Wallington Asset Management LLC raised its stake in shares of Medtronic PLC (NYSE:MDT - Free Report) by 1.6% during the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 199,946 shares of the medical technology company's stock after purchasing an additional 3,094 shares during the period. Medtronic accounts for 2.5% of Wallington Asset Management LLC's portfolio, making the stock its 14th largest holding. Wallington Asset Management LLC's holdings in Medtronic were worth $17,429,000 as of its most recent filing with the Securities & Exchange Commission.

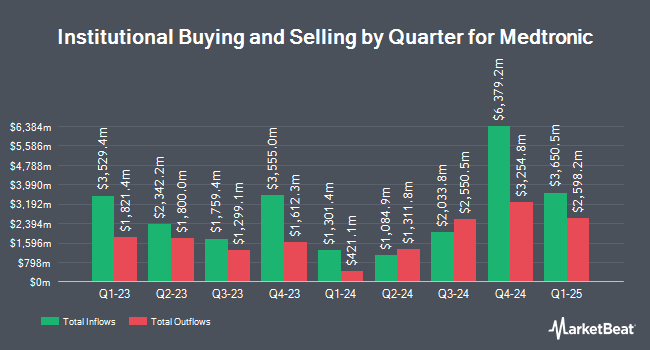

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in MDT. Boston Partners grew its stake in shares of Medtronic by 122.8% in the first quarter. Boston Partners now owns 6,912,055 shares of the medical technology company's stock worth $619,460,000 after acquiring an additional 3,809,450 shares during the last quarter. Ameriprise Financial Inc. grew its stake in shares of Medtronic by 28.8% in the first quarter. Ameriprise Financial Inc. now owns 15,481,028 shares of the medical technology company's stock worth $1,391,141,000 after acquiring an additional 3,461,221 shares during the last quarter. Price T Rowe Associates Inc. MD grew its stake in shares of Medtronic by 42.9% in the first quarter. Price T Rowe Associates Inc. MD now owns 10,059,135 shares of the medical technology company's stock worth $903,915,000 after acquiring an additional 3,017,849 shares during the last quarter. Nuveen LLC acquired a new stake in shares of Medtronic in the first quarter worth $260,649,000. Finally, Mackenzie Financial Corp grew its stake in shares of Medtronic by 220.9% in the first quarter. Mackenzie Financial Corp now owns 2,412,115 shares of the medical technology company's stock worth $216,753,000 after acquiring an additional 1,660,357 shares during the last quarter. Institutional investors and hedge funds own 82.06% of the company's stock.

Medtronic Stock Up 2.3%

MDT opened at $97.63 on Friday. Medtronic PLC has a fifty-two week low of $79.29 and a fifty-two week high of $97.94. The company has a debt-to-equity ratio of 0.54, a current ratio of 2.01 and a quick ratio of 1.50. The firm's fifty day moving average price is $92.94 and its two-hundred day moving average price is $88.50. The company has a market capitalization of $125.23 billion, a P/E ratio of 26.90, a P/E/G ratio of 2.51 and a beta of 0.78.

Medtronic (NYSE:MDT - Get Free Report) last issued its quarterly earnings data on Tuesday, August 19th. The medical technology company reported $1.26 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.23 by $0.03. The company had revenue of $8.58 billion during the quarter, compared to analysts' expectations of $8.37 billion. Medtronic had a return on equity of 14.61% and a net margin of 13.63%.The business's revenue was up 7.7% on a year-over-year basis. During the same period last year, the business earned $1.23 earnings per share. Medtronic has set its FY 2026 guidance at 5.600-5.660 EPS. On average, analysts anticipate that Medtronic PLC will post 5.46 EPS for the current year.

Medtronic Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, October 17th. Shareholders of record on Friday, September 26th will be issued a dividend of $0.71 per share. The ex-dividend date of this dividend is Friday, September 26th. This represents a $2.84 dividend on an annualized basis and a dividend yield of 2.9%. Medtronic's dividend payout ratio (DPR) is presently 78.24%.

Insiders Place Their Bets

In related news, EVP Harry Skip Kiil sold 8,605 shares of the stock in a transaction that occurred on Wednesday, September 3rd. The stock was sold at an average price of $91.58, for a total transaction of $788,045.90. Following the sale, the executive vice president directly owned 35,615 shares in the company, valued at $3,261,621.70. This represents a 19.46% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, Director William R. Jellison purchased 2,500 shares of the company's stock in a transaction that occurred on Monday, August 25th. The shares were acquired at an average cost of $92.37 per share, with a total value of $230,925.00. Following the completion of the acquisition, the director directly owned 5,000 shares in the company, valued at approximately $461,850. This represents a 100.00% increase in their ownership of the stock. The disclosure for this purchase can be found here. 0.26% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

MDT has been the topic of several research analyst reports. William Blair upgraded shares of Medtronic to a "hold" rating in a research note on Friday, July 11th. Needham & Company LLC restated a "hold" rating on shares of Medtronic in a research note on Thursday, August 14th. Wolfe Research upgraded shares of Medtronic from an "underperform" rating to a "peer perform" rating in a research note on Monday, June 30th. Wall Street Zen downgraded shares of Medtronic from a "buy" rating to a "hold" rating in a research note on Friday. Finally, Daiwa Capital Markets lifted their price target on shares of Medtronic from $101.00 to $104.00 and gave the stock a "buy" rating in a research note on Friday, September 12th. One investment analyst has rated the stock with a Strong Buy rating, twelve have assigned a Buy rating and eight have given a Hold rating to the company's stock. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $102.27.

View Our Latest Stock Report on Medtronic

Medtronic Company Profile

(

Free Report)

Medtronic plc develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. Its Cardiovascular Portfolio segment offers implantable cardiac pacemakers, cardioverter defibrillators, and cardiac resynchronization therapy devices; cardiac ablation products; insertable cardiac monitor systems; TYRX products; and remote monitoring and patient-centered software.

See Also

Want to see what other hedge funds are holding MDT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Medtronic PLC (NYSE:MDT - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Medtronic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medtronic wasn't on the list.

While Medtronic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report