Vanguard Group Inc. reduced its position in ANI Pharmaceuticals, Inc. (NASDAQ:ANIP - Free Report) by 10.1% in the 1st quarter, according to its most recent filing with the SEC. The fund owned 1,181,471 shares of the specialty pharmaceutical company's stock after selling 132,901 shares during the period. Vanguard Group Inc. owned about 5.43% of ANI Pharmaceuticals worth $79,099,000 as of its most recent filing with the SEC.

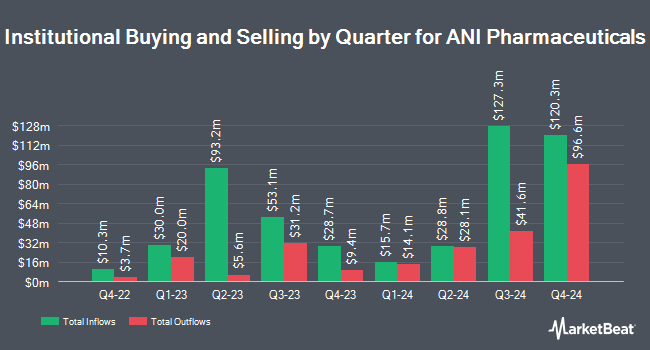

Several other hedge funds have also bought and sold shares of ANIP. Hohimer Wealth Management LLC raised its holdings in ANI Pharmaceuticals by 5.2% in the 1st quarter. Hohimer Wealth Management LLC now owns 4,989 shares of the specialty pharmaceutical company's stock valued at $334,000 after acquiring an additional 247 shares during the period. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in ANI Pharmaceuticals by 3.6% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 10,523 shares of the specialty pharmaceutical company's stock valued at $582,000 after acquiring an additional 364 shares during the period. MetLife Investment Management LLC raised its holdings in ANI Pharmaceuticals by 6.3% in the 4th quarter. MetLife Investment Management LLC now owns 11,397 shares of the specialty pharmaceutical company's stock valued at $630,000 after acquiring an additional 675 shares during the period. GAMMA Investing LLC raised its holdings in ANI Pharmaceuticals by 163.8% in the 1st quarter. GAMMA Investing LLC now owns 1,419 shares of the specialty pharmaceutical company's stock valued at $95,000 after acquiring an additional 881 shares during the period. Finally, Price T Rowe Associates Inc. MD raised its holdings in ANI Pharmaceuticals by 20.1% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 7,288 shares of the specialty pharmaceutical company's stock valued at $403,000 after acquiring an additional 1,220 shares during the period. 76.05% of the stock is currently owned by institutional investors and hedge funds.

Insiders Place Their Bets

In related news, Director Jeanne Thoma sold 21,540 shares of ANI Pharmaceuticals stock in a transaction that occurred on Monday, August 18th. The shares were sold at an average price of $89.15, for a total value of $1,920,291.00. Following the transaction, the director directly owned 23,405 shares of the company's stock, valued at $2,086,555.75. This trade represents a 47.93% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, SVP Chad Gassert sold 20,000 shares of ANI Pharmaceuticals stock in a transaction that occurred on Friday, August 15th. The shares were sold at an average price of $86.97, for a total transaction of $1,739,400.00. Following the completion of the transaction, the senior vice president directly owned 173,226 shares in the company, valued at $15,065,465.22. This trade represents a 10.35% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 405,538 shares of company stock valued at $35,690,131 over the last three months. 11.10% of the stock is owned by corporate insiders.

ANI Pharmaceuticals Price Performance

NASDAQ:ANIP traded up $0.97 during mid-day trading on Friday, reaching $93.50. The stock had a trading volume of 283,240 shares, compared to its average volume of 751,359. The stock has a 50-day simple moving average of $73.39 and a two-hundred day simple moving average of $67.02. The stock has a market capitalization of $2.03 billion, a PE ratio of -121.43 and a beta of 0.61. The company has a debt-to-equity ratio of 1.39, a current ratio of 2.54 and a quick ratio of 1.96. ANI Pharmaceuticals, Inc. has a 12 month low of $52.50 and a 12 month high of $93.72.

ANI Pharmaceuticals (NASDAQ:ANIP - Get Free Report) last announced its quarterly earnings data on Friday, August 8th. The specialty pharmaceutical company reported $1.80 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.42 by $0.38. The business had revenue of $211.37 million for the quarter, compared to analysts' expectations of $187.18 million. ANI Pharmaceuticals had a negative net margin of 1.37% and a positive return on equity of 25.03%. The firm's quarterly revenue was up 53.2% compared to the same quarter last year. During the same period last year, the firm posted $1.02 earnings per share. On average, equities analysts anticipate that ANI Pharmaceuticals, Inc. will post 3.86 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several research analysts have weighed in on ANIP shares. Zacks Research raised shares of ANI Pharmaceuticals from a "hold" rating to a "strong-buy" rating in a report on Thursday, August 21st. Wall Street Zen raised shares of ANI Pharmaceuticals from a "buy" rating to a "strong-buy" rating in a report on Saturday, August 16th. HC Wainwright reissued a "buy" rating and issued a $93.00 price target (up from $84.00) on shares of ANI Pharmaceuticals in a report on Friday, August 8th. Truist Financial increased their price target on shares of ANI Pharmaceuticals from $65.00 to $77.00 and gave the company a "hold" rating in a report on Monday, August 11th. Finally, Piper Sandler reissued an "overweight" rating and issued a $94.00 price target on shares of ANI Pharmaceuticals in a report on Friday, August 8th. Two analysts have rated the stock with a Strong Buy rating, seven have assigned a Buy rating and one has issued a Hold rating to the stock. Based on data from MarketBeat.com, ANI Pharmaceuticals has a consensus rating of "Buy" and an average target price of $84.75.

Get Our Latest Stock Analysis on ANI Pharmaceuticals

ANI Pharmaceuticals Company Profile

(

Free Report)

ANI Pharmaceuticals, Inc, a biopharmaceutical company, develops, manufactures, and markets branded and generic prescription pharmaceuticals in the United States and Canada. The company manufactures oral solid dose products; semi-solids, liquids, and topicals; controlled substances; and potent products, as well as performs contract development and manufacturing of pharmaceutical products.

Recommended Stories

Before you consider ANI Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ANI Pharmaceuticals wasn't on the list.

While ANI Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.