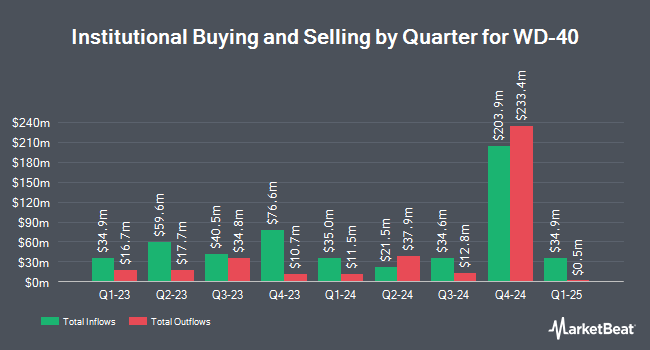

Quantbot Technologies LP cut its stake in WD-40 Company (NASDAQ:WDFC - Free Report) by 31.8% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 3,808 shares of the specialty chemicals company's stock after selling 1,776 shares during the period. Quantbot Technologies LP's holdings in WD-40 were worth $929,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other large investors also recently added to or reduced their stakes in WDFC. Geneva Capital Management LLC increased its position in shares of WD-40 by 18.7% during the first quarter. Geneva Capital Management LLC now owns 248,197 shares of the specialty chemicals company's stock worth $60,560,000 after purchasing an additional 39,137 shares in the last quarter. Invesco Ltd. raised its holdings in WD-40 by 122.0% in the 1st quarter. Invesco Ltd. now owns 162,181 shares of the specialty chemicals company's stock valued at $39,572,000 after acquiring an additional 89,120 shares during the last quarter. Millennium Management LLC increased its holdings in shares of WD-40 by 206.9% during the 4th quarter. Millennium Management LLC now owns 158,156 shares of the specialty chemicals company's stock worth $38,381,000 after buying an additional 106,617 shares during the last quarter. GAMMA Investing LLC raised its position in shares of WD-40 by 28,448.0% in the 1st quarter. GAMMA Investing LLC now owns 114,192 shares of the specialty chemicals company's stock worth $27,863,000 after buying an additional 113,792 shares during the period. Finally, Wellington Management Group LLP acquired a new stake in shares of WD-40 during the first quarter valued at about $23,556,000. 91.52% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Separately, DA Davidson decreased their target price on WD-40 from $322.00 to $300.00 and set a "buy" rating for the company in a research note on Friday, July 11th. One investment analyst has rated the stock with a Buy rating and one has given a Hold rating to the company. According to MarketBeat, WD-40 presently has an average rating of "Moderate Buy" and a consensus target price of $290.00.

Read Our Latest Stock Report on WD-40

WD-40 Trading Down 0.8%

WDFC traded down $1.66 during trading on Friday, reaching $216.04. 90,408 shares of the company's stock were exchanged, compared to its average volume of 95,097. WD-40 Company has a fifty-two week low of $208.00 and a fifty-two week high of $292.36. The firm has a market capitalization of $2.92 billion, a PE ratio of 34.02 and a beta of 0.15. The company has a debt-to-equity ratio of 0.33, a quick ratio of 2.02 and a current ratio of 2.84. The company's fifty day moving average price is $222.75 and its 200-day moving average price is $231.48.

WD-40 (NASDAQ:WDFC - Get Free Report) last issued its earnings results on Thursday, July 10th. The specialty chemicals company reported $1.54 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.40 by $0.14. The company had revenue of $156.92 million for the quarter, compared to analysts' expectations of $160.60 million. WD-40 had a net margin of 14.13% and a return on equity of 31.23%. WD-40's quarterly revenue was up 1.2% compared to the same quarter last year. During the same period in the prior year, the firm earned $1.46 EPS. As a group, equities analysts forecast that WD-40 Company will post 5.42 EPS for the current year.

WD-40 Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, July 31st. Stockholders of record on Friday, July 18th were paid a $0.94 dividend. The ex-dividend date was Friday, July 18th. This represents a $3.76 annualized dividend and a dividend yield of 1.7%. WD-40's dividend payout ratio (DPR) is presently 59.21%.

WD-40 Profile

(

Free Report)

WD-40 Company develops and sells maintenance products, and homecare and cleaning products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company provides multi-purpose maintenance products that include aerosol sprays, non-aerosol trigger sprays, precision pens, and in liquid-bulk form products under the WD-40 Multi-Use brand name; specialty maintenance products, such as penetrants, degreasers, corrosion inhibitors, greases, lubricants, and rust removers under the WD-40 Specialist brand; and bike-specific products.

Featured Articles

Before you consider WD-40, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and WD-40 wasn't on the list.

While WD-40 currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.