Voya Investment Management LLC decreased its holdings in shares of International Bancshares Corporation (NASDAQ:IBOC - Free Report) by 88.9% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 14,547 shares of the bank's stock after selling 116,960 shares during the quarter. Voya Investment Management LLC's holdings in International Bancshares were worth $917,000 at the end of the most recent quarter.

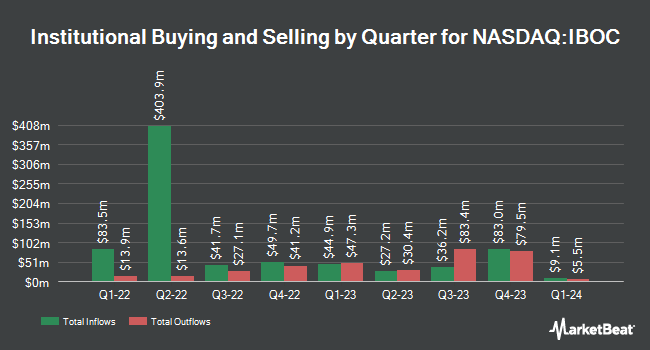

Several other institutional investors have also recently added to or reduced their stakes in the business. American Century Companies Inc. lifted its stake in International Bancshares by 37.9% during the first quarter. American Century Companies Inc. now owns 2,418,758 shares of the bank's stock worth $152,527,000 after purchasing an additional 665,280 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its stake in International Bancshares by 3.1% in the first quarter. Charles Schwab Investment Management Inc. now owns 2,141,959 shares of the bank's stock valued at $135,072,000 after buying an additional 63,791 shares during the last quarter. Azora Capital LP lifted its stake in International Bancshares by 28.4% in the first quarter. Azora Capital LP now owns 947,229 shares of the bank's stock valued at $59,732,000 after buying an additional 209,643 shares during the last quarter. Reinhart Partners LLC. lifted its stake in International Bancshares by 13.2% in the first quarter. Reinhart Partners LLC. now owns 777,713 shares of the bank's stock valued at $49,043,000 after buying an additional 90,553 shares during the last quarter. Finally, Tamar Securities LLC lifted its stake in International Bancshares by 18.0% in the first quarter. Tamar Securities LLC now owns 718,117 shares of the bank's stock valued at $45,284,000 after buying an additional 109,443 shares during the last quarter. Hedge funds and other institutional investors own 65.91% of the company's stock.

International Bancshares Price Performance

Shares of NASDAQ IBOC opened at $69.35 on Thursday. The company has a current ratio of 0.75, a quick ratio of 0.75 and a debt-to-equity ratio of 0.06. International Bancshares Corporation has a twelve month low of $54.11 and a twelve month high of $76.91. The stock has a 50 day moving average of $70.02 and a two-hundred day moving average of $65.62. The stock has a market cap of $4.31 billion, a P/E ratio of 10.48 and a beta of 0.87.

International Bancshares (NASDAQ:IBOC - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The bank reported $1.61 earnings per share for the quarter. International Bancshares had a return on equity of 14.37% and a net margin of 39.51%.

International Bancshares Increases Dividend

The company also recently disclosed a semi-annual dividend, which was paid on Friday, August 29th. Shareholders of record on Friday, August 15th were paid a $0.70 dividend. This is an increase from International Bancshares's previous semi-annual dividend of $0.66. This represents a yield of 200.0%. The ex-dividend date was Friday, August 15th. International Bancshares's dividend payout ratio (DPR) is presently 21.15%.

International Bancshares Profile

(

Free Report)

International Bancshares Corporation, a financial holding company, provides commercial and retail banking services in Texas and the State of Oklahoma. It accepts checking and saving deposits; and offers commercial, real estate, personal, home improvement, automobile, and other installment and term loans.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider International Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Bancshares wasn't on the list.

While International Bancshares currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.