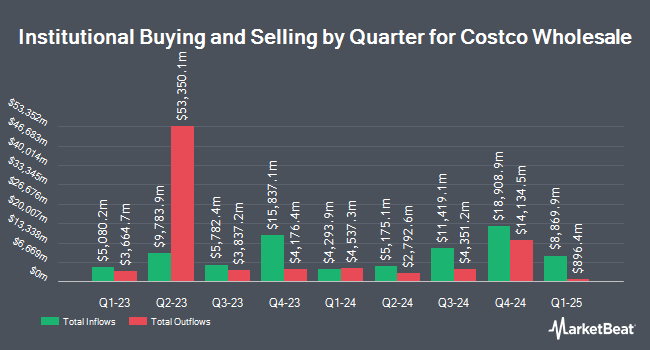

Western Wealth Management LLC reduced its holdings in shares of Costco Wholesale Co. (NASDAQ:COST - Free Report) by 84.6% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 2,689 shares of the retailer's stock after selling 14,771 shares during the quarter. Western Wealth Management LLC's holdings in Costco Wholesale were worth $2,464,000 as of its most recent SEC filing.

A number of other hedge funds have also bought and sold shares of COST. Grassi Investment Management raised its stake in shares of Costco Wholesale by 6.5% in the fourth quarter. Grassi Investment Management now owns 5,155 shares of the retailer's stock valued at $4,723,000 after buying an additional 315 shares during the period. Capital & Planning LLC raised its stake in shares of Costco Wholesale by 28.7% in the fourth quarter. Capital & Planning LLC now owns 3,756 shares of the retailer's stock valued at $3,441,000 after buying an additional 837 shares during the period. Redmond Asset Management LLC bought a new stake in shares of Costco Wholesale in the fourth quarter valued at $1,214,000. May Barnhard Investments LLC bought a new stake in shares of Costco Wholesale in the fourth quarter valued at $485,000. Finally, Ironwood Wealth Management LLC. grew its position in shares of Costco Wholesale by 0.6% in the fourth quarter. Ironwood Wealth Management LLC. now owns 3,852 shares of the retailer's stock valued at $3,529,000 after purchasing an additional 22 shares in the last quarter. 68.48% of the stock is currently owned by institutional investors.

Insider Activity

In other news, CEO Roland Michael Vachris sold 3,600 shares of the business's stock in a transaction dated Tuesday, March 11th. The stock was sold at an average price of $931.00, for a total value of $3,351,600.00. Following the completion of the sale, the chief executive officer now owns 41,077 shares of the company's stock, valued at approximately $38,242,687. The trade was a 8.06% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, EVP James C. Klauer sold 4,000 shares of the business's stock in a transaction dated Thursday, April 17th. The shares were sold at an average price of $981.07, for a total value of $3,924,280.00. Following the completion of the sale, the executive vice president now directly owns 43,994 shares of the company's stock, valued at approximately $43,161,193.58. This trade represents a 8.33% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 9,600 shares of company stock valued at $9,140,195. Insiders own 0.18% of the company's stock.

Costco Wholesale Price Performance

NASDAQ:COST traded down $9.63 during mid-day trading on Friday, reaching $1,008.50. The stock had a trading volume of 1,412,932 shares, compared to its average volume of 2,051,730. The firm has a 50 day moving average price of $973.21 and a two-hundred day moving average price of $972.57. The stock has a market capitalization of $447.45 billion, a P/E ratio of 59.22, a P/E/G ratio of 6.15 and a beta of 1.00. Costco Wholesale Co. has a one year low of $788.20 and a one year high of $1,078.24. The company has a debt-to-equity ratio of 0.23, a quick ratio of 0.43 and a current ratio of 0.98.

Costco Wholesale (NASDAQ:COST - Get Free Report) last released its earnings results on Thursday, March 6th. The retailer reported $4.02 earnings per share for the quarter, missing analysts' consensus estimates of $4.09 by ($0.07). Costco Wholesale had a return on equity of 32.31% and a net margin of 2.93%. The firm had revenue of $63.72 billion during the quarter, compared to the consensus estimate of $63.02 billion. As a group, analysts expect that Costco Wholesale Co. will post 18.03 earnings per share for the current year.

Costco Wholesale Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, May 16th. Stockholders of record on Friday, May 2nd were paid a $1.30 dividend. This represents a $5.20 dividend on an annualized basis and a dividend yield of 0.52%. The ex-dividend date was Friday, May 2nd. This is a positive change from Costco Wholesale's previous quarterly dividend of $1.16. Costco Wholesale's payout ratio is 30.36%.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on the company. Mizuho assumed coverage on Costco Wholesale in a research report on Friday, April 11th. They issued a "neutral" rating and a $975.00 price target for the company. Telsey Advisory Group reiterated an "outperform" rating on shares of Costco Wholesale in a research report on Wednesday. Evercore ISI lifted their price target on Costco Wholesale from $1,050.00 to $1,070.00 and gave the company an "outperform" rating in a research report on Tuesday, March 11th. Cowen reiterated a "buy" rating on shares of Costco Wholesale in a research report on Friday, March 7th. Finally, Stifel Nicolaus reduced their price target on Costco Wholesale from $1,075.00 to $1,035.00 and set a "buy" rating for the company in a research report on Thursday, March 20th. Ten investment analysts have rated the stock with a hold rating and twenty-one have issued a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $1,024.03.

Read Our Latest Stock Analysis on Costco Wholesale

Costco Wholesale Profile

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Featured Stories

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report