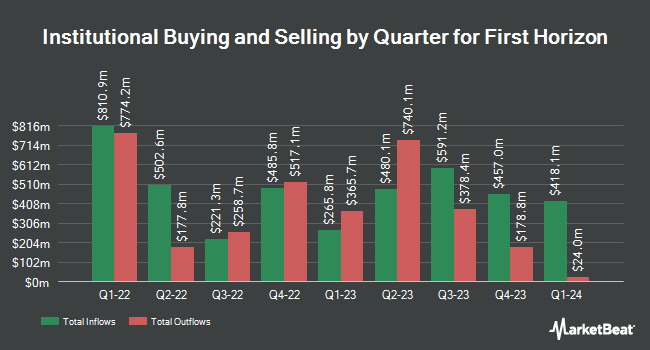

Van Lanschot Kempen Investment Management N.V. acquired a new stake in shares of First Horizon Corporation (NYSE:FHN - Free Report) in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 482,132 shares of the financial services provider's stock, valued at approximately $9,363,000. Van Lanschot Kempen Investment Management N.V. owned about 0.10% of First Horizon as of its most recent SEC filing.

Other institutional investors and hedge funds have also modified their holdings of the company. Mariner LLC raised its holdings in shares of First Horizon by 5.7% in the fourth quarter. Mariner LLC now owns 139,373 shares of the financial services provider's stock worth $2,807,000 after acquiring an additional 7,541 shares during the last quarter. XTX Topco Ltd raised its position in shares of First Horizon by 66.0% in the 4th quarter. XTX Topco Ltd now owns 20,836 shares of the financial services provider's stock worth $420,000 after buying an additional 8,287 shares during the period. Marshall Wace LLP purchased a new position in shares of First Horizon in the 4th quarter worth $1,133,000. Forum Financial Management LP raised its position in shares of First Horizon by 26.8% in the 4th quarter. Forum Financial Management LP now owns 14,958 shares of the financial services provider's stock worth $301,000 after buying an additional 3,159 shares during the period. Finally, First Trust Advisors LP raised its position in First Horizon by 44.0% in the fourth quarter. First Trust Advisors LP now owns 2,217,382 shares of the financial services provider's stock valued at $44,658,000 after purchasing an additional 677,539 shares during the period. Institutional investors and hedge funds own 80.28% of the company's stock.

First Horizon Stock Up 2.5%

NYSE:FHN traded up $0.5510 during trading hours on Friday, reaching $22.5110. The company's stock had a trading volume of 14,988,597 shares, compared to its average volume of 9,575,206. The company has a market cap of $11.43 billion, a price-to-earnings ratio of 14.52, a price-to-earnings-growth ratio of 1.04 and a beta of 0.65. First Horizon Corporation has a one year low of $14.82 and a one year high of $23.00. The business's 50-day moving average is $21.54 and its 200-day moving average is $20.15. The company has a debt-to-equity ratio of 0.15, a current ratio of 0.96 and a quick ratio of 0.95.

First Horizon (NYSE:FHN - Get Free Report) last issued its quarterly earnings data on Wednesday, July 16th. The financial services provider reported $0.45 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.41 by $0.04. The firm had revenue of $830.19 million during the quarter, compared to analysts' expectations of $832.95 million. First Horizon had a net margin of 17.10% and a return on equity of 10.55%. During the same period in the prior year, the company posted $0.36 earnings per share. Equities research analysts predict that First Horizon Corporation will post 1.67 EPS for the current year.

First Horizon Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 1st. Shareholders of record on Friday, September 12th will be given a dividend of $0.15 per share. The ex-dividend date of this dividend is Friday, September 12th. This represents a $0.60 dividend on an annualized basis and a yield of 2.7%. First Horizon's payout ratio is currently 38.71%.

Insiders Place Their Bets

In other First Horizon news, COO Tammy Locascio sold 10,285 shares of the business's stock in a transaction on Friday, July 18th. The shares were sold at an average price of $22.25, for a total transaction of $228,841.25. Following the completion of the transaction, the chief operating officer owned 342,051 shares of the company's stock, valued at $7,610,634.75. The trade was a 2.92% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, EVP David T. Popwell sold 38,010 shares of the business's stock in a transaction on Tuesday, July 22nd. The stock was sold at an average price of $22.20, for a total transaction of $843,822.00. Following the transaction, the executive vice president directly owned 550,011 shares of the company's stock, valued at approximately $12,210,244.20. This represents a 6.46% decrease in their position. The disclosure for this sale can be found here. 0.87% of the stock is owned by insiders.

Analysts Set New Price Targets

Several analysts have recently weighed in on FHN shares. Truist Financial raised their target price on First Horizon from $21.00 to $23.00 and gave the company a "hold" rating in a research note on Friday, July 11th. Bank of America lifted their target price on First Horizon from $26.00 to $27.00 and gave the company a "buy" rating in a research note on Thursday, July 17th. Royal Bank Of Canada reiterated an "outperform" rating and set a $24.00 price objective (up from $22.00) on shares of First Horizon in a research report on Monday, June 9th. Barclays boosted their price objective on First Horizon from $23.00 to $26.00 and gave the stock an "overweight" rating in a research report on Tuesday, July 8th. Finally, Wall Street Zen cut First Horizon from a "hold" rating to a "sell" rating in a report on Saturday. One research analyst has rated the stock with a Strong Buy rating, ten have assigned a Buy rating and six have issued a Hold rating to the company. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $23.28.

View Our Latest Analysis on First Horizon

First Horizon Profile

(

Free Report)

First Horizon Corporation operates as the bank holding company for First Horizon Bank that provides various financial services. The company operates through Regional Banking and Specialty Banking segments. It offers general banking services for consumers, businesses, financial institutions, and governments.

Featured Stories

Before you consider First Horizon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Horizon wasn't on the list.

While First Horizon currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.