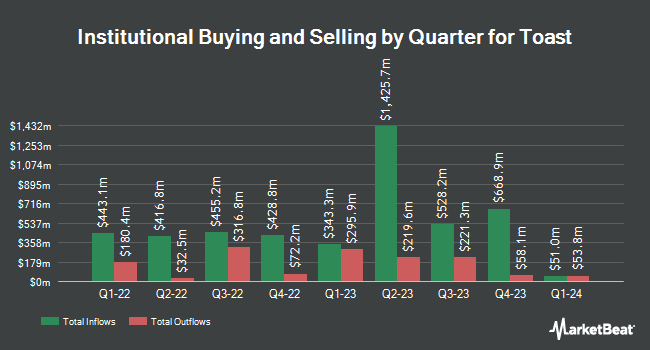

Wellington Management Group LLP cut its stake in Toast, Inc. (NYSE:TOST - Free Report) by 42.8% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 18,498 shares of the company's stock after selling 13,822 shares during the quarter. Wellington Management Group LLP's holdings in Toast were worth $674,000 at the end of the most recent quarter.

A number of other hedge funds have also modified their holdings of TOST. Charles Schwab Investment Management Inc. grew its stake in Toast by 5.6% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 2,938,487 shares of the company's stock valued at $107,108,000 after acquiring an additional 155,446 shares during the period. Jupiter Asset Management Ltd. lifted its holdings in shares of Toast by 134.3% during the 4th quarter. Jupiter Asset Management Ltd. now owns 392,853 shares of the company's stock valued at $14,319,000 after purchasing an additional 225,215 shares in the last quarter. New York Life Investment Management LLC acquired a new position in shares of Toast in the 4th quarter valued at approximately $1,572,000. BNP Paribas Financial Markets bought a new stake in Toast during the 4th quarter worth approximately $83,684,000. Finally, Allspring Global Investments Holdings LLC raised its holdings in Toast by 129,058.5% during the 4th quarter. Allspring Global Investments Holdings LLC now owns 2,074,286 shares of the company's stock worth $75,466,000 after buying an additional 2,072,680 shares during the period. 82.91% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several research firms have recently weighed in on TOST. Piper Sandler upped their price target on shares of Toast from $35.00 to $37.00 and gave the company a "neutral" rating in a report on Friday, May 9th. Wolfe Research raised shares of Toast from a "peer perform" rating to an "outperform" rating and set a $44.00 target price for the company in a research note on Wednesday, April 23rd. BNP Paribas set a $37.00 target price on Toast and gave the stock a "neutral" rating in a report on Wednesday, February 19th. JPMorgan Chase & Co. lifted their price target on Toast from $36.00 to $42.00 and gave the company a "neutral" rating in a research note on Thursday, February 20th. Finally, Wall Street Zen cut Toast from a "strong-buy" rating to a "buy" rating in a research report on Sunday, June 1st. Twelve investment analysts have rated the stock with a hold rating and thirteen have given a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $41.21.

Read Our Latest Analysis on Toast

Toast Price Performance

Shares of TOST stock opened at $44.06 on Friday. The company has a fifty day moving average price of $37.97 and a two-hundred day moving average price of $38.02. Toast, Inc. has a one year low of $21.32 and a one year high of $45.56. The stock has a market cap of $21.94 billion, a P/E ratio of -4,401.60, a P/E/G ratio of 2.16 and a beta of 2.02.

Insider Activity at Toast

In related news, Director Deval L. Patrick sold 34,222 shares of the stock in a transaction on Thursday, March 13th. The stock was sold at an average price of $33.01, for a total value of $1,129,668.22. Following the sale, the director now owns 13,260 shares in the company, valued at approximately $437,712.60. This represents a 72.07% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, President Stephen Fredette sold 47,073 shares of the firm's stock in a transaction on Monday, March 17th. The shares were sold at an average price of $35.03, for a total value of $1,648,967.19. Following the sale, the president now directly owns 1,491,773 shares of the company's stock, valued at $52,256,808.19. This represents a 3.06% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 646,651 shares of company stock worth $25,640,334. Insiders own 13.32% of the company's stock.

About Toast

(

Free Report)

Toast, Inc operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay, Toast catering and events, Toast invoicing, Toast tables, and restaurant retail; and hardware products, including Toast flex, Toast flex for guest, Toast go 2, Toast tap, kiosks, and Delphi by Toast.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Toast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toast wasn't on the list.

While Toast currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.