Wellington Management Group LLP grew its position in Teledyne Technologies Incorporated (NYSE:TDY - Free Report) by 11.1% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 8,585 shares of the scientific and technical instruments company's stock after acquiring an additional 860 shares during the quarter. Wellington Management Group LLP's holdings in Teledyne Technologies were worth $4,273,000 at the end of the most recent reporting period.

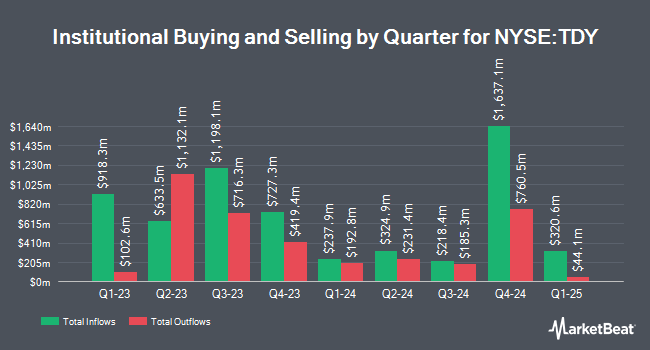

Other hedge funds have also modified their holdings of the company. Tidal Investments LLC grew its position in Teledyne Technologies by 0.4% during the 4th quarter. Tidal Investments LLC now owns 5,508 shares of the scientific and technical instruments company's stock worth $2,556,000 after purchasing an additional 22 shares during the last quarter. Keel Point LLC increased its position in Teledyne Technologies by 4.5% in the 4th quarter. Keel Point LLC now owns 532 shares of the scientific and technical instruments company's stock valued at $247,000 after acquiring an additional 23 shares during the period. Sumitomo Mitsui DS Asset Management Company Ltd raised its stake in Teledyne Technologies by 0.4% during the 1st quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 6,538 shares of the scientific and technical instruments company's stock valued at $3,254,000 after acquiring an additional 23 shares during the last quarter. Sequoia Financial Advisors LLC lifted its position in Teledyne Technologies by 2.6% during the 1st quarter. Sequoia Financial Advisors LLC now owns 947 shares of the scientific and technical instruments company's stock worth $471,000 after acquiring an additional 24 shares during the period. Finally, HighPoint Advisor Group LLC grew its stake in shares of Teledyne Technologies by 3.2% in the 1st quarter. HighPoint Advisor Group LLC now owns 776 shares of the scientific and technical instruments company's stock valued at $359,000 after purchasing an additional 24 shares during the last quarter. 91.58% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Teledyne Technologies news, Director Simon M. Lorne sold 6,311 shares of Teledyne Technologies stock in a transaction on Friday, July 25th. The shares were sold at an average price of $549.64, for a total value of $3,468,778.04. Following the transaction, the director owned 61,913 shares in the company, valued at $34,029,861.32. This trade represents a 9.25% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO George C. Bobb III sold 6,735 shares of Teledyne Technologies stock in a transaction on Wednesday, July 30th. The shares were sold at an average price of $555.41, for a total value of $3,740,686.35. Following the completion of the transaction, the chief executive officer owned 10,391 shares in the company, valued at $5,771,265.31. The trade was a 39.33% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 15,021 shares of company stock valued at $8,315,662 in the last ninety days. Insiders own 1.50% of the company's stock.

Analysts Set New Price Targets

TDY has been the subject of several analyst reports. UBS Group upped their price target on Teledyne Technologies from $585.00 to $630.00 and gave the stock a "buy" rating in a research note on Thursday, July 24th. Wall Street Zen upgraded shares of Teledyne Technologies from a "hold" rating to a "buy" rating in a research note on Friday, May 9th. Stifel Nicolaus began coverage on shares of Teledyne Technologies in a research note on Tuesday, June 24th. They set a "buy" rating and a $626.00 price target on the stock. Finally, Morgan Stanley raised their price objective on shares of Teledyne Technologies from $535.00 to $580.00 and gave the company an "equal weight" rating in a research report on Thursday, July 17th. Six equities research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $576.57.

Read Our Latest Stock Report on Teledyne Technologies

Teledyne Technologies Price Performance

TDY stock traded up $2.23 during trading on Wednesday, reaching $540.14. 118,384 shares of the company were exchanged, compared to its average volume of 322,594. Teledyne Technologies Incorporated has a 52-week low of $416.00 and a 52-week high of $570.56. The company has a debt-to-equity ratio of 0.21, a quick ratio of 1.07 and a current ratio of 1.66. The company has a market cap of $25.33 billion, a P/E ratio of 29.74, a PEG ratio of 2.50 and a beta of 1.09. The stock's 50 day moving average price is $538.44 and its 200 day moving average price is $503.97.

Teledyne Technologies (NYSE:TDY - Get Free Report) last released its quarterly earnings results on Wednesday, July 23rd. The scientific and technical instruments company reported $5.20 earnings per share for the quarter, topping analysts' consensus estimates of $5.05 by $0.15. The business had revenue of $1.51 billion for the quarter, compared to analysts' expectations of $1.47 billion. Teledyne Technologies had a return on equity of 9.96% and a net margin of 14.54%.The company's revenue was up 10.2% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $4.58 EPS. Teledyne Technologies has set its FY 2025 guidance at 21.200-21.50 EPS. Q3 2025 guidance at 5.350-5.45 EPS. As a group, analysts predict that Teledyne Technologies Incorporated will post 21.55 earnings per share for the current fiscal year.

Teledyne Technologies announced that its Board of Directors has approved a stock repurchase plan on Wednesday, July 23rd that authorizes the company to buyback $2.00 billion in outstanding shares. This buyback authorization authorizes the scientific and technical instruments company to purchase up to 7.7% of its stock through open market purchases. Stock buyback plans are generally an indication that the company's board believes its stock is undervalued.

Teledyne Technologies Profile

(

Free Report)

Teledyne Technologies Incorporated, together with its subsidiaries, provides enabling technologies for industrial growth markets in the United States and internationally. Its Digital Imaging segment provides visible spectrum sensors and digital cameras; and infrared, ultraviolet, visible, and X-ray spectra; as well as micro electromechanical systems and semiconductors, including analog-to-digital and digital-to-analog converters.

Featured Articles

Before you consider Teledyne Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teledyne Technologies wasn't on the list.

While Teledyne Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.