Value Holdings Management CO. LLC grew its stake in shares of Devon Energy Corporation (NYSE:DVN - Free Report) by 26.2% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 79,500 shares of the energy company's stock after buying an additional 16,500 shares during the period. Devon Energy accounts for 0.6% of Value Holdings Management CO. LLC's investment portfolio, making the stock its 28th biggest position. Value Holdings Management CO. LLC's holdings in Devon Energy were worth $2,974,000 as of its most recent filing with the SEC.

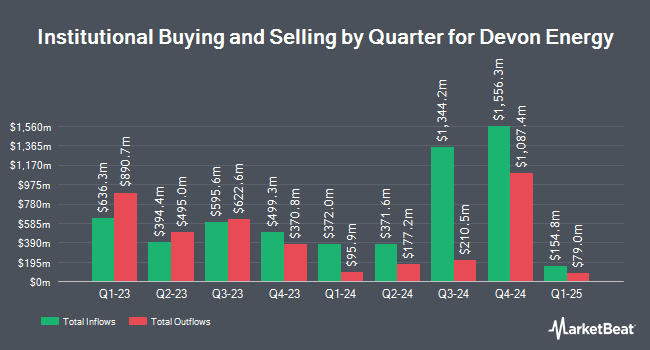

A number of other institutional investors also recently made changes to their positions in the stock. Whittier Trust Co. boosted its holdings in Devon Energy by 24.3% in the 1st quarter. Whittier Trust Co. now owns 1,927 shares of the energy company's stock worth $72,000 after acquiring an additional 377 shares during the period. Callan Family Office LLC boosted its holdings in Devon Energy by 3.7% in the 1st quarter. Callan Family Office LLC now owns 10,581 shares of the energy company's stock worth $396,000 after acquiring an additional 377 shares during the period. Hager Investment Management Services LLC boosted its holdings in Devon Energy by 9.9% in the 1st quarter. Hager Investment Management Services LLC now owns 4,235 shares of the energy company's stock worth $158,000 after acquiring an additional 380 shares during the period. Private Advisor Group LLC boosted its holdings in Devon Energy by 0.4% in the 1st quarter. Private Advisor Group LLC now owns 92,211 shares of the energy company's stock worth $3,449,000 after acquiring an additional 386 shares during the period. Finally, Sierra Ocean LLC boosted its holdings in Devon Energy by 29.4% in the 1st quarter. Sierra Ocean LLC now owns 1,709 shares of the energy company's stock worth $64,000 after acquiring an additional 388 shares during the period. 69.72% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Devon Energy

In related news, Director Kelt Kindick sold 7,685 shares of the firm's stock in a transaction that occurred on Monday, August 11th. The stock was sold at an average price of $33.46, for a total value of $257,140.10. Following the sale, the director directly owned 31,801 shares in the company, valued at $1,064,061.46. This trade represents a 19.46% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.73% of the stock is owned by company insiders.

Devon Energy Stock Performance

Shares of NYSE DVN traded up $0.1750 during midday trading on Wednesday, hitting $33.7550. The company's stock had a trading volume of 8,272,138 shares, compared to its average volume of 8,987,730. Devon Energy Corporation has a 1-year low of $25.89 and a 1-year high of $46.04. The firm's fifty day moving average price is $33.27 and its 200-day moving average price is $33.13. The company has a debt-to-equity ratio of 0.55, a quick ratio of 1.13 and a current ratio of 1.22. The firm has a market cap of $21.43 billion, a P/E ratio of 7.57, a P/E/G ratio of 1.91 and a beta of 1.07.

Devon Energy (NYSE:DVN - Get Free Report) last posted its quarterly earnings results on Tuesday, August 5th. The energy company reported $0.84 EPS for the quarter, beating the consensus estimate of $0.83 by $0.01. The business had revenue of $4.28 billion during the quarter, compared to analyst estimates of $4.01 billion. Devon Energy had a net margin of 16.57% and a return on equity of 18.59%. The company's quarterly revenue was up 9.4% on a year-over-year basis. During the same period in the previous year, the business posted $1.41 EPS. On average, sell-side analysts forecast that Devon Energy Corporation will post 4.85 EPS for the current fiscal year.

Devon Energy Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Investors of record on Monday, September 15th will be issued a $0.24 dividend. This represents a $0.96 dividend on an annualized basis and a yield of 2.8%. The ex-dividend date of this dividend is Monday, September 15th. Devon Energy's dividend payout ratio is 21.52%.

Wall Street Analyst Weigh In

A number of equities analysts have weighed in on DVN shares. JPMorgan Chase & Co. upped their price target on Devon Energy from $40.00 to $42.00 and gave the stock a "neutral" rating in a report on Tuesday, July 8th. Wells Fargo & Company upped their price target on Devon Energy from $42.00 to $43.00 and gave the stock an "overweight" rating in a report on Tuesday, August 12th. Bernstein Bank cut their target price on Devon Energy from $45.00 to $43.00 and set an "outperform" rating on the stock in a research report on Monday, July 7th. Mizuho cut their target price on Devon Energy from $46.00 to $43.00 and set an "outperform" rating on the stock in a research report on Tuesday, May 13th. Finally, Siebert Williams Shank upped their target price on Devon Energy from $47.00 to $52.00 and gave the company a "buy" rating in a research report on Monday, June 23rd. Fifteen analysts have rated the stock with a Buy rating and ten have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $44.15.

Get Our Latest Research Report on DVN

Devon Energy Company Profile

(

Free Report)

Devon Energy Corporation, an independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States. It operates in Delaware, Eagle Ford, Anadarko, Williston, and Powder River Basins. The company was founded in 1971 and is headquartered in Oklahoma City, Oklahoma.

See Also

Before you consider Devon Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Devon Energy wasn't on the list.

While Devon Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.