Versor Investments LP purchased a new position in Ryerson Holding Corporation (NYSE:RYI - Free Report) during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 20,200 shares of the basic materials company's stock, valued at approximately $464,000. Versor Investments LP owned approximately 0.06% of Ryerson at the end of the most recent quarter.

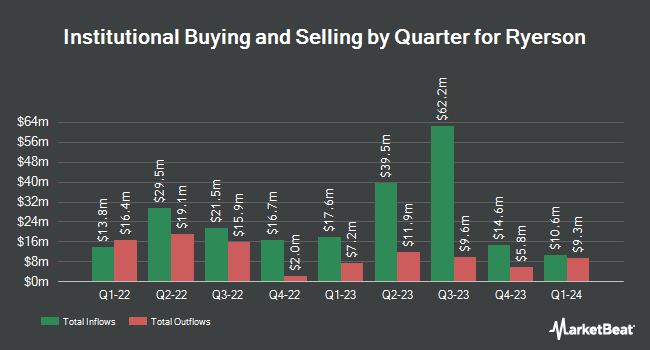

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. Charles Schwab Investment Management Inc. lifted its holdings in shares of Ryerson by 17.4% in the first quarter. Charles Schwab Investment Management Inc. now owns 1,190,988 shares of the basic materials company's stock worth $27,345,000 after buying an additional 176,878 shares in the last quarter. American Century Companies Inc. lifted its holdings in shares of Ryerson by 8.3% in the first quarter. American Century Companies Inc. now owns 1,007,359 shares of the basic materials company's stock worth $23,129,000 after buying an additional 76,920 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. lifted its holdings in shares of Ryerson by 7.6% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 704,448 shares of the basic materials company's stock worth $13,039,000 after buying an additional 49,905 shares in the last quarter. Towle & Co. lifted its holdings in shares of Ryerson by 3.3% in the fourth quarter. Towle & Co. now owns 554,868 shares of the basic materials company's stock worth $10,271,000 after buying an additional 17,925 shares in the last quarter. Finally, Jacobs Levy Equity Management Inc. lifted its holdings in shares of Ryerson by 12.9% in the fourth quarter. Jacobs Levy Equity Management Inc. now owns 542,433 shares of the basic materials company's stock worth $10,040,000 after buying an additional 62,092 shares in the last quarter. 94.81% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

Separately, Wall Street Zen downgraded shares of Ryerson from a "buy" rating to a "hold" rating in a research note on Friday, May 9th. One investment analyst has rated the stock with a Hold rating, According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $25.00.

View Our Latest Report on Ryerson

Insider Activity at Ryerson

In other Ryerson news, CAO Molly D. Kannan sold 2,528 shares of Ryerson stock in a transaction that occurred on Wednesday, August 20th. The shares were sold at an average price of $22.24, for a total transaction of $56,222.72. Following the transaction, the chief accounting officer directly owned 23,516 shares of the company's stock, valued at approximately $522,995.84. This trade represents a 9.71% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Company insiders own 3.95% of the company's stock.

Ryerson Price Performance

RYI traded up $0.06 on Tuesday, reaching $22.98. The company had a trading volume of 337,683 shares, compared to its average volume of 240,336. The business has a 50 day simple moving average of $22.07 and a 200 day simple moving average of $22.31. The company has a market cap of $739.96 million, a price-to-earnings ratio of -51.07 and a beta of 1.56. The company has a debt-to-equity ratio of 0.62, a quick ratio of 1.00 and a current ratio of 2.03. Ryerson Holding Corporation has a 52-week low of $17.18 and a 52-week high of $27.41.

Ryerson (NYSE:RYI - Get Free Report) last announced its earnings results on Tuesday, July 29th. The basic materials company reported $0.08 earnings per share for the quarter, missing analysts' consensus estimates of $0.17 by ($0.09). Ryerson had a negative net margin of 0.33% and a negative return on equity of 1.72%. The company had revenue of $1.17 billion during the quarter, compared to analysts' expectations of $1.17 billion. Ryerson has set its Q3 2025 guidance at 0.000-0.060 EPS. As a group, sell-side analysts anticipate that Ryerson Holding Corporation will post 1.2 EPS for the current year.

Ryerson Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, September 18th. Shareholders of record on Thursday, September 4th will be paid a dividend of $0.1875 per share. The ex-dividend date of this dividend is Thursday, September 4th. This represents a $0.75 annualized dividend and a dividend yield of 3.3%. Ryerson's dividend payout ratio (DPR) is -166.67%.

Ryerson Profile

(

Free Report)

Ryerson Holding Corporation, together with its subsidiaries, processes and distributes industrial metals in the United States and internationally. It offers a line of products in carbon steel, stainless steel, alloy steels, and aluminum, as well as nickel and red metals in various shapes and forms, including coils, sheets, rounds, hexagons, square and flat bars, plates, structural, and tubing.

See Also

Before you consider Ryerson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryerson wasn't on the list.

While Ryerson currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.