Westwood Holdings Group Inc. reduced its stake in shares of Viavi Solutions Inc. (NASDAQ:VIAV - Free Report) by 15.7% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 3,292,976 shares of the communications equipment provider's stock after selling 612,501 shares during the quarter. Westwood Holdings Group Inc. owned about 1.48% of Viavi Solutions worth $36,848,000 at the end of the most recent quarter.

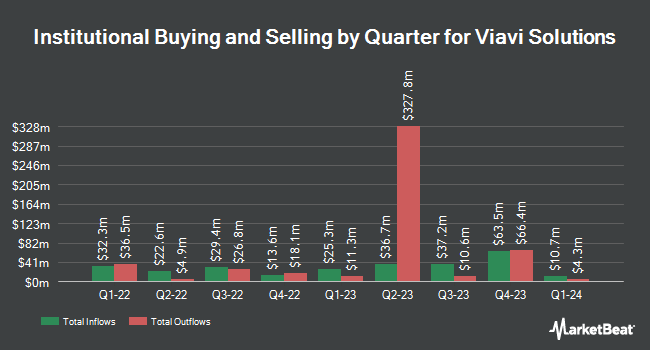

A number of other hedge funds and other institutional investors have also modified their holdings of the stock. Victory Capital Management Inc. raised its position in shares of Viavi Solutions by 7,293.1% during the first quarter. Victory Capital Management Inc. now owns 3,083,135 shares of the communications equipment provider's stock worth $34,500,000 after purchasing an additional 3,041,432 shares during the period. Woodline Partners LP grew its position in Viavi Solutions by 423.7% in the fourth quarter. Woodline Partners LP now owns 3,435,678 shares of the communications equipment provider's stock valued at $34,700,000 after purchasing an additional 2,779,615 shares in the last quarter. LMR Partners LLP bought a new stake in Viavi Solutions during the fourth quarter worth about $8,080,000. Dimensional Fund Advisors LP boosted its holdings in shares of Viavi Solutions by 10.7% in the 4th quarter. Dimensional Fund Advisors LP now owns 6,398,610 shares of the communications equipment provider's stock valued at $64,626,000 after buying an additional 620,773 shares during the last quarter. Finally, Westerly Capital Management LLC lifted its stake in Viavi Solutions by 38.1% in the fourth quarter. Westerly Capital Management LLC now owns 1,450,000 shares of the communications equipment provider's stock valued at $14,645,000 after acquiring an additional 400,000 shares during the last quarter. Institutional investors and hedge funds own 95.54% of the company's stock.

Viavi Solutions Price Performance

VIAV stock traded up $0.12 during midday trading on Thursday, reaching $10.16. 2,844,867 shares of the stock were exchanged, compared to its average volume of 1,598,029. The company has a fifty day moving average price of $9.88 and a 200 day moving average price of $10.36. Viavi Solutions Inc. has a 52 week low of $7.05 and a 52 week high of $12.91. The company has a debt-to-equity ratio of 0.54, a current ratio of 1.53 and a quick ratio of 1.32. The stock has a market capitalization of $2.27 billion, a PE ratio of 508.25 and a beta of 0.87.

Analysts Set New Price Targets

A number of research analysts recently commented on the stock. Needham & Company LLC reiterated a "buy" rating and issued a $15.00 price target on shares of Viavi Solutions in a research note on Friday, May 2nd. B. Riley decreased their price target on shares of Viavi Solutions from $12.00 to $11.00 and set a "neutral" rating on the stock in a research note on Friday, May 2nd. Rosenblatt Securities reissued a "buy" rating and issued a $13.50 price objective on shares of Viavi Solutions in a report on Friday, June 20th. UBS Group dropped their price objective on Viavi Solutions from $11.50 to $11.00 and set a "neutral" rating for the company in a report on Friday, May 2nd. Finally, Wall Street Zen raised shares of Viavi Solutions from a "buy" rating to a "strong-buy" rating in a report on Tuesday, May 13th. One analyst has rated the stock with a sell rating, two have assigned a hold rating, five have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $12.69.

View Our Latest Research Report on Viavi Solutions

Insider Activity at Viavi Solutions

In related news, Director Richard Belluzzo sold 8,385 shares of the stock in a transaction on Tuesday, July 1st. The stock was sold at an average price of $10.02, for a total value of $84,017.70. Following the completion of the sale, the director directly owned 242,311 shares in the company, valued at $2,427,956.22. This represents a 3.34% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Company insiders own 1.52% of the company's stock.

Viavi Solutions Company Profile

(

Free Report)

Viavi Solutions, Inc engages in the provision of network test, monitoring, and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. It operates through the following segments: Network Enablement, Service Enablement, and Optical Security and Performance.

See Also

Before you consider Viavi Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viavi Solutions wasn't on the list.

While Viavi Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.