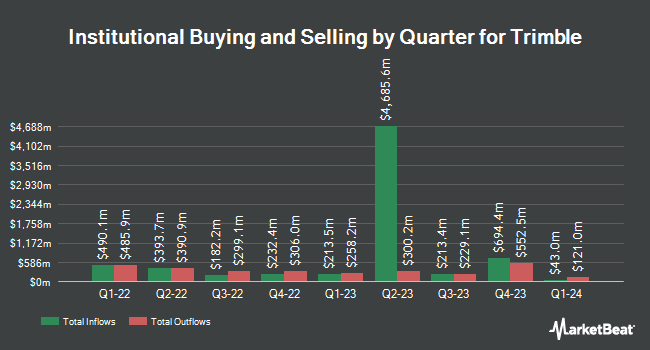

Vontobel Holding Ltd. lessened its stake in Trimble Inc. (NASDAQ:TRMB - Free Report) by 19.5% in the 2nd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 543,524 shares of the scientific and technical instruments company's stock after selling 131,287 shares during the period. Vontobel Holding Ltd. owned about 0.23% of Trimble worth $41,297,000 at the end of the most recent reporting period.

Other hedge funds have also made changes to their positions in the company. Flaharty Asset Management LLC bought a new stake in shares of Trimble in the first quarter valued at about $45,000. Ameritas Advisory Services LLC bought a new stake in shares of Trimble in the second quarter valued at about $48,000. Steph & Co. lifted its stake in Trimble by 592.0% during the second quarter. Steph & Co. now owns 692 shares of the scientific and technical instruments company's stock worth $53,000 after purchasing an additional 592 shares during the period. State of Wyoming bought a new position in Trimble during the first quarter worth about $58,000. Finally, Farther Finance Advisors LLC lifted its stake in Trimble by 153.5% during the first quarter. Farther Finance Advisors LLC now owns 976 shares of the scientific and technical instruments company's stock worth $64,000 after purchasing an additional 591 shares during the period. Institutional investors own 93.21% of the company's stock.

Trimble Stock Performance

Shares of Trimble stock opened at $80.47 on Thursday. The company has a debt-to-equity ratio of 0.25, a current ratio of 0.94 and a quick ratio of 0.81. The firm has a market cap of $19.15 billion, a P/E ratio of 69.37, a P/E/G ratio of 3.25 and a beta of 1.65. The firm has a 50 day simple moving average of $81.50 and a 200 day simple moving average of $74.17. Trimble Inc. has a fifty-two week low of $52.91 and a fifty-two week high of $87.50.

Trimble (NASDAQ:TRMB - Get Free Report) last released its earnings results on Wednesday, August 6th. The scientific and technical instruments company reported $0.71 EPS for the quarter, topping analysts' consensus estimates of $0.63 by $0.08. Trimble had a net margin of 8.02% and a return on equity of 10.24%. The firm had revenue of $875.70 million during the quarter, compared to analyst estimates of $835.81 million. During the same quarter in the previous year, the business earned $0.62 EPS. The business's quarterly revenue was up .6% compared to the same quarter last year. Sell-side analysts predict that Trimble Inc. will post 2.37 earnings per share for the current fiscal year.

Insider Transactions at Trimble

In other news, Director James Calvin Dalton sold 609 shares of Trimble stock in a transaction on Thursday, August 28th. The shares were sold at an average price of $82.41, for a total transaction of $50,187.69. Following the transaction, the director directly owned 13,809 shares of the company's stock, valued at $1,137,999.69. This trade represents a 4.22% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CEO Robert G. Painter sold 115,781 shares of Trimble stock in a transaction on Monday, August 11th. The stock was sold at an average price of $82.83, for a total transaction of $9,590,140.23. Following the transaction, the chief executive officer directly owned 114,879 shares in the company, valued at approximately $9,515,427.57. This represents a 50.20% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 216,821 shares of company stock valued at $18,110,143 over the last three months. 0.54% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

A number of research analysts have commented on the stock. Berenberg Bank set a $95.00 price target on shares of Trimble and gave the stock a "buy" rating in a research note on Friday, October 3rd. Wall Street Zen upgraded shares of Trimble from a "hold" rating to a "buy" rating in a research note on Saturday, August 9th. Oppenheimer raised their price target on shares of Trimble from $88.00 to $94.00 and gave the stock an "outperform" rating in a research note on Thursday, August 7th. JPMorgan Chase & Co. lifted their target price on shares of Trimble from $96.00 to $98.00 and gave the company an "overweight" rating in a research note on Friday, September 19th. Finally, Raymond James Financial reiterated an "outperform" rating and issued a $93.00 target price (up previously from $85.00) on shares of Trimble in a research note on Thursday, August 7th. One analyst has rated the stock with a Strong Buy rating, nine have assigned a Buy rating and one has issued a Hold rating to the company's stock. According to data from MarketBeat.com, Trimble presently has a consensus rating of "Buy" and a consensus target price of $92.10.

Read Our Latest Research Report on TRMB

About Trimble

(

Free Report)

Trimble Inc provides technology solutions that enable professionals and field mobile workers to enhance or transform their work processes worldwide. The company's Buildings and Infrastructure segment offers field and office software for project design and visualization; systems to guide and control construction equipment; software for 3D design and data sharing; systems to monitor, track, and manage assets, equipment, and workers; software to share and communicate data; program management solutions for construction owners; 3D conceptual design and modeling software; building information modeling software; enterprise resource planning, project management, and project collaboration solutions; integrated site layout and measurement systems; cost estimating, scheduling, and project controls solutions; and applications for sub-contractors and trades.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Trimble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trimble wasn't on the list.

While Trimble currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.