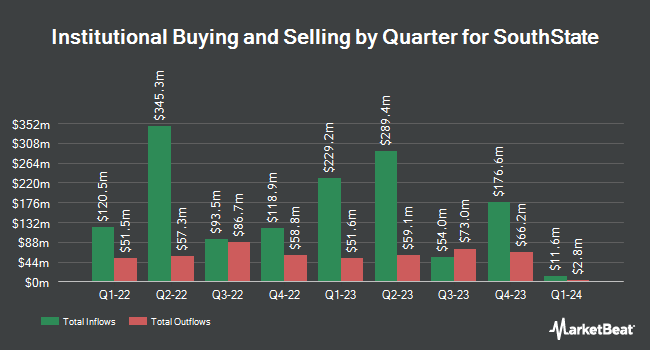

Vident Advisory LLC bought a new position in shares of SouthState Co. (NASDAQ:SSB - Free Report) during the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund bought 2,897 shares of the bank's stock, valued at approximately $269,000.

Other institutional investors also recently modified their holdings of the company. Cambridge Investment Research Advisors Inc. lifted its holdings in shares of SouthState by 153.6% in the first quarter. Cambridge Investment Research Advisors Inc. now owns 10,229 shares of the bank's stock valued at $949,000 after purchasing an additional 6,196 shares in the last quarter. GAMMA Investing LLC raised its holdings in SouthState by 68.1% during the first quarter. GAMMA Investing LLC now owns 1,172 shares of the bank's stock worth $109,000 after acquiring an additional 475 shares in the last quarter. Allspring Global Investments Holdings LLC raised its holdings in SouthState by 5.0% during the first quarter. Allspring Global Investments Holdings LLC now owns 1,093,176 shares of the bank's stock worth $100,856,000 after acquiring an additional 51,933 shares in the last quarter. State of Alaska Department of Revenue raised its holdings in SouthState by 32.1% during the first quarter. State of Alaska Department of Revenue now owns 11,492 shares of the bank's stock worth $1,066,000 after acquiring an additional 2,790 shares in the last quarter. Finally, New York State Teachers Retirement System raised its holdings in SouthState by 25.4% during the first quarter. New York State Teachers Retirement System now owns 15,427 shares of the bank's stock worth $1,432,000 after acquiring an additional 3,127 shares in the last quarter. 89.76% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several analysts recently issued reports on the company. Hovde Group upped their target price on SouthState from $97.00 to $105.00 and gave the stock a "market perform" rating in a report on Friday, July 25th. Jefferies Financial Group assumed coverage on SouthState in a report on Wednesday, May 21st. They set a "buy" rating and a $110.00 target price on the stock. DA Davidson upped their target price on SouthState from $115.00 to $117.00 and gave the stock a "buy" rating in a report on Monday, July 28th. Barclays upped their target price on SouthState from $117.00 to $120.00 and gave the stock an "overweight" rating in a report on Monday, July 28th. Finally, Citigroup reiterated a "buy" rating and set a $117.00 target price (up previously from $113.00) on shares of SouthState in a report on Monday, July 28th. Two analysts have rated the stock with a Strong Buy rating, eight have issued a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and an average price target of $115.27.

View Our Latest Stock Report on SSB

Insider Buying and Selling at SouthState

In other SouthState news, Director Janet P. Froetscher bought 3,338 shares of SouthState stock in a transaction on Wednesday, July 30th. The shares were purchased at an average price of $97.31 per share, with a total value of $324,820.78. Following the acquisition, the director owned 8,294 shares in the company, valued at $807,089.14. This trade represents a 67.35% increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, insider Daniel E. Bockhorst sold 5,000 shares of the firm's stock in a transaction on Friday, August 22nd. The shares were sold at an average price of $99.60, for a total value of $498,000.00. Following the completion of the sale, the insider directly owned 31,785 shares in the company, valued at approximately $3,165,786. This represents a 13.59% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have acquired 8,338 shares of company stock valued at $786,321. 1.70% of the stock is currently owned by corporate insiders.

SouthState Price Performance

Shares of SSB stock traded down $0.44 during trading on Monday, hitting $100.81. The company had a trading volume of 524,090 shares, compared to its average volume of 910,067. The company has a debt-to-equity ratio of 0.07, a quick ratio of 0.91 and a current ratio of 0.91. The firm has a market capitalization of $10.20 billion, a P/E ratio of 14.48 and a beta of 0.74. The stock's 50-day moving average price is $97.91 and its 200 day moving average price is $92.35. SouthState Co. has a one year low of $77.74 and a one year high of $114.26.

SouthState (NASDAQ:SSB - Get Free Report) last issued its quarterly earnings results on Thursday, July 24th. The bank reported $2.30 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.98 by $0.32. The business had revenue of $840.50 million during the quarter, compared to analysts' expectations of $645.12 million. SouthState had a return on equity of 9.62% and a net margin of 22.38%.During the same period in the previous year, the company posted $1.74 earnings per share. Equities analysts expect that SouthState Co. will post 8.12 EPS for the current fiscal year.

SouthState Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, August 15th. Shareholders of record on Friday, August 8th were issued a $0.60 dividend. The ex-dividend date of this dividend was Friday, August 8th. This represents a $2.40 dividend on an annualized basis and a dividend yield of 2.4%. This is a boost from SouthState's previous quarterly dividend of $0.54. SouthState's dividend payout ratio (DPR) is 35.77%.

SouthState Profile

(

Free Report)

SouthState Corporation operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies. It offers checking accounts, savings deposits, interest-bearing transaction accounts, certificates of deposits, money market accounts, and other time deposits, as well as bond accounting, asset/liability consulting related activities, and other clearing and corporate checking account services.

Featured Articles

Before you consider SouthState Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SouthState Bank wasn't on the list.

While SouthState Bank currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.