Wealth Enhancement Advisory Services LLC raised its stake in AMN Healthcare Services Inc (NYSE:AMN - Free Report) by 74.1% in the 2nd quarter, according to its most recent disclosure with the SEC. The fund owned 42,159 shares of the company's stock after purchasing an additional 17,949 shares during the quarter. Wealth Enhancement Advisory Services LLC owned 0.11% of AMN Healthcare Services worth $924,000 at the end of the most recent quarter.

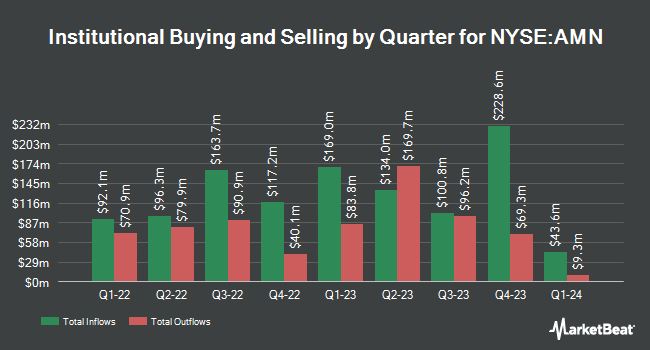

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Newtyn Management LLC raised its holdings in shares of AMN Healthcare Services by 1.0% during the first quarter. Newtyn Management LLC now owns 1,200,000 shares of the company's stock valued at $29,352,000 after acquiring an additional 11,984 shares in the last quarter. Millennium Management LLC raised its holdings in shares of AMN Healthcare Services by 137.5% during the first quarter. Millennium Management LLC now owns 1,097,482 shares of the company's stock valued at $26,844,000 after acquiring an additional 635,296 shares in the last quarter. Charles Schwab Investment Management Inc. raised its holdings in shares of AMN Healthcare Services by 1.9% during the first quarter. Charles Schwab Investment Management Inc. now owns 904,275 shares of the company's stock valued at $22,119,000 after acquiring an additional 17,064 shares in the last quarter. Reinhart Partners LLC. raised its holdings in shares of AMN Healthcare Services by 44.4% during the first quarter. Reinhart Partners LLC. now owns 744,943 shares of the company's stock valued at $18,221,000 after acquiring an additional 229,002 shares in the last quarter. Finally, New South Capital Management Inc. raised its holdings in shares of AMN Healthcare Services by 13.0% during the first quarter. New South Capital Management Inc. now owns 579,400 shares of the company's stock valued at $14,172,000 after acquiring an additional 66,812 shares in the last quarter. Institutional investors own 99.23% of the company's stock.

Analyst Ratings Changes

AMN has been the subject of a number of recent analyst reports. Bank of America decreased their target price on AMN Healthcare Services from $20.00 to $18.00 and set an "underperform" rating for the company in a report on Wednesday, September 10th. JMP Securities decreased their target price on AMN Healthcare Services from $33.00 to $22.00 and set a "market outperform" rating for the company in a report on Tuesday, August 12th. Finally, BMO Capital Markets decreased their target price on AMN Healthcare Services from $27.00 to $22.00 and set an "outperform" rating for the company in a report on Monday, August 11th. Three analysts have rated the stock with a Buy rating, three have assigned a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and a consensus price target of $23.25.

View Our Latest Stock Report on AMN

AMN Healthcare Services Trading Down 2.1%

NYSE AMN opened at $19.55 on Friday. AMN Healthcare Services Inc has a 12 month low of $14.86 and a 12 month high of $43.08. The stock has a market cap of $749.23 million, a P/E ratio of -2.52 and a beta of 0.15. The stock's fifty day moving average price is $19.13 and its 200-day moving average price is $20.44. The company has a current ratio of 1.00, a quick ratio of 1.00 and a debt-to-equity ratio of 1.51.

AMN Healthcare Services (NYSE:AMN - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported $0.30 EPS for the quarter, topping analysts' consensus estimates of $0.17 by $0.13. AMN Healthcare Services had a positive return on equity of 11.09% and a negative net margin of 10.75%.The firm had revenue of $658.18 million for the quarter, compared to analysts' expectations of $652.89 million. During the same period in the prior year, the firm posted $0.98 earnings per share. The company's quarterly revenue was down 11.1% on a year-over-year basis. AMN Healthcare Services has set its Q3 2025 guidance at EPS. As a group, equities analysts forecast that AMN Healthcare Services Inc will post 1.33 EPS for the current fiscal year.

AMN Healthcare Services Profile

(

Free Report)

AMN Healthcare Services, Inc provides healthcare workforce solutions and staffing services to healthcare facilities in the United States. It operates through three segments: Nurse and Allied Solutions, Physician and Leadership Solutions, and Technology and Workforce Solutions. The Nurse and Allied Solutions segment offers travel nurse staffing, labor disruption staffing, local staffing, international nurse and allied permanent placement, and allied staffing solutions.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AMN Healthcare Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMN Healthcare Services wasn't on the list.

While AMN Healthcare Services currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.