Venturi Wealth Management LLC cut its position in Airbnb, Inc. (NASDAQ:ABNB - Free Report) by 57.5% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,890 shares of the company's stock after selling 2,556 shares during the period. Venturi Wealth Management LLC's holdings in Airbnb were worth $226,000 as of its most recent filing with the Securities and Exchange Commission.

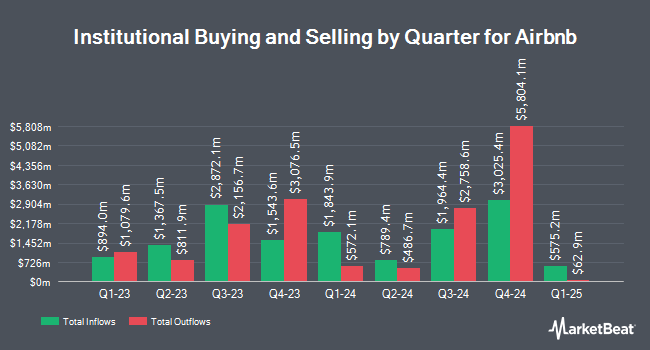

Other large investors also recently modified their holdings of the company. Park Square Financial Group LLC purchased a new stake in Airbnb during the 4th quarter worth about $26,000. Orion Capital Management LLC purchased a new stake in Airbnb during the 4th quarter worth about $28,000. Stonebridge Financial Group LLC lifted its holdings in Airbnb by 75.7% during the 1st quarter. Stonebridge Financial Group LLC now owns 246 shares of the company's stock worth $29,000 after buying an additional 106 shares during the last quarter. Bartlett & CO. Wealth Management LLC boosted its holdings in shares of Airbnb by 209.6% in the 1st quarter. Bartlett & CO. Wealth Management LLC now owns 257 shares of the company's stock valued at $31,000 after buying an additional 174 shares in the last quarter. Finally, BankPlus Trust Department acquired a new position in shares of Airbnb in the 1st quarter valued at $43,000. 80.76% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

ABNB has been the subject of several research analyst reports. B. Riley lowered their target price on shares of Airbnb from $145.00 to $140.00 and set a "neutral" rating for the company in a report on Friday, May 2nd. Piper Sandler lowered their target price on shares of Airbnb from $145.00 to $132.00 and set a "neutral" rating for the company in a report on Monday, April 28th. Wedbush cut shares of Airbnb from an "outperform" rating to a "neutral" rating and lowered their target price for the company from $150.00 to $135.00 in a report on Friday, May 2nd. Susquehanna lowered their target price on shares of Airbnb from $200.00 to $150.00 and set a "positive" rating for the company in a report on Monday, May 5th. Finally, Needham & Company LLC restated a "hold" rating on shares of Airbnb in a report on Wednesday, May 14th. Five analysts have rated the stock with a sell rating, seventeen have issued a hold rating, thirteen have issued a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $141.50.

Check Out Our Latest Analysis on ABNB

Insider Activity

In other news, CEO Brian Chesky sold 8,000 shares of the stock in a transaction dated Thursday, May 29th. The shares were sold at an average price of $128.33, for a total value of $1,026,640.00. Following the completion of the transaction, the chief executive officer owned 40,800 shares in the company, valued at $5,235,864. This trade represents a 16.39% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CFO Elinor Mertz sold 6,250 shares of the stock in a transaction dated Monday, May 5th. The shares were sold at an average price of $123.43, for a total transaction of $771,437.50. Following the completion of the transaction, the chief financial officer owned 485,080 shares of the company's stock, valued at $59,873,424.40. This represents a 1.27% decrease in their position. The disclosure for this sale can be found here. Insiders sold 1,650,658 shares of company stock worth $218,970,735 in the last 90 days. 27.91% of the stock is currently owned by corporate insiders.

Airbnb Stock Down 0.2%

Shares of ABNB opened at $141.31 on Friday. The company has a 50-day simple moving average of $134.66 and a 200-day simple moving average of $131.04. The company has a market capitalization of $88.52 billion, a PE ratio of 35.68, a P/E/G ratio of 2.64 and a beta of 1.13. Airbnb, Inc. has a 52-week low of $99.88 and a 52-week high of $163.93.

Airbnb (NASDAQ:ABNB - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The company reported $0.24 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.25 by ($0.01). The company had revenue of $2.27 billion during the quarter, compared to analysts' expectations of $2.26 billion. Airbnb had a net margin of 22.60% and a return on equity of 30.91%. The business's revenue for the quarter was up 7.4% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.41 EPS. On average, research analysts anticipate that Airbnb, Inc. will post 4.31 EPS for the current year.

Airbnb Company Profile

(

Free Report)

Airbnb, Inc, together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, and vacation homes.

See Also

Want to see what other hedge funds are holding ABNB? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Airbnb, Inc. (NASDAQ:ABNB - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.