Vontobel Holding Ltd. lessened its stake in shares of West Fraser Timber Co. Ltd. (NYSE:WFG - Free Report) by 5.2% in the second quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 421,650 shares of the company's stock after selling 23,179 shares during the quarter. Vontobel Holding Ltd. owned approximately 0.55% of West Fraser Timber worth $30,940,000 at the end of the most recent quarter.

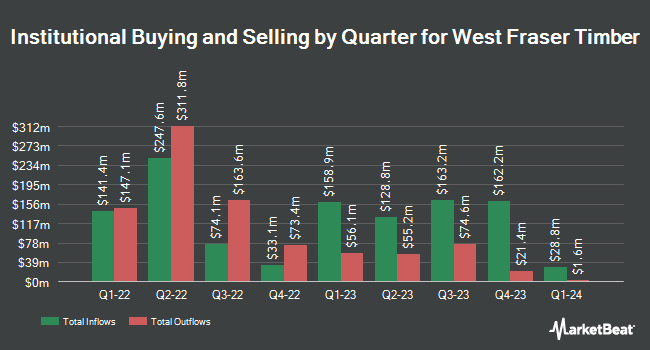

A number of other institutional investors have also recently made changes to their positions in WFG. GAMMA Investing LLC boosted its stake in shares of West Fraser Timber by 7,588.9% during the first quarter. GAMMA Investing LLC now owns 692 shares of the company's stock valued at $53,000 after purchasing an additional 683 shares during the period. Intact Investment Management Inc. boosted its stake in shares of West Fraser Timber by 18.3% during the first quarter. Intact Investment Management Inc. now owns 23,900 shares of the company's stock valued at $1,836,000 after purchasing an additional 3,700 shares during the period. Manning & Napier Advisors LLC boosted its stake in shares of West Fraser Timber by 2.7% during the first quarter. Manning & Napier Advisors LLC now owns 875,815 shares of the company's stock valued at $67,385,000 after purchasing an additional 22,777 shares during the period. Comprehensive Money Management Services LLC boosted its stake in shares of West Fraser Timber by 3.8% during the first quarter. Comprehensive Money Management Services LLC now owns 4,065 shares of the company's stock valued at $313,000 after purchasing an additional 150 shares during the period. Finally, Cambridge Investment Research Advisors Inc. boosted its stake in shares of West Fraser Timber by 6.9% during the first quarter. Cambridge Investment Research Advisors Inc. now owns 2,806 shares of the company's stock valued at $216,000 after purchasing an additional 181 shares during the period. Hedge funds and other institutional investors own 40.23% of the company's stock.

Analysts Set New Price Targets

A number of research firms have recently weighed in on WFG. Wall Street Zen lowered West Fraser Timber from a "hold" rating to a "sell" rating in a research note on Friday, July 18th. Zacks Research raised West Fraser Timber from a "strong sell" rating to a "hold" rating in a research note on Friday, September 26th. Weiss Ratings reissued a "sell (d)" rating on shares of West Fraser Timber in a research note on Wednesday. Raymond James Financial restated a "market perform" rating on shares of West Fraser Timber in a report on Monday, July 21st. Finally, TD Securities decreased their target price on West Fraser Timber from $98.00 to $96.00 and set a "buy" rating for the company in a report on Friday, July 25th. Four analysts have rated the stock with a Buy rating, two have issued a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $100.00.

Check Out Our Latest Stock Report on West Fraser Timber

West Fraser Timber Price Performance

WFG opened at $68.68 on Friday. The stock has a fifty day simple moving average of $71.97 and a two-hundred day simple moving average of $73.53. The company has a current ratio of 2.89, a quick ratio of 1.61 and a debt-to-equity ratio of 0.04. The company has a market cap of $5.25 billion, a price-to-earnings ratio of -39.25 and a beta of 1.13. West Fraser Timber Co. Ltd. has a 12-month low of $66.36 and a 12-month high of $102.40.

West Fraser Timber (NYSE:WFG - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The company reported ($0.38) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.36 by ($0.74). The firm had revenue of $1.53 billion during the quarter, compared to the consensus estimate of $1.61 billion. West Fraser Timber had a negative return on equity of 0.85% and a negative net margin of 2.18%. Research analysts predict that West Fraser Timber Co. Ltd. will post 4.45 earnings per share for the current fiscal year.

West Fraser Timber Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, October 14th. Shareholders of record on Thursday, September 25th will be issued a $0.32 dividend. The ex-dividend date is Thursday, September 25th. This represents a $1.28 dividend on an annualized basis and a yield of 1.9%. West Fraser Timber's dividend payout ratio is -73.14%.

West Fraser Timber Profile

(

Free Report)

West Fraser Timber Co Ltd., a diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy. It offers spruce-pine-fir, douglas fir-larch, hem-fir, and southern yellow pine lumber, treated wood products, medium density fiberboard panels and plywood, oriented strand board, and laminated veneer lumber wood products, as well as particleboards.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider West Fraser Timber, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and West Fraser Timber wasn't on the list.

While West Fraser Timber currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.