Victory Capital Management Inc. raised its holdings in shares of Okta, Inc. (NASDAQ:OKTA - Free Report) by 67.8% in the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 35,494 shares of the company's stock after buying an additional 14,340 shares during the period. Victory Capital Management Inc.'s holdings in Okta were worth $3,735,000 at the end of the most recent reporting period.

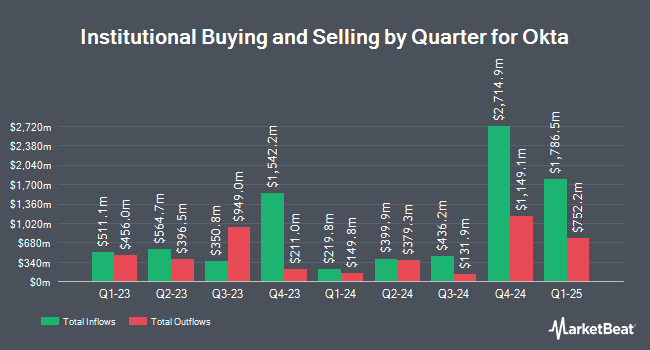

Other institutional investors have also added to or reduced their stakes in the company. Wolff Wiese Magana LLC increased its stake in Okta by 167.4% in the 1st quarter. Wolff Wiese Magana LLC now owns 246 shares of the company's stock worth $26,000 after purchasing an additional 154 shares during the period. Wayfinding Financial LLC bought a new position in shares of Okta in the first quarter worth approximately $27,000. Rossby Financial LCC purchased a new position in shares of Okta in the first quarter worth $31,000. University of Texas Texas AM Investment Management Co. bought a new stake in Okta during the 4th quarter valued at $40,000. Finally, Brown Brothers Harriman & Co. purchased a new stake in Okta during the 4th quarter valued at $43,000. 86.64% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

OKTA has been the topic of a number of analyst reports. Arete assumed coverage on shares of Okta in a research report on Monday, July 7th. They issued a "sell" rating and a $83.00 price objective on the stock. Mizuho reduced their price target on Okta from $135.00 to $130.00 and set an "outperform" rating on the stock in a report on Wednesday, May 28th. Loop Capital began coverage on Okta in a report on Monday, May 5th. They issued a "buy" rating and a $140.00 price objective for the company. JPMorgan Chase & Co. boosted their target price on Okta from $120.00 to $140.00 and gave the company an "overweight" rating in a research note on Friday, May 23rd. Finally, Wall Street Zen lowered Okta from a "buy" rating to a "hold" rating in a research note on Saturday. Three analysts have rated the stock with a sell rating, fifteen have issued a hold rating and twenty have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $118.61.

View Our Latest Analysis on OKTA

Okta Stock Performance

Shares of Okta stock traded down $3.26 during trading hours on Monday, reaching $97.84. 4,125,323 shares of the stock traded hands, compared to its average volume of 3,048,388. Okta, Inc. has a one year low of $70.56 and a one year high of $127.57. The firm has a market capitalization of $17.13 billion, a price-to-earnings ratio of 155.30, a P/E/G ratio of 4.89 and a beta of 0.82. The company has a quick ratio of 1.47, a current ratio of 1.47 and a debt-to-equity ratio of 0.05. The company has a 50 day moving average price of $101.80 and a 200 day moving average price of $102.11.

Okta (NASDAQ:OKTA - Get Free Report) last announced its earnings results on Tuesday, May 27th. The company reported $0.86 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.77 by $0.09. Okta had a net margin of 4.85% and a return on equity of 2.79%. The company had revenue of $688.00 million during the quarter, compared to analyst estimates of $680.14 million. During the same period in the previous year, the business posted $0.65 earnings per share. The firm's quarterly revenue was up 11.5% compared to the same quarter last year. On average, equities research analysts expect that Okta, Inc. will post 0.42 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Okta news, CRO Jonathan James Addison sold 6,027 shares of the business's stock in a transaction dated Monday, July 14th. The stock was sold at an average price of $92.01, for a total transaction of $554,544.27. Following the completion of the sale, the executive owned 19,067 shares of the company's stock, valued at approximately $1,754,354.67. The trade was a 24.02% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CEO Todd Mckinnon sold 31,592 shares of Okta stock in a transaction dated Monday, July 21st. The shares were sold at an average price of $95.30, for a total value of $3,010,717.60. Following the transaction, the chief executive officer directly owned 20,682 shares in the company, valued at approximately $1,970,994.60. The trade was a 60.44% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 79,594 shares of company stock worth $7,482,790 in the last quarter. Company insiders own 5.68% of the company's stock.

Okta Company Profile

(

Free Report)

Okta, Inc operates as an identity partner in the United States and internationally. The company offers Okta's suite of products and services used to manage and secure identities, such as Single Sign-On that enables users to access applications in the cloud or on-premises from various devices; Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications, and data; API Access Management enables organizations to secure APIs; Access Gateway enables organizations to extend Workforce Identity Cloud; and Okta Device Access enables end users to securely log in to devices with Okta credentials.

Read More

Before you consider Okta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Okta wasn't on the list.

While Okta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.