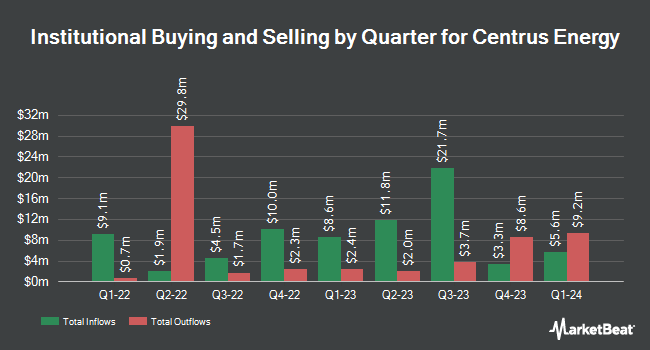

Victory Capital Management Inc. acquired a new position in shares of Centrus Energy Corp. (NYSE:LEU - Free Report) during the 1st quarter, according to its most recent 13F filing with the SEC. The firm acquired 11,964 shares of the company's stock, valued at approximately $744,000. Victory Capital Management Inc. owned 0.07% of Centrus Energy as of its most recent SEC filing.

Several other hedge funds have also made changes to their positions in LEU. State of Wyoming purchased a new position in Centrus Energy during the 4th quarter valued at about $33,000. Altshuler Shaham Ltd bought a new position in shares of Centrus Energy in the 4th quarter worth $49,000. National Bank of Canada FI purchased a new stake in shares of Centrus Energy during the 4th quarter worth $51,000. KBC Group NV bought a new stake in Centrus Energy during the first quarter valued at about $53,000. Finally, Parallel Advisors LLC grew its stake in Centrus Energy by 69.5% in the first quarter. Parallel Advisors LLC now owns 1,271 shares of the company's stock valued at $79,000 after purchasing an additional 521 shares during the last quarter. 49.96% of the stock is currently owned by hedge funds and other institutional investors.

Centrus Energy Stock Performance

Shares of LEU traded up $3.75 during mid-day trading on Tuesday, hitting $213.80. 1,056,123 shares of the company's stock were exchanged, compared to its average volume of 979,129. The business's 50 day moving average is $182.00 and its two-hundred day moving average is $116.47. The firm has a market capitalization of $3.64 billion, a P/E ratio of 48.48 and a beta of 1.35. The company has a current ratio of 2.93, a quick ratio of 2.46 and a debt-to-equity ratio of 3.09. Centrus Energy Corp. has a fifty-two week low of $34.91 and a fifty-two week high of $250.88.

Centrus Energy (NYSE:LEU - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The company reported $1.60 earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.08) by $1.68. Centrus Energy had a net margin of 16.56% and a return on equity of 84.09%. Centrus Energy's quarterly revenue was up 67.3% compared to the same quarter last year. During the same quarter in the previous year, the company posted ($0.38) EPS. On average, equities analysts expect that Centrus Energy Corp. will post 2.63 earnings per share for the current year.

Analyst Upgrades and Downgrades

Several equities analysts have issued reports on the stock. Stifel Nicolaus initiated coverage on shares of Centrus Energy in a report on Friday, July 11th. They issued a "buy" rating and a $220.00 price target on the stock. JPMorgan Chase & Co. began coverage on Centrus Energy in a report on Thursday, June 26th. They issued a "neutral" rating and a $148.00 price objective for the company. B. Riley reissued a "buy" rating and issued a $221.00 price target (up previously from $134.00) on shares of Centrus Energy in a report on Monday, June 23rd. Northland Capmk raised shares of Centrus Energy to a "strong-buy" rating in a research note on Monday, July 7th. Finally, Northland Securities began coverage on Centrus Energy in a report on Monday, July 7th. They set an "outperform" rating and a $205.00 price target for the company. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating, eight have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $178.64.

View Our Latest Stock Analysis on LEU

Insider Buying and Selling at Centrus Energy

In other Centrus Energy news, SVP John M. A. Donelson sold 3,732 shares of the firm's stock in a transaction dated Tuesday, May 13th. The stock was sold at an average price of $96.31, for a total value of $359,428.92. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CFO Kevin J. Harrill sold 1,728 shares of the company's stock in a transaction dated Friday, May 30th. The shares were sold at an average price of $126.00, for a total transaction of $217,728.00. The disclosure for this sale can be found here. Corporate insiders own 1.00% of the company's stock.

Centrus Energy Profile

(

Free Report)

Centrus Energy Corp. supplies nuclear fuel components and services for the nuclear power industry in the United States, Belgium, Japan, and internationally. The company operates through two segments, Low-Enriched Uranium (LEU) and Technical Solutions. The LEU segment sells separative work units (SWU) components of LEU; natural uranium hexafluoride, uranium concentrates, and uranium conversion; and enriched uranium products to utilities that operate nuclear power plants.

Featured Articles

Before you consider Centrus Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centrus Energy wasn't on the list.

While Centrus Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.