Verdence Capital Advisors LLC raised its stake in shares of Arista Networks, Inc. (NYSE:ANET - Free Report) by 22.6% in the second quarter, according to its most recent 13F filing with the SEC. The fund owned 21,537 shares of the technology company's stock after purchasing an additional 3,973 shares during the period. Verdence Capital Advisors LLC's holdings in Arista Networks were worth $2,203,000 as of its most recent SEC filing.

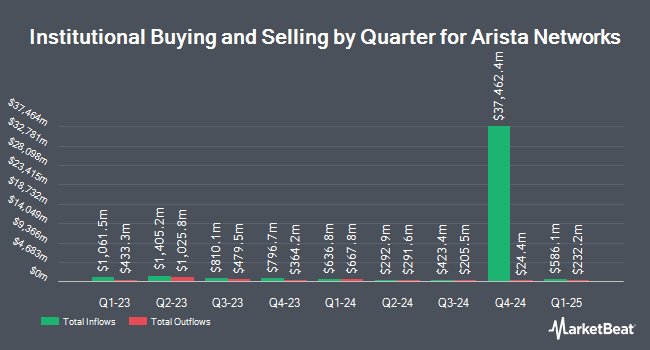

A number of other hedge funds and other institutional investors have also recently modified their holdings of the business. Oregon Public Employees Retirement Fund boosted its stake in shares of Arista Networks by 0.3% in the 2nd quarter. Oregon Public Employees Retirement Fund now owns 89,046 shares of the technology company's stock worth $9,110,000 after buying an additional 300 shares during the last quarter. Sequoia Financial Advisors LLC raised its holdings in Arista Networks by 22.1% during the 2nd quarter. Sequoia Financial Advisors LLC now owns 33,514 shares of the technology company's stock valued at $3,429,000 after acquiring an additional 6,064 shares during the period. Total Clarity Wealth Management Inc. raised its holdings in Arista Networks by 86.0% during the 2nd quarter. Total Clarity Wealth Management Inc. now owns 17,591 shares of the technology company's stock valued at $1,800,000 after acquiring an additional 8,133 shares during the period. Vest Financial LLC bought a new stake in Arista Networks during the 2nd quarter valued at $350,000. Finally, MGO One Seven LLC increased its holdings in shares of Arista Networks by 33.3% in the second quarter. MGO One Seven LLC now owns 44,800 shares of the technology company's stock worth $4,583,000 after purchasing an additional 11,191 shares during the period. Hedge funds and other institutional investors own 82.47% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on ANET shares. Wolfe Research upped their price target on shares of Arista Networks from $160.00 to $185.00 and gave the stock an "outperform" rating in a report on Friday, September 12th. Evercore ISI upped their price target on shares of Arista Networks from $150.00 to $175.00 and gave the company an "outperform" rating in a research report on Friday, September 12th. Rosenblatt Securities upped their price target on shares of Arista Networks from $125.00 to $140.00 and gave the company a "neutral" rating in a research report on Friday, September 12th. BNP Paribas Exane upgraded shares of Arista Networks from a "neutral" rating to an "outperform" rating and set a $172.00 target price for the company in a report on Thursday, September 25th. Finally, BNP Paribas upgraded shares of Arista Networks from a "hold" rating to an "outperform" rating in a report on Thursday, September 25th. Nineteen equities research analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the company. According to data from MarketBeat.com, Arista Networks has an average rating of "Moderate Buy" and an average price target of $163.94.

View Our Latest Report on ANET

Insiders Place Their Bets

In other news, Director Charles H. Giancarlo sold 8,000 shares of Arista Networks stock in a transaction on Wednesday, October 1st. The shares were sold at an average price of $147.49, for a total transaction of $1,179,920.00. Following the transaction, the director owned 41,784 shares in the company, valued at $6,162,722.16. This trade represents a 16.07% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, insider Kenneth Duda sold 30,000 shares of Arista Networks stock in a transaction on Wednesday, September 17th. The stock was sold at an average price of $141.79, for a total transaction of $4,253,700.00. Following the transaction, the insider owned 12,976 shares in the company, valued at $1,839,867.04. This represents a 69.81% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 6,678,904 shares of company stock valued at $894,021,161. Company insiders own 3.54% of the company's stock.

Arista Networks Stock Down 4.3%

Shares of ANET opened at $147.45 on Tuesday. The company has a market capitalization of $185.32 billion, a P/E ratio of 57.99, a price-to-earnings-growth ratio of 3.21 and a beta of 1.47. The firm has a 50 day moving average of $141.39 and a 200 day moving average of $109.58. Arista Networks, Inc. has a twelve month low of $59.43 and a twelve month high of $162.68.

Arista Networks (NYSE:ANET - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The technology company reported $0.73 earnings per share for the quarter, beating the consensus estimate of $0.65 by $0.08. Arista Networks had a net margin of 40.90% and a return on equity of 31.05%. The company had revenue of $2.20 billion during the quarter, compared to the consensus estimate of $2.11 billion. During the same quarter last year, the firm earned $0.53 earnings per share. The firm's quarterly revenue was up 30.4% compared to the same quarter last year. Arista Networks has set its Q3 2025 guidance at EPS. On average, sell-side analysts expect that Arista Networks, Inc. will post 2.2 EPS for the current year.

Arista Networks Company Profile

(

Free Report)

Arista Networks, Inc engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. Its cloud networking solutions consist of Extensible Operating System (EOS), a publish-subscribe state-sharing networking operating system offered in combination with a set of network applications.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Arista Networks, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arista Networks wasn't on the list.

While Arista Networks currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.