Vanguard Group Inc. raised its stake in shares of New Fortress Energy LLC (NASDAQ:NFE - Free Report) by 22.6% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 13,879,490 shares of the company's stock after purchasing an additional 2,560,242 shares during the period. Vanguard Group Inc. owned 5.07% of New Fortress Energy worth $115,339,000 at the end of the most recent quarter.

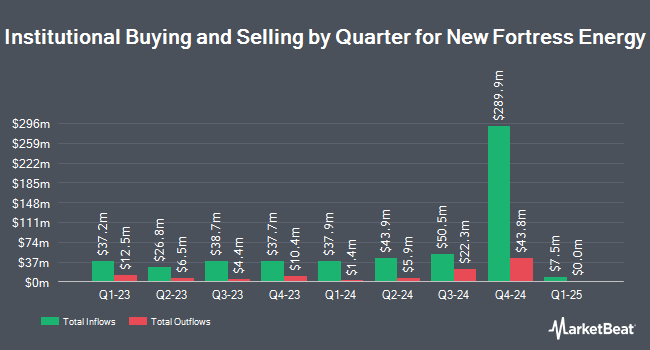

Several other large investors have also bought and sold shares of NFE. Kailix Advisors LLC raised its position in shares of New Fortress Energy by 28.9% in the 1st quarter. Kailix Advisors LLC now owns 1,908,791 shares of the company's stock worth $15,862,000 after acquiring an additional 428,470 shares in the last quarter. American Assets Investment Management LLC raised its position in shares of New Fortress Energy by 888.8% in the 1st quarter. American Assets Investment Management LLC now owns 1,859,106 shares of the company's stock worth $15,449,000 after acquiring an additional 1,671,094 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in shares of New Fortress Energy by 32.3% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 1,470,832 shares of the company's stock worth $22,239,000 after acquiring an additional 359,421 shares in the last quarter. First Trust Advisors LP raised its position in shares of New Fortress Energy by 275.7% in the 4th quarter. First Trust Advisors LP now owns 1,315,926 shares of the company's stock worth $19,897,000 after acquiring an additional 965,669 shares in the last quarter. Finally, Voya Investment Management LLC raised its position in shares of New Fortress Energy by 6,417.1% in the 4th quarter. Voya Investment Management LLC now owns 1,307,455 shares of the company's stock worth $19,769,000 after acquiring an additional 1,287,393 shares in the last quarter. 58.61% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several research analysts have recently weighed in on NFE shares. New Street Research set a $8.50 price objective on New Fortress Energy in a research report on Monday, June 30th. Johnson Rice lowered New Fortress Energy from a "buy" rating to a "hold" rating and lowered their price objective for the stock from $7.00 to $4.00 in a research report on Wednesday, August 13th. Compass Point began coverage on New Fortress Energy in a research note on Tuesday, July 1st. They issued a "buy" rating and a $8.50 target price for the company. Zacks Research upgraded New Fortress Energy to a "hold" rating in a research note on Monday, August 11th. Finally, Morgan Stanley set a $4.00 target price on New Fortress Energy and gave the company an "equal weight" rating in a research note on Tuesday, May 27th. Three equities research analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $7.88.

Read Our Latest Analysis on NFE

New Fortress Energy Stock Up 1.2%

NFE stock traded up $0.03 during mid-day trading on Wednesday, reaching $2.60. 4,369,745 shares of the company traded hands, compared to its average volume of 8,431,767. The stock has a market cap of $712.92 million, a price-to-earnings ratio of -1.16 and a beta of 1.08. The company has a quick ratio of 0.95, a current ratio of 1.00 and a debt-to-equity ratio of 4.77. New Fortress Energy LLC has a fifty-two week low of $2.01 and a fifty-two week high of $16.66. The firm's 50 day moving average price is $3.14 and its 200 day moving average price is $5.58.

New Fortress Energy Company Profile

(

Free Report)

New Fortress Energy Inc operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide. The company operates in two segments, Terminals and Infrastructure, and Ships. The Terminals and Infrastructure segment engages in the natural gas procurement and liquefaction; and shipping, logistics, facilities and conversion, or development of natural gas-fired power generation.

Further Reading

Before you consider New Fortress Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and New Fortress Energy wasn't on the list.

While New Fortress Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.