Virtu Financial LLC purchased a new position in shares of Live Oak Bancshares, Inc. (NASDAQ:LOB - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 24,651 shares of the bank's stock, valued at approximately $657,000. Virtu Financial LLC owned approximately 0.05% of Live Oak Bancshares at the end of the most recent quarter.

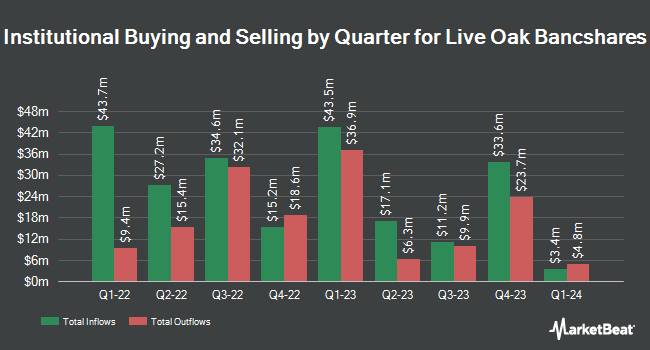

Several other hedge funds and other institutional investors have also bought and sold shares of LOB. GAMMA Investing LLC lifted its position in shares of Live Oak Bancshares by 4,595.5% during the 1st quarter. GAMMA Investing LLC now owns 9,438 shares of the bank's stock valued at $252,000 after buying an additional 9,237 shares during the last quarter. Wealth Enhancement Advisory Services LLC lifted its position in shares of Live Oak Bancshares by 100.6% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 38,802 shares of the bank's stock valued at $1,034,000 after buying an additional 19,457 shares during the last quarter. Raymond James Financial Inc. purchased a new position in shares of Live Oak Bancshares during the 4th quarter valued at $5,277,000. Rice Hall James & Associates LLC lifted its position in shares of Live Oak Bancshares by 20.2% during the 1st quarter. Rice Hall James & Associates LLC now owns 155,471 shares of the bank's stock valued at $4,145,000 after buying an additional 26,085 shares during the last quarter. Finally, Envestnet Asset Management Inc. lifted its position in shares of Live Oak Bancshares by 16.4% during the 1st quarter. Envestnet Asset Management Inc. now owns 145,117 shares of the bank's stock valued at $3,869,000 after buying an additional 20,430 shares during the last quarter. Hedge funds and other institutional investors own 63.95% of the company's stock.

Wall Street Analyst Weigh In

Separately, Keefe, Bruyette & Woods reaffirmed a "market perform" rating and set a $37.00 price target (up previously from $36.00) on shares of Live Oak Bancshares in a research report on Friday, July 25th.

Read Our Latest Stock Report on Live Oak Bancshares

Live Oak Bancshares Stock Up 0.0%

LOB traded up $0.01 during trading on Friday, reaching $34.50. 311,981 shares of the company were exchanged, compared to its average volume of 288,726. The company's 50-day moving average is $31.13 and its two-hundred day moving average is $29.41. The company has a market cap of $1.57 billion, a price-to-earnings ratio of 23.79 and a beta of 1.82. Live Oak Bancshares, Inc. has a 12-month low of $22.68 and a 12-month high of $50.57.

Live Oak Bancshares Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, June 17th. Investors of record on Tuesday, June 3rd were issued a dividend of $0.03 per share. The ex-dividend date of this dividend was Tuesday, June 3rd. This represents a $0.12 dividend on an annualized basis and a yield of 0.3%. Live Oak Bancshares's dividend payout ratio is 9.84%.

Live Oak Bancshares Profile

(

Free Report)

Live Oak Bancshares, Inc operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States. It operates through two segments, Banking and Fintech. The company accepts various deposit products, including noninterest-bearing demand, as well as interest-bearing checking, money market, savings, and time deposits.

Read More

Before you consider Live Oak Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Live Oak Bancshares wasn't on the list.

While Live Oak Bancshares currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.