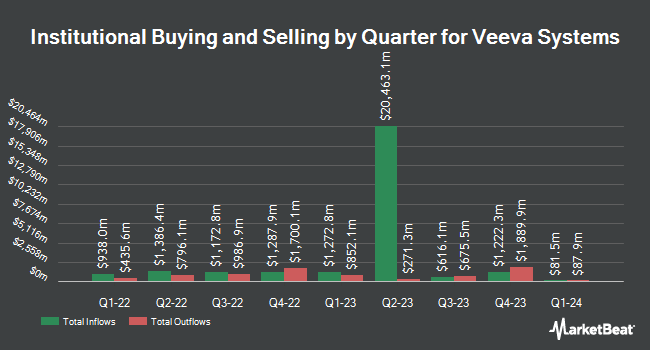

Wendell David Associates Inc. increased its position in shares of Veeva Systems Inc. (NYSE:VEEV - Free Report) by 8.5% in the second quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 19,391 shares of the technology company's stock after purchasing an additional 1,522 shares during the quarter. Wendell David Associates Inc.'s holdings in Veeva Systems were worth $5,584,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. Vanguard Group Inc. lifted its holdings in shares of Veeva Systems by 2.2% during the first quarter. Vanguard Group Inc. now owns 14,760,566 shares of the technology company's stock worth $3,418,990,000 after purchasing an additional 315,421 shares during the period. Alliancebernstein L.P. lifted its holdings in shares of Veeva Systems by 10.7% during the first quarter. Alliancebernstein L.P. now owns 5,499,651 shares of the technology company's stock worth $1,273,884,000 after purchasing an additional 532,269 shares during the period. T. Rowe Price Investment Management Inc. lifted its holdings in shares of Veeva Systems by 0.7% during the first quarter. T. Rowe Price Investment Management Inc. now owns 5,203,867 shares of the technology company's stock worth $1,205,372,000 after purchasing an additional 34,169 shares during the period. Price T Rowe Associates Inc. MD lifted its holdings in shares of Veeva Systems by 20.9% during the first quarter. Price T Rowe Associates Inc. MD now owns 3,992,372 shares of the technology company's stock worth $924,754,000 after purchasing an additional 689,700 shares during the period. Finally, JPMorgan Chase & Co. raised its position in Veeva Systems by 7.5% during the first quarter. JPMorgan Chase & Co. now owns 3,230,758 shares of the technology company's stock valued at $748,341,000 after acquiring an additional 225,125 shares in the last quarter. Institutional investors and hedge funds own 88.20% of the company's stock.

Veeva Systems Price Performance

Veeva Systems stock opened at $283.96 on Friday. The stock has a market capitalization of $46.54 billion, a PE ratio of 58.31, a price-to-earnings-growth ratio of 2.19 and a beta of 0.98. Veeva Systems Inc. has a 12 month low of $201.54 and a 12 month high of $310.50. The business has a 50 day simple moving average of $283.44 and a 200-day simple moving average of $267.01.

Veeva Systems (NYSE:VEEV - Get Free Report) last posted its quarterly earnings data on Wednesday, August 27th. The technology company reported $1.26 EPS for the quarter, missing analysts' consensus estimates of $1.90 by ($0.64). The business had revenue of $789.08 million during the quarter, compared to analysts' expectations of $768.49 million. Veeva Systems had a net margin of 27.29% and a return on equity of 13.72%. The firm's quarterly revenue was up 16.7% compared to the same quarter last year. During the same quarter last year, the firm earned $1.62 earnings per share. Veeva Systems has set its Q3 2026 guidance at 1.940-1.950 EPS. FY 2026 guidance at 7.780-7.780 EPS. On average, equities research analysts anticipate that Veeva Systems Inc. will post 4.35 EPS for the current fiscal year.

Insider Activity

In related news, insider Eleni Nitsa Zuppas sold 6,000 shares of the business's stock in a transaction that occurred on Tuesday, October 7th. The stock was sold at an average price of $306.62, for a total transaction of $1,839,720.00. Following the completion of the sale, the insider directly owned 25,325 shares in the company, valued at approximately $7,765,151.50. The trade was a 19.15% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Thomas D. Schwenger sold 3,350 shares of the business's stock in a transaction that occurred on Thursday, October 2nd. The stock was sold at an average price of $300.04, for a total value of $1,005,134.00. Following the sale, the insider owned 23,773 shares of the company's stock, valued at $7,132,850.92. The trade was a 12.35% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 24,665 shares of company stock worth $7,438,000 over the last three months. 10.30% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

VEEV has been the subject of a number of analyst reports. Wall Street Zen raised Veeva Systems from a "hold" rating to a "buy" rating in a report on Saturday, October 11th. Canaccord Genuity Group boosted their price target on Veeva Systems from $270.00 to $300.00 and gave the company a "hold" rating in a report on Thursday, August 28th. JPMorgan Chase & Co. raised Veeva Systems from a "neutral" rating to an "overweight" rating and boosted their price target for the company from $290.00 to $330.00 in a report on Monday, September 8th. William Blair reissued an "outperform" rating on shares of Veeva Systems in a report on Friday. Finally, Morgan Stanley boosted their price target on Veeva Systems from $210.00 to $222.00 and gave the company an "underweight" rating in a report on Thursday, August 28th. Seventeen analysts have rated the stock with a Buy rating, seven have assigned a Hold rating and two have issued a Sell rating to the company's stock. Based on data from MarketBeat.com, Veeva Systems has a consensus rating of "Moderate Buy" and an average price target of $307.58.

Read Our Latest Report on VEEV

Veeva Systems Company Profile

(

Free Report)

Veeva Systems Inc provides cloud-based software for the life sciences industry. It offers Veeva Commercial Cloud, a suite of software and analytics solutions, such as Veeva customer relationship management (CRM) that enable customer-facing employees at pharmaceutical and biotechnology companies; Veeva Vault PromoMats, an end-to-end content and digital asset management solution; Veeva Vault Medical that provides source of medical content across multiple channels and geographies; Veeva Crossix, an analytics platform for pharmaceutical brands; Veeva OpenData, a customer reference data solution; Veeva Link, a data application that allows link to generate real-time intelligence; and Veeva Compass includes de-identified and longitudinal patient data for the United States.

Recommended Stories

Want to see what other hedge funds are holding VEEV? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Veeva Systems Inc. (NYSE:VEEV - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Veeva Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veeva Systems wasn't on the list.

While Veeva Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report