Vanguard Group Inc. reduced its holdings in Valaris Limited (NYSE:VAL - Free Report) by 0.8% in the first quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 6,404,674 shares of the company's stock after selling 49,485 shares during the quarter. Vanguard Group Inc. owned about 9.02% of Valaris worth $251,448,000 at the end of the most recent quarter.

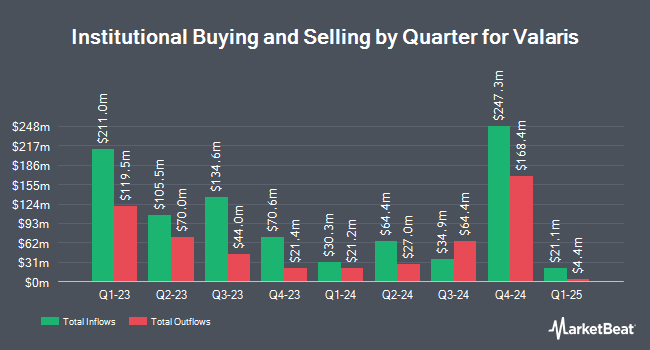

Other hedge funds have also added to or reduced their stakes in the company. Quarry LP increased its holdings in Valaris by 51.7% in the fourth quarter. Quarry LP now owns 684 shares of the company's stock worth $30,000 after purchasing an additional 233 shares in the last quarter. Lowe Wealth Advisors LLC bought a new stake in shares of Valaris during the first quarter valued at approximately $28,000. Sterling Capital Management LLC increased its holdings in shares of Valaris by 518.3% during the fourth quarter. Sterling Capital Management LLC now owns 742 shares of the company's stock valued at $33,000 after acquiring an additional 622 shares in the last quarter. UMB Bank n.a. bought a new stake in shares of Valaris during the first quarter valued at approximately $44,000. Finally, GAMMA Investing LLC increased its holdings in shares of Valaris by 1,027.5% during the first quarter. GAMMA Investing LLC now owns 1,353 shares of the company's stock valued at $53,000 after acquiring an additional 1,233 shares in the last quarter. 96.74% of the stock is currently owned by institutional investors.

Valaris Stock Up 6.4%

Valaris stock traded up $2.9730 during trading on Friday, hitting $49.1530. 1,757,495 shares of the company were exchanged, compared to its average volume of 1,374,593. The business's 50 day moving average is $46.68 and its 200 day moving average is $40.88. Valaris Limited has a 52 week low of $27.15 and a 52 week high of $65.68. The company has a market capitalization of $3.50 billion, a P/E ratio of 12.80 and a beta of 1.17. The company has a current ratio of 1.81, a quick ratio of 1.81 and a debt-to-equity ratio of 0.46.

Valaris (NYSE:VAL - Get Free Report) last announced its quarterly earnings results on Wednesday, July 30th. The company reported $1.61 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.16 by $0.45. Valaris had a return on equity of 12.36% and a net margin of 11.18%.The business had revenue of $615.20 million during the quarter, compared to the consensus estimate of $582.70 million. During the same quarter in the prior year, the company posted $2.03 earnings per share. Valaris's revenue was up .8% compared to the same quarter last year. Analysts predict that Valaris Limited will post 3.96 earnings per share for the current year.

Analyst Ratings Changes

VAL has been the subject of several recent research reports. Evercore ISI decreased their price objective on Valaris from $55.00 to $50.00 and set an "in-line" rating for the company in a report on Friday, May 2nd. Susquehanna boosted their price objective on Valaris from $46.00 to $52.00 and gave the company a "neutral" rating in a report on Friday, August 1st. Citigroup restated a "neutral" rating and set a $50.00 price objective (up previously from $47.00) on shares of Valaris in a report on Thursday, July 10th. Wall Street Zen upgraded Valaris to a "sell" rating in a report on Tuesday, May 13th. Finally, Fearnley Fonds downgraded Valaris from a "strong-buy" rating to a "hold" rating in a report on Wednesday, July 30th. One analyst has rated the stock with a Buy rating, six have given a Hold rating and one has given a Sell rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $46.20.

View Our Latest Stock Report on Valaris

About Valaris

(

Free Report)

Valaris Limited, together with its subsidiaries, provides offshore contract drilling services Gulf of Mexico, South America, North Sea, the Middle East, Africa, and the Asia Pacific. The company operates through four segments: Floaters, Jackups, ARO, and Other. It owns an offshore drilling rig fleet, which include drillships, dynamically positioned semisubmersible rigs, moored semisubmersible rig, and jackup rigs.

Featured Articles

Before you consider Valaris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valaris wasn't on the list.

While Valaris currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.