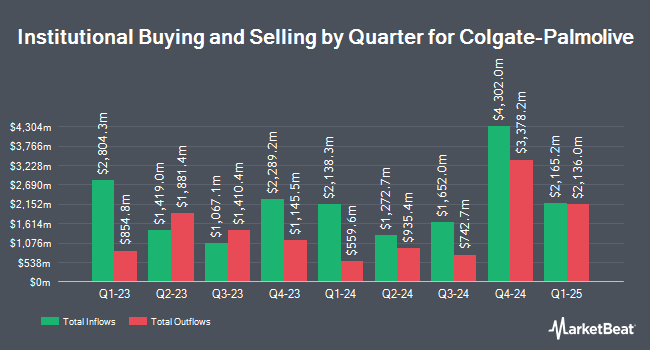

Voleon Capital Management LP raised its stake in Colgate-Palmolive Company (NYSE:CL - Free Report) by 223.7% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 86,788 shares of the company's stock after acquiring an additional 59,979 shares during the quarter. Voleon Capital Management LP's holdings in Colgate-Palmolive were worth $8,132,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also made changes to their positions in CL. Brighton Jones LLC increased its position in shares of Colgate-Palmolive by 4.4% in the fourth quarter. Brighton Jones LLC now owns 10,578 shares of the company's stock valued at $962,000 after buying an additional 450 shares in the last quarter. Bernard Wealth Management Corp. purchased a new stake in shares of Colgate-Palmolive in the fourth quarter valued at approximately $36,000. Focus Partners Wealth increased its position in shares of Colgate-Palmolive by 22.7% in the fourth quarter. Focus Partners Wealth now owns 179,636 shares of the company's stock valued at $16,331,000 after buying an additional 33,219 shares in the last quarter. Humankind Investments LLC increased its position in shares of Colgate-Palmolive by 14.0% in the fourth quarter. Humankind Investments LLC now owns 22,538 shares of the company's stock valued at $2,049,000 after buying an additional 2,768 shares in the last quarter. Finally, Hudson Bay Capital Management LP purchased a new stake in shares of Colgate-Palmolive in the fourth quarter valued at approximately $3,326,000. 80.41% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of research firms have recently commented on CL. UBS Group cut their price objective on Colgate-Palmolive from $109.00 to $106.00 and set a "buy" rating for the company in a research report on Thursday, July 17th. Citigroup dropped their price target on Colgate-Palmolive from $108.00 to $105.00 and set a "buy" rating for the company in a research report on Monday, August 4th. Morgan Stanley dropped their price target on Colgate-Palmolive from $104.00 to $96.00 and set an "overweight" rating for the company in a research report on Monday, August 4th. Wells Fargo & Company dropped their price target on Colgate-Palmolive from $88.00 to $83.00 and set an "underweight" rating for the company in a research report on Monday, August 4th. Finally, JPMorgan Chase & Co. dropped their price target on Colgate-Palmolive from $99.00 to $95.00 and set an "overweight" rating for the company in a research report on Monday, August 4th. Seven analysts have rated the stock with a Buy rating, three have issued a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $98.00.

Check Out Our Latest Report on Colgate-Palmolive

Colgate-Palmolive Trading Down 0.8%

NYSE CL traded down $0.71 on Friday, reaching $83.35. 3,169,120 shares of the company were exchanged, compared to its average volume of 4,484,784. The business's fifty day moving average price is $85.95 and its 200 day moving average price is $89.54. The stock has a market capitalization of $67.37 billion, a P/E ratio of 23.41, a price-to-earnings-growth ratio of 4.37 and a beta of 0.35. The company has a current ratio of 0.89, a quick ratio of 0.57 and a debt-to-equity ratio of 6.79. Colgate-Palmolive Company has a fifty-two week low of $82.29 and a fifty-two week high of $106.26.

Colgate-Palmolive (NYSE:CL - Get Free Report) last released its quarterly earnings data on Friday, August 1st. The company reported $0.92 earnings per share for the quarter, topping analysts' consensus estimates of $0.89 by $0.03. The company had revenue of $5.11 billion for the quarter, compared to analyst estimates of $5.03 billion. Colgate-Palmolive had a return on equity of 377.63% and a net margin of 14.55%.The firm's revenue for the quarter was up 1.0% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.91 earnings per share. Analysts forecast that Colgate-Palmolive Company will post 3.75 earnings per share for the current year.

Colgate-Palmolive Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 14th. Shareholders of record on Friday, October 17th will be paid a dividend of $0.52 per share. The ex-dividend date of this dividend is Friday, October 17th. This represents a $2.08 dividend on an annualized basis and a yield of 2.5%. Colgate-Palmolive's payout ratio is 58.43%.

About Colgate-Palmolive

(

Free Report)

Colgate-Palmolive Company, together with its subsidiaries, manufactures and sells consumer products in the United States and internationally. It operates through two segments: Oral, Personal and Home Care; and Pet Nutrition. The Oral, Personal and Home Care segment offers toothpaste, toothbrushes, mouthwash, bar and liquid hand soaps, shower gels, shampoos, conditioners, deodorants and antiperspirants, skin health products, dishwashing detergents, fabric conditioners, household cleaners, and other related items.

Featured Articles

Before you consider Colgate-Palmolive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Colgate-Palmolive wasn't on the list.

While Colgate-Palmolive currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.