Vanguard Personalized Indexing Management LLC boosted its stake in shares of Cummins Inc. (NYSE:CMI - Free Report) by 11.8% in the 2nd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 31,861 shares of the company's stock after acquiring an additional 3,353 shares during the quarter. Vanguard Personalized Indexing Management LLC's holdings in Cummins were worth $10,435,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

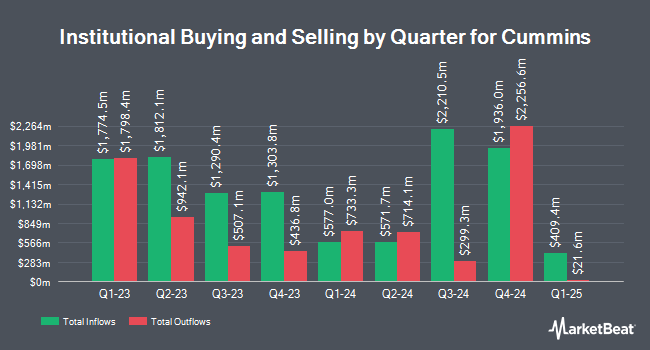

Several other institutional investors also recently bought and sold shares of the stock. Concurrent Investment Advisors LLC boosted its holdings in Cummins by 3.6% during the 2nd quarter. Concurrent Investment Advisors LLC now owns 12,971 shares of the company's stock valued at $4,248,000 after acquiring an additional 450 shares during the period. Johnson Investment Counsel Inc. boosted its holdings in Cummins by 13.7% during the 2nd quarter. Johnson Investment Counsel Inc. now owns 2,161 shares of the company's stock valued at $708,000 after acquiring an additional 260 shares during the period. Apollon Wealth Management LLC boosted its holdings in Cummins by 4.7% during the 2nd quarter. Apollon Wealth Management LLC now owns 13,138 shares of the company's stock valued at $4,303,000 after acquiring an additional 586 shares during the period. Fifth Third Wealth Advisors LLC boosted its holdings in Cummins by 9.7% during the 2nd quarter. Fifth Third Wealth Advisors LLC now owns 5,502 shares of the company's stock valued at $1,802,000 after acquiring an additional 485 shares during the period. Finally, Conning Inc. boosted its holdings in Cummins by 4.3% during the 2nd quarter. Conning Inc. now owns 106,070 shares of the company's stock valued at $34,738,000 after acquiring an additional 4,376 shares during the period. 83.46% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Cummins

In related news, CFO Mark Andrew Smith sold 8,000 shares of the firm's stock in a transaction that occurred on Monday, October 6th. The stock was sold at an average price of $439.30, for a total transaction of $3,514,400.00. Following the completion of the transaction, the chief financial officer owned 31,582 shares of the company's stock, valued at $13,873,972.60. This trade represents a 20.21% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Karen H. Quintos sold 1,307 shares of the firm's stock in a transaction that occurred on Tuesday, August 19th. The shares were sold at an average price of $405.33, for a total value of $529,766.31. Following the transaction, the director directly owned 5,227 shares of the company's stock, valued at approximately $2,118,659.91. This trade represents a 20.00% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 43,119 shares of company stock worth $17,674,285 over the last quarter. 0.41% of the stock is currently owned by company insiders.

Cummins Trading Down 3.1%

CMI opened at $413.28 on Monday. The stock has a market cap of $56.94 billion, a PE ratio of 19.43, a PEG ratio of 1.99 and a beta of 1.04. The company has a quick ratio of 1.03, a current ratio of 1.64 and a debt-to-equity ratio of 0.53. The business has a 50 day moving average of $407.21 and a 200-day moving average of $349.70. Cummins Inc. has a 52 week low of $260.02 and a 52 week high of $440.51.

Cummins (NYSE:CMI - Get Free Report) last released its earnings results on Tuesday, August 5th. The company reported $6.43 EPS for the quarter, beating analysts' consensus estimates of $5.21 by $1.22. The company had revenue of $8.64 billion during the quarter, compared to analysts' expectations of $8.45 billion. Cummins had a return on equity of 26.96% and a net margin of 8.72%.The firm's revenue for the quarter was down 1.7% compared to the same quarter last year. During the same quarter last year, the business posted $5.26 EPS. Equities research analysts predict that Cummins Inc. will post 22.54 earnings per share for the current fiscal year.

Cummins Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, September 4th. Investors of record on Friday, August 22nd were given a dividend of $2.00 per share. This is a boost from Cummins's previous quarterly dividend of $1.82. The ex-dividend date of this dividend was Friday, August 22nd. This represents a $8.00 dividend on an annualized basis and a yield of 1.9%. Cummins's dividend payout ratio is 37.61%.

Analyst Upgrades and Downgrades

Several equities research analysts have weighed in on the company. Robert W. Baird increased their price objective on Cummins from $315.00 to $355.00 and gave the stock a "neutral" rating in a report on Friday, July 11th. Melius upgraded Cummins from a "hold" rating to a "buy" rating and set a $500.00 price objective for the company in a report on Wednesday, September 3rd. Barclays increased their price objective on Cummins from $381.00 to $387.00 and gave the stock an "equal weight" rating in a report on Monday, July 21st. Wolfe Research upgraded Cummins from a "hold" rating to an "outperform" rating in a report on Monday, August 11th. Finally, Truist Financial increased their price objective on Cummins from $380.00 to $434.00 and gave the stock a "hold" rating in a report on Wednesday. One investment analyst has rated the stock with a Strong Buy rating, ten have assigned a Buy rating, six have given a Hold rating and one has issued a Sell rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $397.43.

Get Our Latest Report on CMI

Cummins Profile

(

Free Report)

Cummins Inc designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide. It operates through five segments: Engine, Distribution, Components, Power Systems, and Accelera. The company offers diesel and natural gas-powered engines under the Cummins and other customer brands for the heavy and medium-duty truck, bus, recreational vehicle, light-duty automotive, construction, mining, marine, rail, oil and gas, defense, and agricultural markets; and offers parts and services, as well as remanufactured parts and engines.

Featured Stories

Want to see what other hedge funds are holding CMI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Cummins Inc. (NYSE:CMI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cummins, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cummins wasn't on the list.

While Cummins currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report