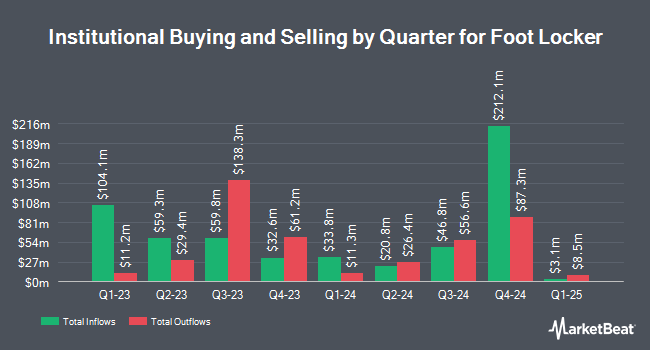

Vontobel Holding Ltd. boosted its stake in Foot Locker, Inc. (NYSE:FL - Free Report) by 55.0% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 46,847 shares of the athletic footwear retailer's stock after buying an additional 16,618 shares during the quarter. Vontobel Holding Ltd.'s holdings in Foot Locker were worth $661,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. Bank of New York Mellon Corp increased its holdings in Foot Locker by 30.4% in the fourth quarter. Bank of New York Mellon Corp now owns 1,429,870 shares of the athletic footwear retailer's stock worth $31,114,000 after buying an additional 333,247 shares during the last quarter. Proficio Capital Partners LLC acquired a new position in Foot Locker in the fourth quarter worth approximately $241,000. Smartleaf Asset Management LLC increased its holdings in Foot Locker by 198.0% in the fourth quarter. Smartleaf Asset Management LLC now owns 2,876 shares of the athletic footwear retailer's stock worth $63,000 after buying an additional 1,911 shares during the last quarter. Charles Schwab Investment Management Inc. increased its holdings in Foot Locker by 5.6% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,176,449 shares of the athletic footwear retailer's stock worth $25,600,000 after buying an additional 62,866 shares during the last quarter. Finally, Keybank National Association OH acquired a new position in Foot Locker in the fourth quarter worth approximately $213,000.

Analyst Ratings Changes

Several equities analysts have commented on FL shares. Citigroup increased their price target on Foot Locker from $20.00 to $24.00 and gave the company a "neutral" rating in a report on Friday, May 16th. Morgan Stanley reduced their price objective on Foot Locker from $16.00 to $14.00 and set an "underweight" rating for the company in a research report on Tuesday, May 6th. Evercore ISI reduced their price objective on Foot Locker from $22.00 to $15.00 and set an "outperform" rating for the company in a research report on Friday, April 11th. Needham & Company LLC set a $24.00 price objective on Foot Locker in a research report on Thursday, May 29th. Finally, Barclays cut Foot Locker from an "overweight" rating to an "equal weight" rating in a research report on Thursday, May 29th. Three research analysts have rated the stock with a sell rating, eleven have assigned a hold rating and two have given a buy rating to the company. According to data from MarketBeat.com, Foot Locker presently has a consensus rating of "Hold" and an average price target of $21.20.

Get Our Latest Stock Report on Foot Locker

Insider Activity

In other news, CAO Giovanna Cipriano sold 22,383 shares of the stock in a transaction on Tuesday, July 1st. The shares were sold at an average price of $24.90, for a total transaction of $557,336.70. Following the completion of the sale, the chief accounting officer owned 93,895 shares of the company's stock, valued at $2,337,985.50. This represents a 19.25% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.89% of the stock is owned by corporate insiders.

Foot Locker Trading Up 1.5%

NYSE FL traded up $0.39 during trading on Thursday, reaching $25.32. 2,842,580 shares of the stock traded hands, compared to its average volume of 4,095,131. The firm has a market cap of $2.41 billion, a price-to-earnings ratio of -6.71, a price-to-earnings-growth ratio of 2.08 and a beta of 1.72. Foot Locker, Inc. has a fifty-two week low of $11.00 and a fifty-two week high of $33.94. The company has a quick ratio of 0.49, a current ratio of 1.64 and a debt-to-equity ratio of 0.17. The stock's 50-day moving average price is $21.80 and its 200 day moving average price is $18.86.

Foot Locker (NYSE:FL - Get Free Report) last issued its quarterly earnings data on Thursday, May 29th. The athletic footwear retailer reported ($0.07) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.07). Foot Locker had a negative net margin of 4.54% and a positive return on equity of 3.65%. The company had revenue of $1.79 billion during the quarter, compared to the consensus estimate of $1.86 billion. During the same quarter in the prior year, the firm earned $0.22 earnings per share. The firm's revenue was down 4.6% compared to the same quarter last year. Analysts predict that Foot Locker, Inc. will post 1.23 EPS for the current year.

About Foot Locker

(

Free Report)

Foot Locker, Inc, through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, Australia, New Zealand, Asia, and the Middle East. Its brand portfolio includes Foot Locker, a brand comprising sneakers and apparel; Kids Foot Locker, which offers athletic footwear, apparel, and accessories for children; and Champs Sports that operates as a mall-based specialty athletic footwear and apparel retailer.

Featured Articles

Before you consider Foot Locker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Foot Locker wasn't on the list.

While Foot Locker currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.