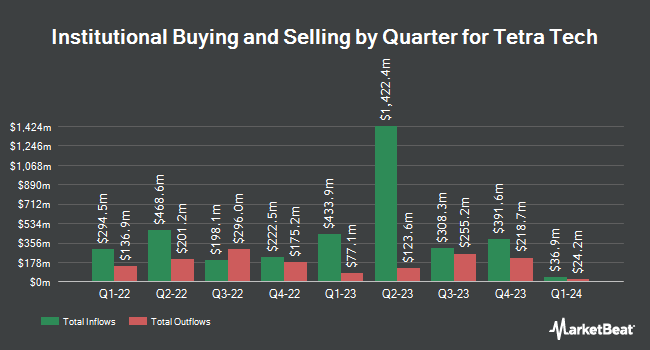

Van Berkom & Associates Inc. bought a new position in Tetra Tech, Inc. (NASDAQ:TTEK - Free Report) during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 1,121,927 shares of the industrial products company's stock, valued at approximately $32,816,000. Van Berkom & Associates Inc. owned approximately 0.42% of Tetra Tech at the end of the most recent reporting period.

Other institutional investors and hedge funds have also modified their holdings of the company. Chilton Capital Management LLC bought a new position in Tetra Tech in the 1st quarter worth approximately $25,000. Baillie Gifford & Co. bought a new position in Tetra Tech in the 1st quarter worth approximately $27,000. Caption Management LLC bought a new position in Tetra Tech in the 4th quarter worth approximately $40,000. Edmond DE Rothschild Holding S.A. bought a new position in Tetra Tech in the 4th quarter worth approximately $63,000. Finally, Johnson Financial Group Inc. bought a new stake in shares of Tetra Tech during the 4th quarter valued at $61,000. 93.89% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

TTEK has been the subject of several recent research reports. Maxim Group cut shares of Tetra Tech from a "strong-buy" rating to a "hold" rating in a research report on Friday, April 4th. Robert W. Baird upped their target price on shares of Tetra Tech from $31.00 to $33.00 and gave the company a "neutral" rating in a research report on Thursday, May 8th. Finally, KeyCorp upped their target price on shares of Tetra Tech from $34.00 to $41.00 and gave the company an "overweight" rating in a research report on Friday, May 9th. Three investment analysts have rated the stock with a hold rating and two have given a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $41.00.

Check Out Our Latest Report on TTEK

Tetra Tech Trading Up 0.3%

Shares of TTEK stock traded up $0.12 on Wednesday, hitting $37.66. The stock had a trading volume of 638,481 shares, compared to its average volume of 2,456,551. Tetra Tech, Inc. has a twelve month low of $27.27 and a twelve month high of $51.20. The firm has a market cap of $9.92 billion, a P/E ratio of 54.65 and a beta of 0.94. The company has a current ratio of 1.10, a quick ratio of 1.10 and a debt-to-equity ratio of 0.49. The company has a fifty day moving average price of $36.21 and a two-hundred day moving average price of $33.67.

Tetra Tech (NASDAQ:TTEK - Get Free Report) last announced its quarterly earnings results on Wednesday, May 7th. The industrial products company reported $0.33 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.31 by $0.02. Tetra Tech had a net margin of 3.44% and a return on equity of 23.31%. The company had revenue of $1.10 billion during the quarter, compared to analyst estimates of $1.05 billion. During the same quarter in the previous year, the business earned $0.28 EPS. The firm's revenue was up 25.9% on a year-over-year basis. As a group, analysts forecast that Tetra Tech, Inc. will post 1.37 earnings per share for the current fiscal year.

Tetra Tech Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, June 5th. Stockholders of record on Friday, May 23rd were issued a $0.065 dividend. This is a boost from Tetra Tech's previous quarterly dividend of $0.06. The ex-dividend date of this dividend was Friday, May 23rd. This represents a $0.26 annualized dividend and a dividend yield of 0.69%. Tetra Tech's dividend payout ratio (DPR) is presently 37.68%.

Tetra Tech Company Profile

(

Free Report)

Tetra Tech, Inc provides consulting and engineering services in the United States and internationally. The company operates through two segments, Government Services Group (GSG) and Commercial/International Services Group (CIG). The GSG segment offers early data collection and monitoring, data analysis and information management, science and engineering applied research, engineering design, project management, and operations and maintenance services; and climate change and energy management consulting, as well as greenhouse gas inventory assessment, certification, reduction, and management services.

Read More

Before you consider Tetra Tech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tetra Tech wasn't on the list.

While Tetra Tech currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.