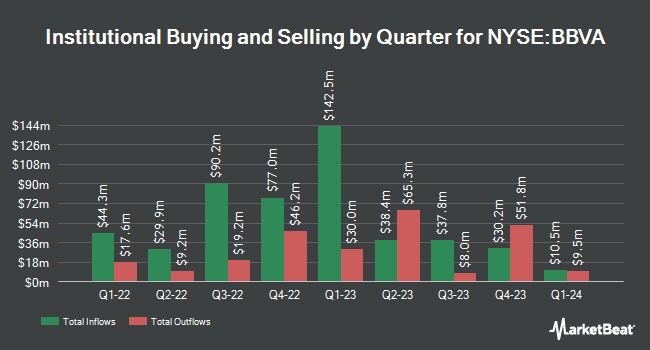

Walleye Capital LLC purchased a new stake in Banco Bilbao Viscaya Argentaria S.A. (NYSE:BBVA - Free Report) in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 140,789 shares of the bank's stock, valued at approximately $1,918,000.

Other hedge funds have also made changes to their positions in the company. Alpine Bank Wealth Management purchased a new position in shares of Banco Bilbao Viscaya Argentaria in the first quarter valued at $29,000. Private Trust Co. NA increased its position in shares of Banco Bilbao Viscaya Argentaria by 224.7% in the first quarter. Private Trust Co. NA now owns 2,607 shares of the bank's stock valued at $36,000 after buying an additional 1,804 shares in the last quarter. Cullen Frost Bankers Inc. purchased a new position in shares of Banco Bilbao Viscaya Argentaria in the first quarter valued at $46,000. Bessemer Group Inc. increased its position in shares of Banco Bilbao Viscaya Argentaria by 25.3% in the first quarter. Bessemer Group Inc. now owns 3,901 shares of the bank's stock valued at $53,000 after buying an additional 787 shares in the last quarter. Finally, Manchester Capital Management LLC increased its position in shares of Banco Bilbao Viscaya Argentaria by 19.2% in the first quarter. Manchester Capital Management LLC now owns 4,643 shares of the bank's stock valued at $63,000 after buying an additional 748 shares in the last quarter. Hedge funds and other institutional investors own 2.96% of the company's stock.

Banco Bilbao Viscaya Argentaria Price Performance

Banco Bilbao Viscaya Argentaria stock traded down $0.03 during midday trading on Monday, reaching $18.13. 860,882 shares of the company were exchanged, compared to its average volume of 1,493,124. The company has a market capitalization of $105.81 billion, a price-to-earnings ratio of 9.54, a P/E/G ratio of 1.42 and a beta of 1.20. The firm's 50-day simple moving average is $16.59 and its 200-day simple moving average is $14.95. Banco Bilbao Viscaya Argentaria S.A. has a 1 year low of $9.23 and a 1 year high of $19.39. The company has a debt-to-equity ratio of 1.18, a quick ratio of 1.01 and a current ratio of 1.01.

Banco Bilbao Viscaya Argentaria (NYSE:BBVA - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The bank reported $0.52 EPS for the quarter, beating the consensus estimate of $0.47 by $0.05. The company had revenue of $10.30 billion during the quarter, compared to analysts' expectations of $10.24 billion. Banco Bilbao Viscaya Argentaria had a return on equity of 17.61% and a net margin of 29.17%. On average, analysts anticipate that Banco Bilbao Viscaya Argentaria S.A. will post 1.59 EPS for the current year.

Analyst Upgrades and Downgrades

BBVA has been the subject of a number of research analyst reports. Barclays upgraded Banco Bilbao Viscaya Argentaria from an "equal weight" rating to an "overweight" rating in a research report on Thursday, August 7th. Wall Street Zen cut Banco Bilbao Viscaya Argentaria from a "buy" rating to a "hold" rating in a research report on Saturday, July 12th. One equities research analyst has rated the stock with a Strong Buy rating, one has assigned a Buy rating and one has assigned a Hold rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Buy".

Read Our Latest Research Report on Banco Bilbao Viscaya Argentaria

Banco Bilbao Viscaya Argentaria Profile

(

Free Report)

Banco Bilbao Vizcaya Argentaria, SA provides retail banking, wholesale banking, and asset management services in the United States, Spain, Mexico, Turkey, South America, and internationally. The company offers savings account, demand deposits, and time deposits; and loan products, such as residential mortgages, other households, credit card loans, loans to enterprises and public sector, as well as consumer finance.

Featured Articles

Before you consider Banco Bilbao Viscaya Argentaria, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Banco Bilbao Viscaya Argentaria wasn't on the list.

While Banco Bilbao Viscaya Argentaria currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.