an average price of $642.33 per share, with a total value of $1,005,246.45. Following the completion of the purchase, the director owned 74,578 shares in the company, valued at approximately $47,903,686.74. The trade was a 2.14% increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through this link. Also, EVP Daniel Skovronsky acquired 1,000 shares of Eli Lilly and Company stock in a transaction that occurred on Tuesday, August 12th. The shares were purchased at an average cost of $634.40 per share, with a total value of $634,400.00. Following the purchase, the executive vice president owned 137,660 shares of the company's stock, valued at $87,331,504. This represents a 0.73% increase in their position. The disclosure for this purchase can be found here. Over the last quarter, insiders have purchased 4,514 shares of company stock valued at $2,894,841. Corporate insiders own 0.13% of the company's stock.

Analyst Upgrades and Downgrades

LLY has been the topic of a number of recent research reports. Daiwa Capital Markets lowered shares of Eli Lilly and Company from an "outperform" rating to a "neutral" rating and set a $700.00 price objective on the stock. in a research note on Sunday, August 17th. HSBC raised their price objective on shares of Eli Lilly and Company from $700.00 to $800.00 in a research note on Wednesday, October 1st. Cantor Fitzgerald dropped their price objective on shares of Eli Lilly and Company from $975.00 to $825.00 and set an "overweight" rating on the stock in a research note on Wednesday, August 13th. DZ Bank upgraded shares of Eli Lilly and Company from a "hold" rating to a "strong-buy" rating in a report on Thursday, August 14th. Finally, Daiwa America cut shares of Eli Lilly and Company from a "strong-buy" rating to a "hold" rating in a report on Sunday, August 17th. One investment analyst has rated the stock with a Strong Buy rating, fourteen have assigned a Buy rating and ten have assigned a Hold rating to the company. According to MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $943.00.

Read Our Latest Stock Analysis on Eli Lilly and Company

Eli Lilly and Company Company Profile

(

Free Report)

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals worldwide. The company offers Basaglar, Humalog, Humalog Mix 75/25, Humalog U-100, Humalog U-200, Humalog Mix 50/50, insulin lispro, insulin lispro protamine, insulin lispro mix 75/25, Humulin, Humulin 70/30, Humulin N, Humulin R, and Humulin U-500 for diabetes; Jardiance, Mounjaro, and Trulicity for type 2 diabetes; and Zepbound for obesity.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Eli Lilly and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eli Lilly and Company wasn't on the list.

While Eli Lilly and Company currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.