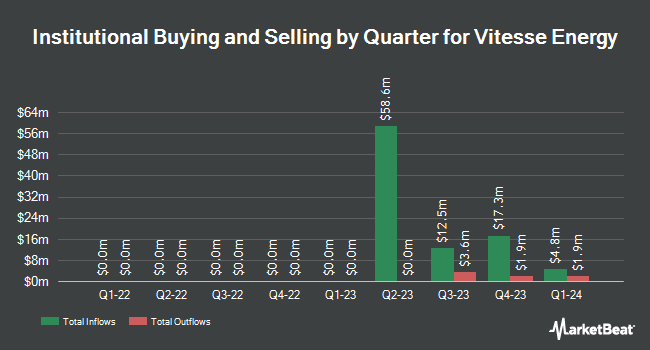

Vanguard Group Inc. raised its stake in Vitesse Energy, Inc. (NYSE:VTS - Free Report) by 2.5% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 2,515,479 shares of the company's stock after acquiring an additional 60,476 shares during the period. Vanguard Group Inc. owned about 6.52% of Vitesse Energy worth $61,856,000 as of its most recent SEC filing.

Other large investors have also recently bought and sold shares of the company. GAMMA Investing LLC raised its position in Vitesse Energy by 2,023.8% in the 1st quarter. GAMMA Investing LLC now owns 6,074 shares of the company's stock valued at $149,000 after purchasing an additional 5,788 shares during the last quarter. BNP Paribas Financial Markets bought a new position in Vitesse Energy in the 4th quarter valued at $162,000. GF Fund Management CO. LTD. bought a new position in Vitesse Energy in the 4th quarter valued at $189,000. QRG Capital Management Inc. bought a new position in Vitesse Energy in the 1st quarter valued at $206,000. Finally, Principal Financial Group Inc. raised its position in Vitesse Energy by 5.4% in the 1st quarter. Principal Financial Group Inc. now owns 9,260 shares of the company's stock valued at $228,000 after purchasing an additional 476 shares during the last quarter. 51.63% of the stock is currently owned by institutional investors.

Vitesse Energy Trading Down 0.1%

Shares of Vitesse Energy stock traded down $0.03 on Friday, hitting $26.64. 661,516 shares of the company's stock traded hands, compared to its average volume of 333,900. The firm's 50-day moving average price is $24.26 and its two-hundred day moving average price is $23.39. The stock has a market capitalization of $1.03 billion, a PE ratio of 25.13 and a beta of 0.67. Vitesse Energy, Inc. has a one year low of $18.90 and a one year high of $28.41. The company has a debt-to-equity ratio of 0.16, a current ratio of 0.95 and a quick ratio of 0.95.

Vitesse Energy (NYSE:VTS - Get Free Report) last announced its quarterly earnings results on Monday, August 4th. The company reported $0.60 earnings per share for the quarter, topping analysts' consensus estimates of $0.10 by $0.50. The company had revenue of $81.76 million for the quarter, compared to analysts' expectations of $69.78 million. Vitesse Energy had a net margin of 15.12% and a return on equity of 7.25%. On average, research analysts expect that Vitesse Energy, Inc. will post 1.05 EPS for the current fiscal year.

Vitesse Energy Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Monday, September 15th will be given a $0.5625 dividend. This represents a $2.25 dividend on an annualized basis and a dividend yield of 8.4%. The ex-dividend date of this dividend is Monday, September 15th. Vitesse Energy's payout ratio is currently 212.26%.

Analysts Set New Price Targets

VTS has been the topic of a number of recent research reports. Northland Capmk upgraded Vitesse Energy to a "hold" rating in a research report on Tuesday, May 20th. Northland Securities lowered Vitesse Energy from an "outperform" rating to a "market perform" rating and set a $19.00 price objective on the stock. in a research report on Tuesday, May 20th. Zacks Research upgraded Vitesse Energy to a "strong-buy" rating in a research report on Friday, August 8th. Alliance Global Partners initiated coverage on Vitesse Energy in a research report on Wednesday, May 14th. They issued a "buy" rating and a $26.00 price objective on the stock. Finally, Wall Street Zen upgraded Vitesse Energy from a "sell" rating to a "hold" rating in a research report on Saturday, August 9th. One investment analyst has rated the stock with a Strong Buy rating, two have issued a Buy rating and three have assigned a Hold rating to the company. According to data from MarketBeat.com, Vitesse Energy currently has an average rating of "Moderate Buy" and a consensus target price of $26.50.

Read Our Latest Report on VTS

Vitesse Energy Company Profile

(

Free Report)

Vitesse Energy, Inc, together with its subsidiaries, engages in the acquisition, development, and production of non-operated oil and natural gas properties in the United States. It owns and acquires non-operated working interest and royalty interest ownership in the Williston Basin properties located in North Dakota and Montana.

Recommended Stories

Before you consider Vitesse Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vitesse Energy wasn't on the list.

While Vitesse Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.