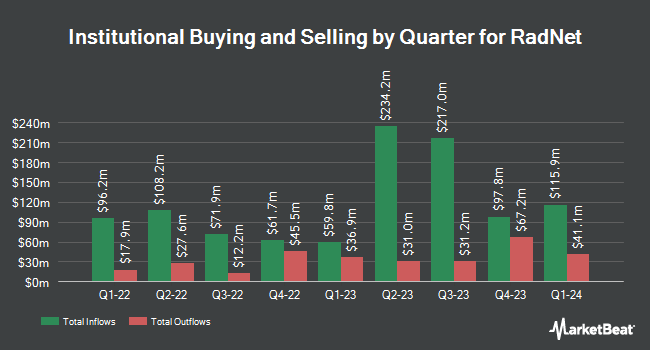

Wellington Shields & Co. LLC bought a new stake in RadNet, Inc. (NASDAQ:RDNT - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor bought 7,900 shares of the medical research company's stock, valued at approximately $393,000.

Other institutional investors and hedge funds also recently made changes to their positions in the company. Norges Bank bought a new position in RadNet during the fourth quarter worth about $56,381,000. Raymond James Financial Inc. bought a new position in RadNet during the fourth quarter worth about $33,090,000. T. Rowe Price Investment Management Inc. boosted its position in RadNet by 79.3% during the fourth quarter. T. Rowe Price Investment Management Inc. now owns 913,691 shares of the medical research company's stock worth $63,813,000 after purchasing an additional 404,241 shares during the period. Tidal Investments LLC boosted its position in RadNet by 7,219.2% during the fourth quarter. Tidal Investments LLC now owns 389,308 shares of the medical research company's stock worth $27,189,000 after purchasing an additional 383,989 shares during the period. Finally, Alyeska Investment Group L.P. boosted its position in RadNet by 108.6% during the fourth quarter. Alyeska Investment Group L.P. now owns 502,612 shares of the medical research company's stock worth $35,102,000 after purchasing an additional 261,711 shares during the period. Hedge funds and other institutional investors own 77.90% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities analysts have recently commented on the stock. Wall Street Zen lowered shares of RadNet from a "hold" rating to a "sell" rating in a research report on Sunday, June 29th. B. Riley assumed coverage on shares of RadNet in a research report on Friday, June 13th. They issued a "buy" rating and a $69.00 price objective for the company. Finally, Truist Financial set a $74.00 price objective on shares of RadNet in a research report on Thursday, July 10th. One research analyst has rated the stock with a sell rating, three have given a buy rating and three have issued a strong buy rating to the company. According to MarketBeat, the company has an average rating of "Buy" and a consensus price target of $69.60.

Get Our Latest Stock Analysis on RadNet

Insiders Place Their Bets

In other news, COO Norman R. Hames sold 5,536 shares of the business's stock in a transaction on Thursday, May 15th. The shares were sold at an average price of $60.00, for a total transaction of $332,160.00. Following the sale, the chief operating officer owned 249,183 shares in the company, valued at approximately $14,950,980. The trade was a 2.17% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, EVP Alma Gregory Sorensen sold 55,000 shares of the business's stock in a transaction on Friday, May 23rd. The shares were sold at an average price of $56.48, for a total transaction of $3,106,400.00. Following the sale, the executive vice president owned 1,160,509 shares in the company, valued at approximately $65,545,548.32. This trade represents a 4.52% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 63,447 shares of company stock worth $3,613,220. Insiders own 5.60% of the company's stock.

RadNet Trading Down 3.5%

RadNet stock traded down $1.96 during mid-day trading on Thursday, reaching $54.73. 564,078 shares of the company traded hands, compared to its average volume of 793,930. The company has a debt-to-equity ratio of 0.87, a current ratio of 2.01 and a quick ratio of 2.01. The firm's 50 day moving average price is $56.89 and its 200 day moving average price is $56.28. The firm has a market capitalization of $4.11 billion, a price-to-earnings ratio of -127.28 and a beta of 1.41. RadNet, Inc. has a 52-week low of $45.00 and a 52-week high of $93.65.

RadNet Profile

(

Free Report)

RadNet, Inc, together with its subsidiaries, provides outpatient diagnostic imaging services in the United States. The company operates in two segments: Imaging Centers and Artificial Intelligence. Its services include magnetic resonance imaging, computed tomography, positron emission tomography, nuclear medicine, mammography, ultrasound, diagnostic radiology, fluoroscopy, and other related procedures, as well as multi-modality imaging services.

Recommended Stories

Before you consider RadNet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RadNet wasn't on the list.

While RadNet currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.