Versor Investments LP purchased a new stake in Crescent Energy Company (NYSE:CRGY - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund purchased 81,800 shares of the company's stock, valued at approximately $919,000.

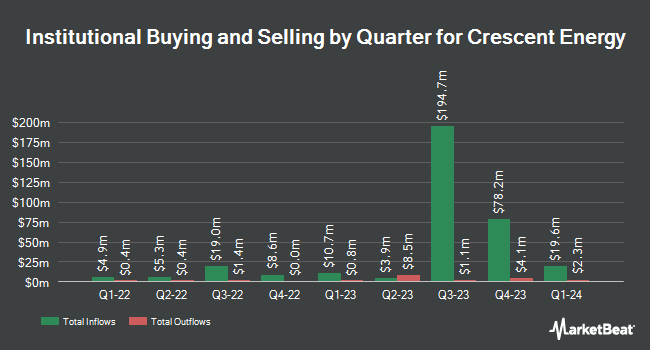

Several other large investors have also modified their holdings of CRGY. ArrowMark Colorado Holdings LLC bought a new stake in shares of Crescent Energy in the 4th quarter valued at about $36,593,000. Nuveen LLC bought a new stake in shares of Crescent Energy in the 1st quarter valued at about $21,782,000. Adage Capital Partners GP L.L.C. raised its holdings in shares of Crescent Energy by 6,700.0% in the 4th quarter. Adage Capital Partners GP L.L.C. now owns 1,700,000 shares of the company's stock valued at $24,837,000 after purchasing an additional 1,675,000 shares in the last quarter. American Century Companies Inc. raised its holdings in shares of Crescent Energy by 10.0% in the 1st quarter. American Century Companies Inc. now owns 13,967,599 shares of the company's stock valued at $156,996,000 after purchasing an additional 1,266,674 shares in the last quarter. Finally, Yaupon Capital Management LP bought a new stake in shares of Crescent Energy in the 4th quarter valued at about $13,149,000. Institutional investors own 52.11% of the company's stock.

Crescent Energy Stock Up 5.9%

Shares of NYSE CRGY traded up $0.5520 during trading hours on Friday, hitting $9.9320. 2,708,298 shares of the stock were exchanged, compared to its average volume of 2,987,728. The company has a quick ratio of 0.88, a current ratio of 0.88 and a debt-to-equity ratio of 0.75. The company has a market cap of $2.53 billion, a PE ratio of -55.18 and a beta of 1.86. The firm has a fifty day moving average price of $9.13 and a 200-day moving average price of $9.82. Crescent Energy Company has a 12 month low of $6.83 and a 12 month high of $16.94.

Crescent Energy (NYSE:CRGY - Get Free Report) last posted its quarterly earnings data on Monday, August 4th. The company reported $0.43 EPS for the quarter, topping the consensus estimate of $0.23 by $0.20. Crescent Energy had a net margin of 0.67% and a return on equity of 13.35%. The firm had revenue of $897.98 million during the quarter, compared to analyst estimates of $868.34 million. On average, sell-side analysts expect that Crescent Energy Company will post 0.77 EPS for the current year.

Crescent Energy Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, September 2nd. Shareholders of record on Monday, August 18th will be paid a dividend of $0.12 per share. The ex-dividend date is Monday, August 18th. This represents a $0.48 dividend on an annualized basis and a yield of 4.8%. Crescent Energy's dividend payout ratio is presently -266.67%.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently commented on the stock. Piper Sandler boosted their price target on shares of Crescent Energy from $14.00 to $15.00 and gave the company an "overweight" rating in a report on Thursday, July 17th. Wells Fargo & Company reduced their price target on shares of Crescent Energy from $20.00 to $19.00 and set an "overweight" rating for the company in a report on Monday, June 16th. Raymond James Financial restated a "strong-buy" rating and issued a $14.00 price target (down previously from $16.00) on shares of Crescent Energy in a report on Friday. Mizuho reduced their price target on shares of Crescent Energy from $13.00 to $12.00 and set a "neutral" rating for the company in a report on Tuesday, May 13th. Finally, Wall Street Zen upgraded shares of Crescent Energy from a "hold" rating to a "buy" rating in a research note on Saturday, August 9th. One analyst has rated the stock with a Strong Buy rating, eight have assigned a Buy rating, three have issued a Hold rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $15.70.

Get Our Latest Analysis on CRGY

Crescent Energy Company Profile

(

Free Report)

Crescent Energy Company acquires, develops, and produces crude oil, natural gas, and natural gas liquids (NGLs) reserves. Its portfolio of assets comprises mid-cycle unconventional and conventional assets in the Eagle Ford and Uinta Basins. It also owns and operates various midstream assets, which provide services to customers.

Featured Stories

Before you consider Crescent Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crescent Energy wasn't on the list.

While Crescent Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.