Wealth Enhancement Advisory Services LLC boosted its stake in Dropbox, Inc. (NASDAQ:DBX - Free Report) by 37.3% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 43,088 shares of the company's stock after purchasing an additional 11,713 shares during the quarter. Wealth Enhancement Advisory Services LLC's holdings in Dropbox were worth $1,151,000 at the end of the most recent reporting period.

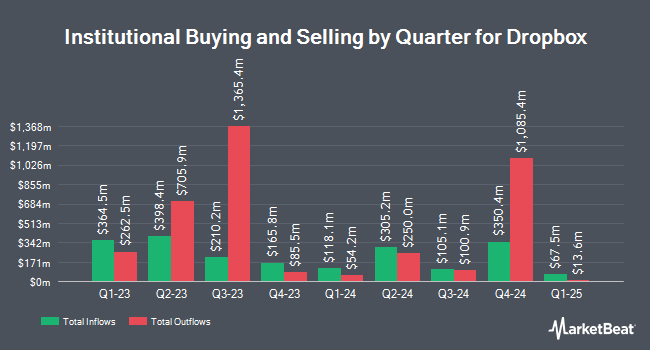

A number of other hedge funds and other institutional investors have also bought and sold shares of the stock. IFP Advisors Inc grew its position in Dropbox by 436.7% in the fourth quarter. IFP Advisors Inc now owns 3,322 shares of the company's stock valued at $101,000 after acquiring an additional 2,703 shares during the last quarter. Proficio Capital Partners LLC bought a new stake in shares of Dropbox during the fourth quarter worth about $511,000. SVB Wealth LLC bought a new stake in shares of Dropbox during the fourth quarter worth about $230,000. Fisher Asset Management LLC grew its holdings in shares of Dropbox by 26.6% during the fourth quarter. Fisher Asset Management LLC now owns 196,406 shares of the company's stock worth $5,900,000 after purchasing an additional 41,275 shares during the last quarter. Finally, SBI Securities Co. Ltd. bought a new stake in shares of Dropbox during the fourth quarter worth about $40,000. Institutional investors and hedge funds own 94.84% of the company's stock.

Insider Activity

In other Dropbox news, CEO Andrew Houston sold 319,000 shares of the firm's stock in a transaction on Wednesday, June 11th. The stock was sold at an average price of $28.48, for a total transaction of $9,085,120.00. Following the transaction, the chief executive officer directly owned 8,266,666 shares in the company, valued at approximately $235,434,647.68. This trade represents a 3.72% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider William T. Yoon sold 5,449 shares of the firm's stock in a transaction on Friday, May 16th. The shares were sold at an average price of $28.94, for a total value of $157,694.06. Following the transaction, the insider owned 245,837 shares in the company, valued at approximately $7,114,522.78. This trade represents a 2.17% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 466,125 shares of company stock worth $13,222,405. Company insiders own 29.95% of the company's stock.

Analysts Set New Price Targets

Several analysts have recently weighed in on DBX shares. UBS Group boosted their price target on Dropbox from $30.00 to $31.00 and gave the stock a "buy" rating in a report on Friday, May 9th. Citigroup boosted their price target on Dropbox from $30.00 to $32.00 and gave the stock a "neutral" rating in a report on Friday, May 9th.

Check Out Our Latest Stock Report on Dropbox

Dropbox Stock Up 1.5%

DBX traded up $0.40 during trading on Friday, hitting $27.95. The company's stock had a trading volume of 2,351,807 shares, compared to its average volume of 3,394,626. The firm has a market capitalization of $7.87 billion, a P/E ratio of 18.27, a PEG ratio of 11.01 and a beta of 0.65. Dropbox, Inc. has a twelve month low of $21.32 and a twelve month high of $33.33. The stock's fifty day moving average price is $28.75 and its 200-day moving average price is $28.78.

Dropbox (NASDAQ:DBX - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The company reported $0.70 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.62 by $0.08. The firm had revenue of $624.70 million for the quarter, compared to analysts' expectations of $619.56 million. Dropbox had a negative return on equity of 79.66% and a net margin of 18.50%. The company's revenue for the quarter was down 1.0% compared to the same quarter last year. During the same period in the prior year, the business earned $0.58 EPS. Equities research analysts expect that Dropbox, Inc. will post 1.64 EPS for the current fiscal year.

Dropbox Company Profile

(

Free Report)

Dropbox, Inc provides a content collaboration platform worldwide. The company's platform allows individuals, families, teams, and organizations to collaborate and sign up for free through its website or app, as well as upgrade to a paid subscription plan for premium features. It serves customers in professional services, technology, media, education, industrial, consumer and retail, and financial services industries.

See Also

Before you consider Dropbox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dropbox wasn't on the list.

While Dropbox currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.