Wellington Management Group LLP raised its holdings in Xenon Pharmaceuticals Inc. (NASDAQ:XENE - Free Report) by 0.3% in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 3,789,197 shares of the biopharmaceutical company's stock after purchasing an additional 11,586 shares during the quarter. Wellington Management Group LLP owned approximately 4.95% of Xenon Pharmaceuticals worth $127,128,000 as of its most recent SEC filing.

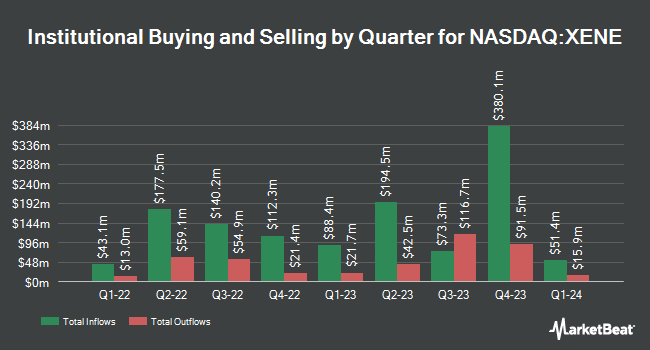

Several other hedge funds and other institutional investors also recently made changes to their positions in XENE. Caitong International Asset Management Co. Ltd acquired a new position in Xenon Pharmaceuticals in the first quarter valued at about $30,000. GF Fund Management CO. LTD. acquired a new stake in Xenon Pharmaceuticals during the fourth quarter worth approximately $63,000. Quarry LP acquired a new stake in shares of Xenon Pharmaceuticals in the 4th quarter valued at $78,000. Vident Advisory LLC bought a new position in shares of Xenon Pharmaceuticals in the 4th quarter valued at $212,000. Finally, Tema Etfs LLC bought a new position in Xenon Pharmaceuticals during the 4th quarter worth $240,000. 95.45% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several research analysts have recently weighed in on the company. William Blair reissued an "outperform" rating on shares of Xenon Pharmaceuticals in a research report on Monday, May 5th. Needham & Company LLC lowered their target price on shares of Xenon Pharmaceuticals from $60.00 to $55.00 and set a "buy" rating on the stock in a report on Tuesday, May 13th. HC Wainwright restated a "buy" rating and set a $53.00 price target on shares of Xenon Pharmaceuticals in a research report on Tuesday, May 13th. Wells Fargo & Company cut their price target on shares of Xenon Pharmaceuticals from $50.00 to $47.00 and set an "overweight" rating for the company in a research report on Tuesday, May 13th. Finally, Royal Bank Of Canada lowered their price objective on shares of Xenon Pharmaceuticals from $57.00 to $55.00 and set an "outperform" rating for the company in a research note on Tuesday, August 12th. Eleven research analysts have rated the stock with a Buy rating, According to MarketBeat, the company presently has a consensus rating of "Buy" and an average price target of $53.20.

View Our Latest Stock Analysis on XENE

Xenon Pharmaceuticals Trading Up 0.8%

Shares of XENE traded up $0.32 during mid-day trading on Wednesday, hitting $38.97. The company's stock had a trading volume of 102,357 shares, compared to its average volume of 888,003. The company's 50-day moving average is $33.42 and its 200-day moving average is $33.93. Xenon Pharmaceuticals Inc. has a 52-week low of $26.74 and a 52-week high of $46.00. The firm has a market capitalization of $3.01 billion, a price-to-earnings ratio of -11.00 and a beta of 1.16.

Xenon Pharmaceuticals (NASDAQ:XENE - Get Free Report) last posted its earnings results on Monday, August 11th. The biopharmaceutical company reported ($1.07) EPS for the quarter, missing analysts' consensus estimates of ($1.03) by ($0.04). During the same quarter in the prior year, the firm earned ($0.75) EPS. As a group, sell-side analysts predict that Xenon Pharmaceuticals Inc. will post -3.1 earnings per share for the current fiscal year.

Xenon Pharmaceuticals Company Profile

(

Free Report)

Xenon Pharmaceuticals Inc, a neuroscience-focused biopharmaceutical company, engages in the development of therapeutics to treat patients with neurological disorders in Canada. Its clinical development pipeline includes XEN1101, a novel and potent Kv7 potassium channel opener, which is in Phase 3 clinical trials for the treatment of epilepsy and other neurological disorders.

Recommended Stories

Before you consider Xenon Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xenon Pharmaceuticals wasn't on the list.

While Xenon Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.